Ahead Today

G3: US CPI, Germany ZEW Expectations, US NFIB Small Business Survey

Asia: India CPI, India IP

Market Highlights

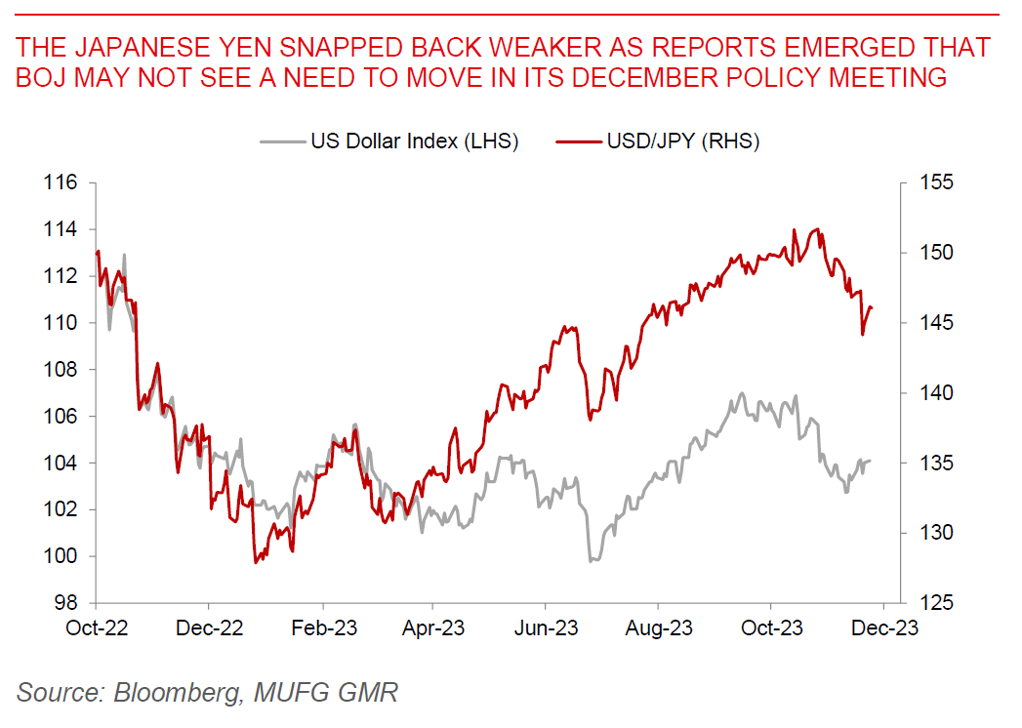

Bloomberg reported that Bank of Japan officials see little need to rush into scrapping its negative interest rate policy in its meeting this month. According to the report, BOJ officials view the cost of waiting for more information to confirm solid wage growth as not very high. The Japanese Yen snapped back by weakening around 1% to 146.1 against the US Dollar post the report. Our expectation is for the BOJ to scrap both the negative interest rate policy and YCC sometime in 1Q2024, and BOJ’s December meeting may ultimately still offer some guidance, even if policy remains unchanged.

Markets will focus on US CPI numbers for November, which comes ahead of the FOMC meeting later this week. Consensus is expecting an unchanged print for the headline rate given declining gasoline prices. More importantly, the core rate is expected to bounce to 0.3% mom from 0.2% mom previously. Latest data shows that used car prices continue to decline signaling continued goods disinflation, but this could be partly offset by higher airfare costs during the month.

Regional FX

China leaders including President Xi Jinping started their annual Central Economic Work Conference (CEWC) to discuss the 2024 growth target and plans, according to Reuters, and will likely end on Tuesday. Chinese policymakers will discuss 2024 growth targets, and plans such as government bond issuance and fiscal deficits, while continuing to work towards addressing issues in the local government debt and supporting the property sector. India will release its CPI estimates for November, which is expected to pick up to 5.8%yoy on the back or rising onion and vegetable prices. Meanwhile, India’s industrial production is likely to accelerate to 10.4%yoy in October, with growth likely to remain strong. Overall, Asian FX pairs were generally weaker on the back of a stronger Dollar, with USDCNH rising to 7.19.