Ahead Today

G3: US JOLTS Job Opening, US Consumer Confidence

Asia: South Korea Retail Sales

Market Highlights

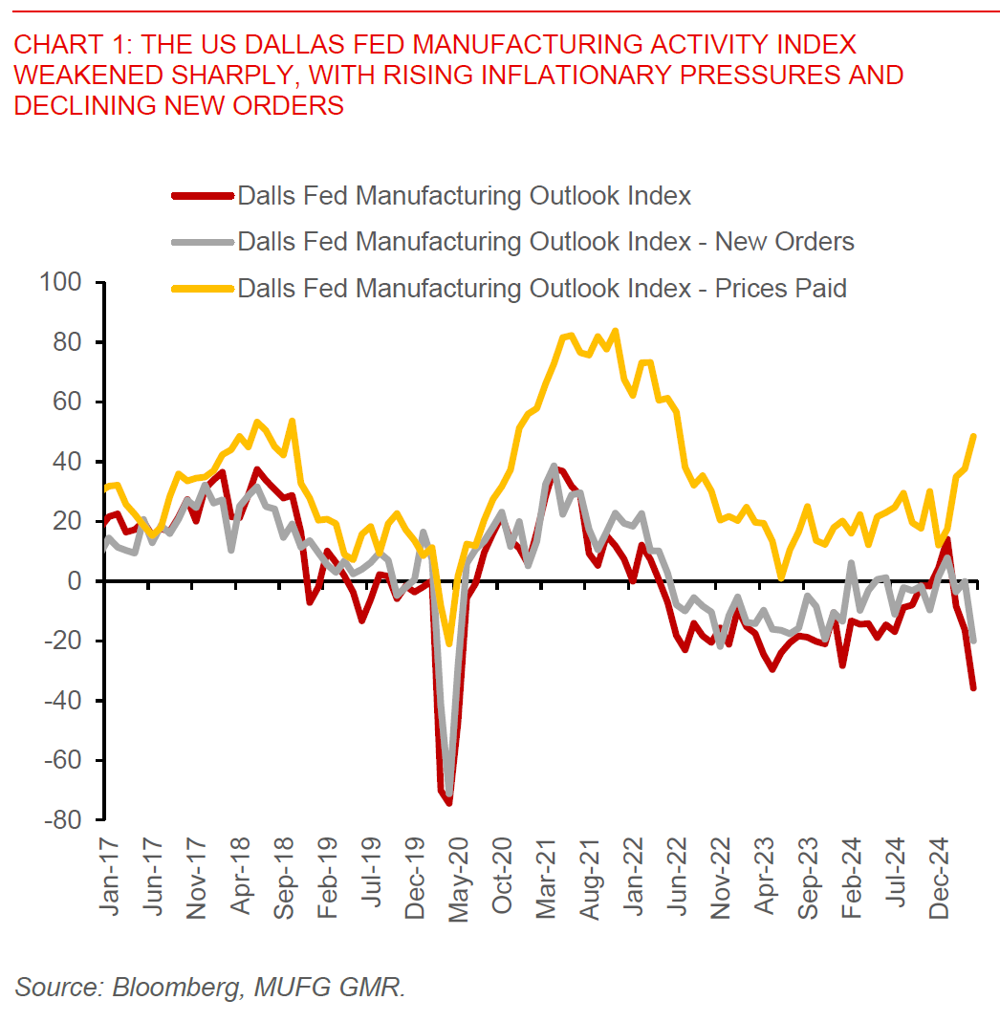

The US Dallas Fed Manufacturing activity index fell to the weakest since 2020, with executives using words such as “chaos” and “insanity” to describe the turmoil from tariffs. Almost 60% of respondents said higher tariffs would negatively impact their business this year, with a majority saying that they would pass higher costs onto customers and 38% saying it’s becoming harder to do so.

The weak Dallas Fed data numbers add to a collection of evidence including sharp declines in container bookings highlighting a slowing US economy and rising inflation pressures – stagflationary conditions that come with a huge negative supply side shock for the US from tariffs. For the rest of the world including China, it is however a negative demand side shock, bringing about lower growth and lower inflation. This is even as Chinese authorities have been highlighting that they have substitutes for supply of imports from the US such as soybeans and grains, and they are also trying to diversify sources of end-demand for Chinese goods including domestically. The press briefing by Chinese authorities yesterday on stimulus measures however struck a tone of confidence and calm on the current trajectory, announcing more details and expansion of measures largely based on existing plans, while also highlighting a preference for a stable RMB. Whether this sufficiently addresses the growth hit to China from the current trade war remains to be seen.

Regional FX

Overall, the US Dollar weakened somewhat yesterday with US Treasury yields declining following the announcement of the Treasury funding projections for 2Q and 3Q and US Treasury Secretary Scott Bessent signalled that he will announce the X-date for the US debt ceiling by next week. Asian currencies were generally stronger as well, with THB (+0.6%), MYR (+0.6%), and SGD (+0.4%) outperforming, while CNH underperformed to some extent. Bloomberg news reported that some Chinese based firms are reaching out to Indian exporters to fill orders on their behalf and help retain their American customers amidst the trade war, with Indian firms being approached to supply goods to US companies under the brands of Chinese firms, or co-branded with the Indian firms with a commission paid to the Chinese businesses. Thus far, India seems to have come out on top both in terms of relative tariff differentials with China and its key export competitors such as Vietnam, and also in terms of the speed of trade negotiations with the US on a potential trade deal. Both India and Japan seems to be first in line in terms of any possible trade deal agreement, notwithstanding the difficulty in actually working through the details of agreeing a truly durable trade deal for both sides.