Ahead Today

G3: US-China trade talks

Asia: Indonesia Foreign Reserves

Market Highlights

The big market mover both globally and in Asia was the weaker than expected inflation numbers from the US, with CPI rising 0.1%mom and producer prices also rising a smaller than expected 0.1%. These were also coupled with signs of softness in the US labour market, with continuing claims rising higher.

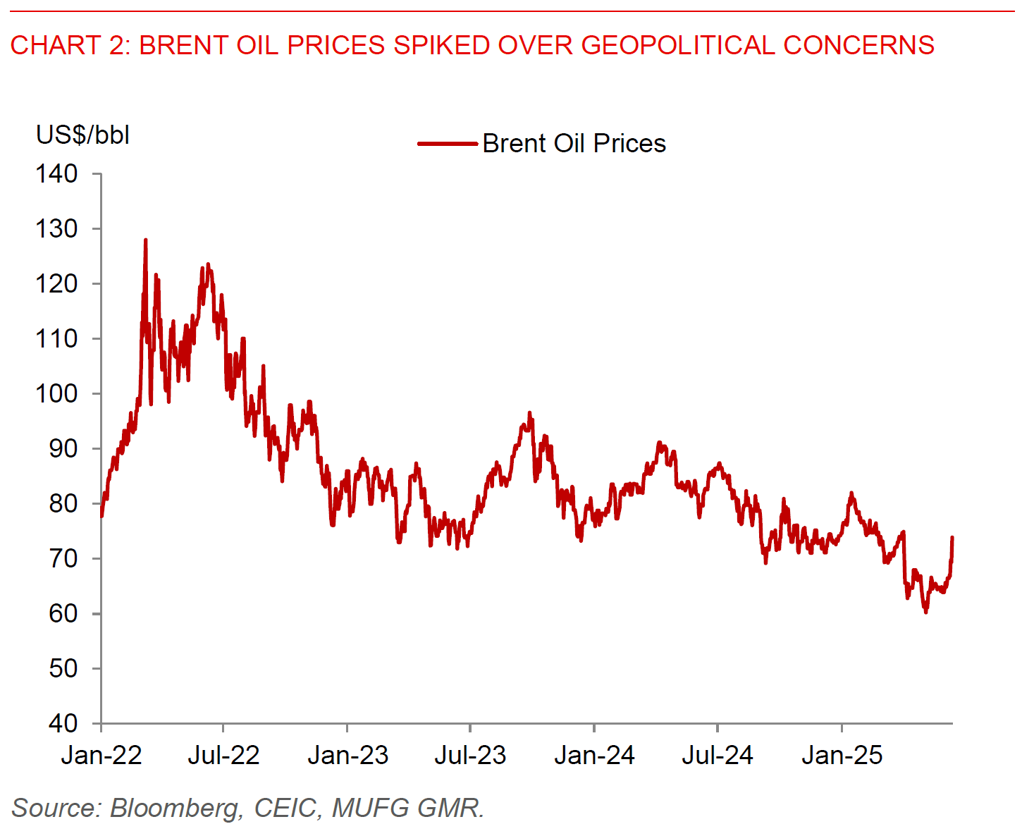

With these developments, the US dollar weakened meaningfully as markets priced in for more Fed rate cuts and risk sentiment improved, and led in the G10 space by strength in JPY and EUR, with EUR/USD in particular touching 1.1600 briefly at one point. In the Asia FX space, we saw some outperformance in the likes of the Taiwan Dollar, Thai Baht, and Korean Won, but with underperformance in INR and VND. The 0.9% FX appreciation seen in Taiwan was likely driven by a combination of foreign inflows into the equity market coupled with increased exporter USD selling, although the pace was certainly not as large as what we saw in back earlier in May. Meanwhile, the South Korean won strengthened, in the very near-term driven in part by proxy hedging from Taiwanese lifers. More generally, KRW was also helped by continued optimism over the new President’s more expansionary fiscal policies and corporate reforms including giving minority shareholders greater rights.

Regional FX

The big macro question of course is where is the inflation post the tariff implementation, and over here we think the jury is still out, even as we should be open-minded to different possibilities. For one, front-loading even before Liberation Day on 1 April has already led to a meaningful build-up of anticipatory inventory and it’s possible that retailers and distributors are still working through that stock of inventory, caping the inflation impact so far. Second, what we see from Asia exports is a very clear shift away from direct exports from China to the US, and with exports from the likes of Vietnam, ASEAN, and Taiwan still doing very well so far. In some ways, the shift in composition to US imports to the Rest of Asia from China has to some extent lowered the effect tariff rate, and perhaps had some dampening impact on inflation in the very near-term. Third, it’s also possible that a weak US economy and softening labour market has resulted in lower price pass through to end-consumers and producers, while lower energy prices have thus far offset the inflation pick-up so far. Lastly, exporters may also be paying at least part of these tariffs, although we are skeptical on the extent to which they can do so given low margins for some of these goods especially on the lower-end. Which of these factors prove more dominant will be important to gauge for the path of inflation and markets moving forward.

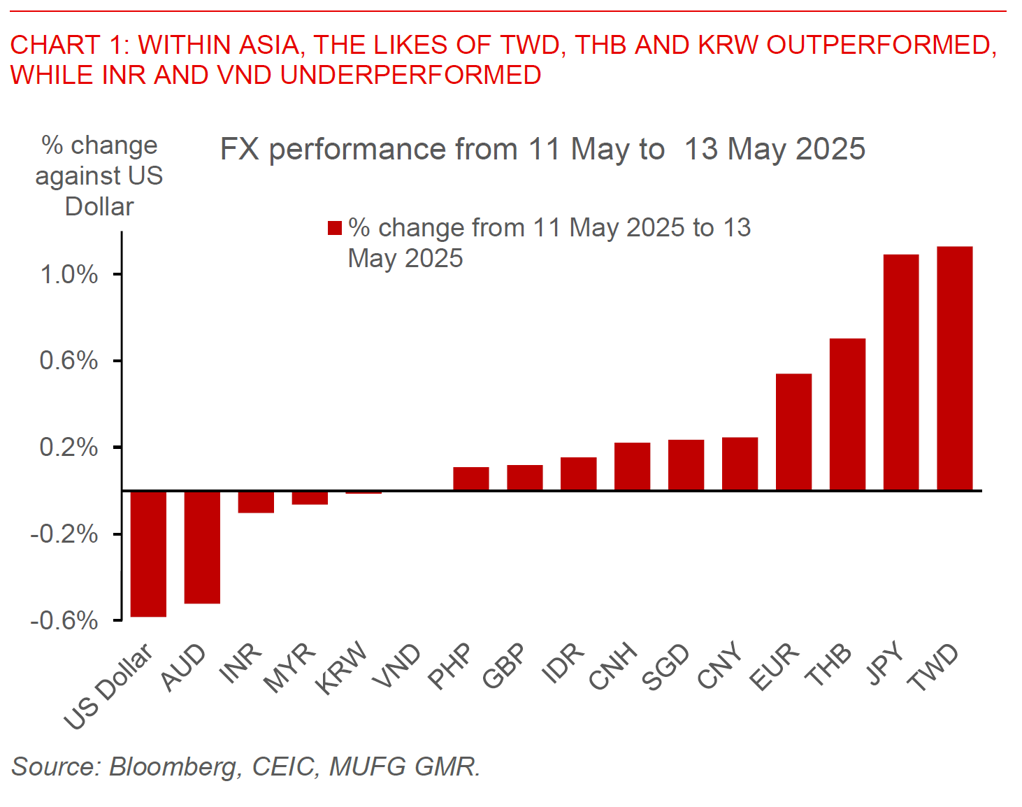

On that front, one key risk to watch for on inflation not just in US but also in Asia is on oil prices, with Israel reportedly launching airstrikes on Iran, in a major escalation in the standoff over Iran’s atomic program. Oil prices surged by more than 5% post the report, jumping above US$73/bbl. We have already seen some reversal in risk-sensitive assets such as the Korean Won this morning, together with a rally in alternative safe havens such as gold, JPY and CHF. The spike in oil prices may also weigh on currencies which depend on oil imports such as INR and PHP, but with the starting level of inflation and current account deficits quite decent, it could take a sustained spike in oil prices to meaningfully change the trajectory of Asia FX.