Ahead Today

G3: US NY Fed Inflation Expectations, Eurozone Sentix Investor Confidence, Germany Industrial Production

Asia: China Money Supply

Market Highlights

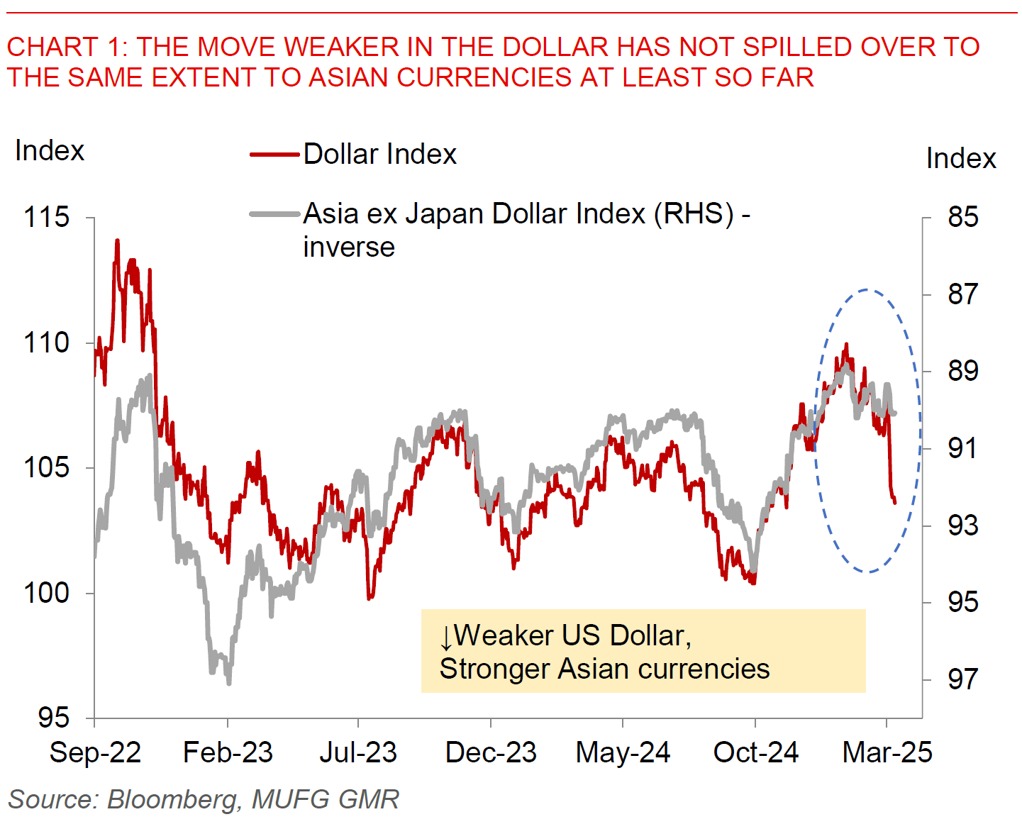

Market moves have been seismic and historic last week, with a big move lower in the US Dollar by close to 4%. The big structural shift for FX markets was certainly the big fiscal announcement by Germany’s Chancellor Elect Federich Merz to exempt defence spending above 1% of GDP from the constitutional debt brake, raise EUR500bn for a special fund for infrastructure (11% of GDP) to be disbursed over 10 years, and allow regional governments to borrow up to 0.35% of GDP. If passed by Germany’s parliament, this likely represents a meaningful demand shock, even if there are existing capacity constraints which likely prevents an immediate ramp up in defence and infrastructure spending. Our European economists see a 0.8% boost to Germany’s GDP in 2026 to around 2% (see Euro – the brakes are off in Germany). From an FX perspective, our G10 team has been highlighting a slowing US economy as well as the possibility of greater fiscal stimulus from Germany as key driving forces for their medium-term call for a weaker Dollar (see G10 FX Weekly). On that note, US non-farm payrolls print out on Friday was decent at 151k, but declines in federal government and retail employment suggest this could soften more moving forward.

Regional FX

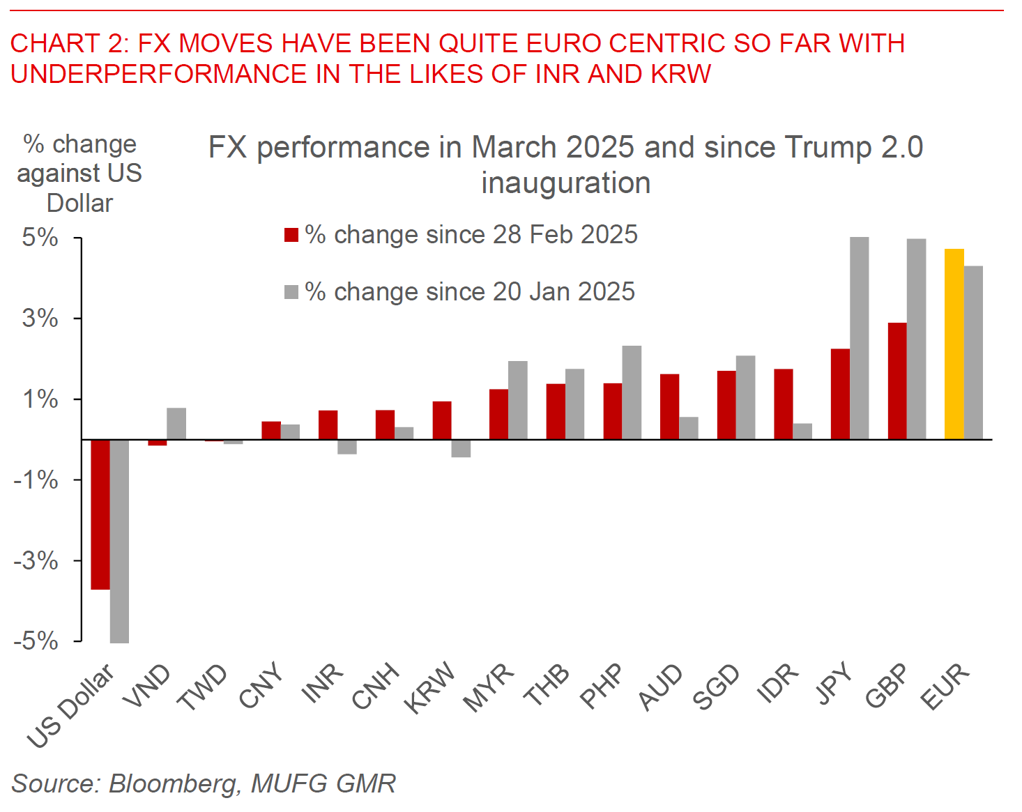

While our Global FX team highlight that their current Q1 and Q2 EUR/USD forecasts of 1.0200 look too low given recent developments, the pipeline and potential aggressiveness of tariffs by Trump moving forward including reciprocal tariffs on April 2, and the scale of the move on EUR suggests that there may be a spell of strength for the Dollar first in 1H2025. From Asia FX perspective, it’s interesting that the moves have so far been quite EUR centric, with Asian currencies generally lagging. INR and KRW have underperformed since Trump’s inauguration, likely due to local factors as well, while the likes of PHP and MYR have outperformed, with CNY/CNH seeing moderate gains. Moving forward, certainly one big driver for Asian currencies will be the extent and efficacy of stimulus from China and with that China’s growth prospects. On that note, the annual “two sessions” out last week was supportive for China’s economy, even as the long-term direction of a focus on science and technology and also increasingly the AI sector has not changed from the authorities. The higher fiscal deficit targets, together with higher support for consumption spending including on vouchers and social spending can all help to put a floor to growth in our view in the context of tariff increases in Trump 2.0 even as the authorities engender a structural transformation in the economy (see China NPC 2025: Proactive policies support a positive transition of growth model). The crucial question for both the Dollar and CNY is also whether recent developments in Chinese tech, including recent craze around Manus AI, is the spark that the Chinese economy is waiting for and also able to resolve the binding constrains plaguing it.