Ahead Today

G3: US S&P Manufacturing PMI, US S&P Services PMI, US Existing Home Sales, Eurozone PMI

Asia: India PMI

Market Highlights

In what was another example of President Trump’s possible attack on Fed independence, Trump called for Fed Governor Lisa Cook to step down in a social media post overnight. This was on the back of a letter by Federal Housing Finance Agency Director Bill Pulte urging the US Attorney General to investigate Cook over a pair of mortgages with allegations of criminal offences. Beyond the specifics and putting aside views on where rates should eventually head to, the broader trend is one where the President exerts more of his power over various agencies, and on top of tariff uncertainty longer-term is one fundamental reason why the US dollar may not be as structurally strong as it has been over the past 10 years.

Meanwhile, the Fed Minutes released overnight were somewhat more hawkish than expected, with most Fed officials highlighting inflation risks as outweighing concerns over the labour market, even as tariffs have already fueled a growing public divide within the FOMC. A majority of the 18 FOMC members “judged the upside risk to inflation as greater of the two risks” in their dual mandate of price stability and full employment, although it must be noted that the FOMC meeting was held before the latest weak non-farm payrolls was released. Overall, all these resulted in some weaker risk sentiment overnight as markets pared back some expectations of US rate cuts.

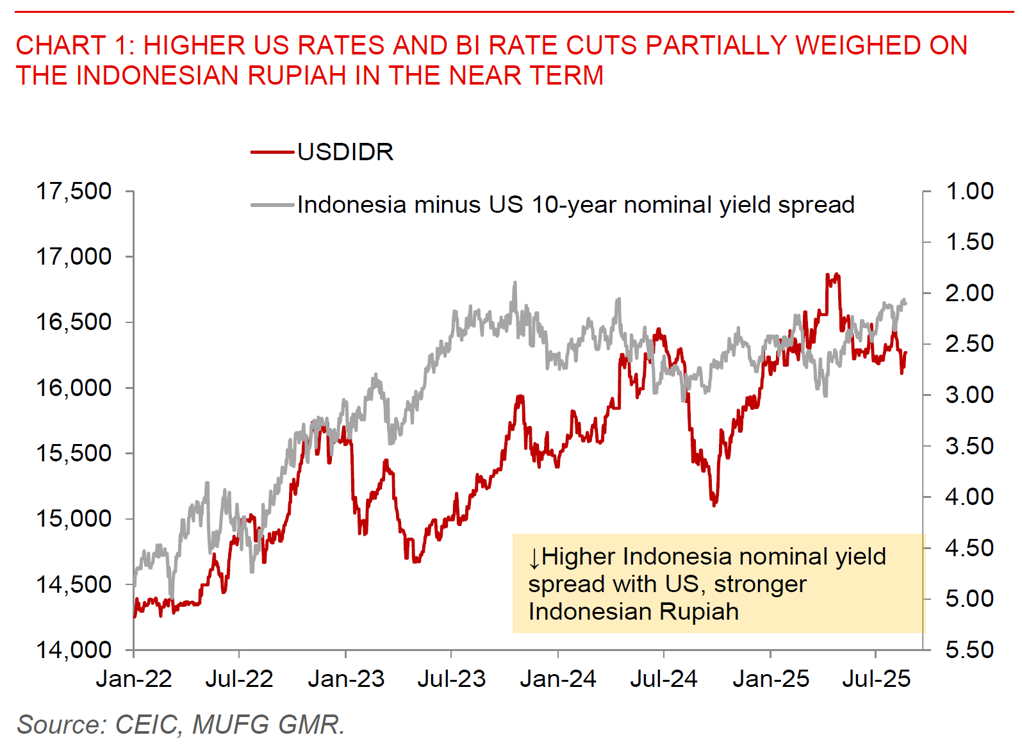

For Asia, the key notable event yesterday was a surprise rate cut by Bank Indonesia, bringing the policy rate to 5.00% from 5.25%. While we were of the view that BI will keep rates on hold, the move is directionally in line with our call for BI to cut rates over time, with a terminal rate of 4.50% by 2Q2026 (see IndonesiaPulse: Rupiah Resilience expected despite trade headwinds). BI Governor Perry said that BI will continue to monitor scope for further interest rate cuts, with the decision to cut in line with rupiah stability, inflation outlook, and the need to boost economic growth. Meanwhile, BI expects the Fed to cut rates twice by 25bps each this year, with the Indonesia economy expected to improve in 2H supported by faster government spending and investment in sectors including exports, transportation and agriculture.

The key possible market moving event for this week ahead will likely be Fed Chair Powell’s speech in Jackson Hole on Friday night. Our US rates strategist expects a possible pivot by Powell, but thinks it is unlikely that there will be a material dovish tilt given inflation worries (see We know what you did last summer).