Ahead Today

G3: US MBA Mortgage Applications, US Wholesale Inventories

Asia: China CPI, China PPI, BNM Policy rate

Market Highlights

While we await President Trump to firm up the details of the reciprocal tariff rates in letters to other nations, overnight the focus shifted to Trump’s comments on sectoral tariffs and also the 1 August deadline. In particular, President Trump said “no extensions will be granted” on country-specific levies set to come into place in early August, a change in tone from earlier comments that the date was “not 100% firm”. Meanwhile, Trump said he planned to implement a 50% tariff on copper imports as part of a set of sector tariffs, while indicating he could offer pharmaceutical manufacturers at least a year before a 200% tariff in order for manufacturers to bring their production onshore. Semiconductor and electronic sectoral tariffs are also being studied in the pipeline but details were not provided yet. Trump also reiterated his call to impose 10% additional tariffs on BRICS countries even as he said the US is close to a trade deal with India. These plethora of tariff announcements led to a recovery in the US Dollar and with that some weakness in Asian currencies, although risk assets including equities were still overall reasonably resilient.

Regional FX

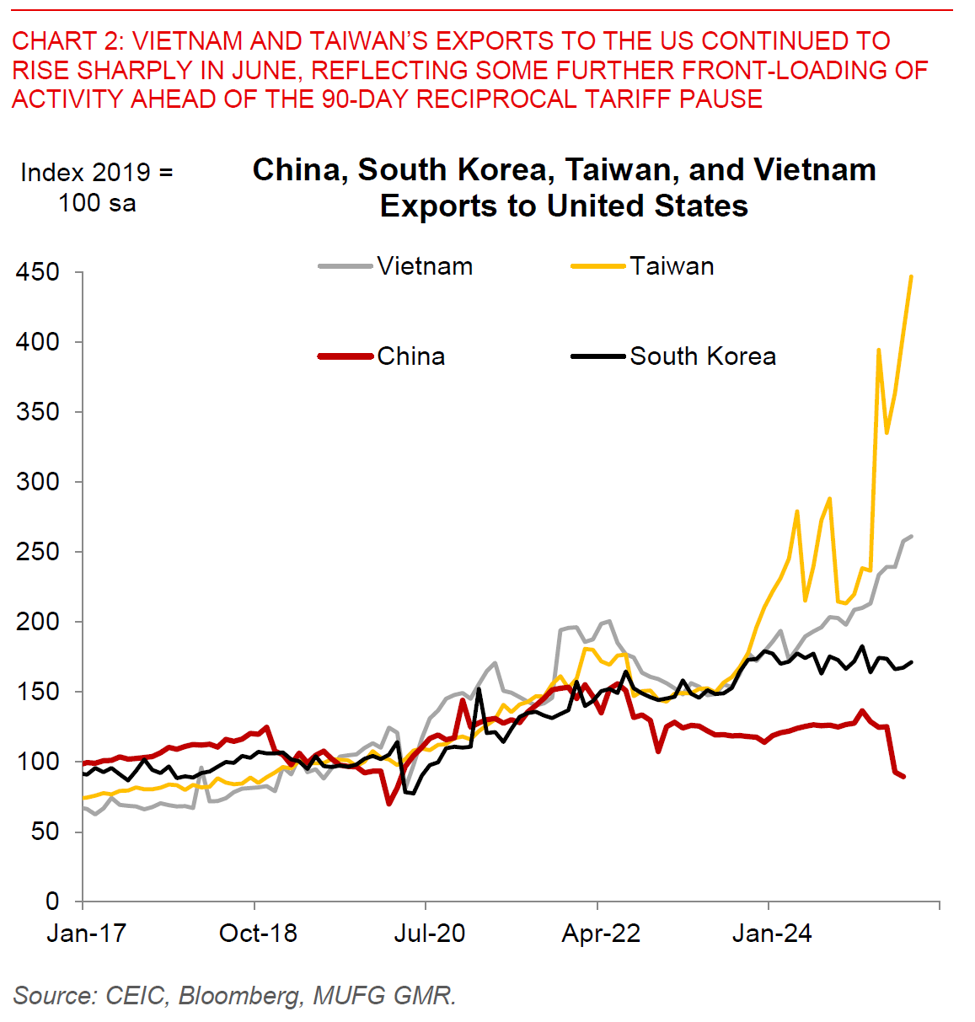

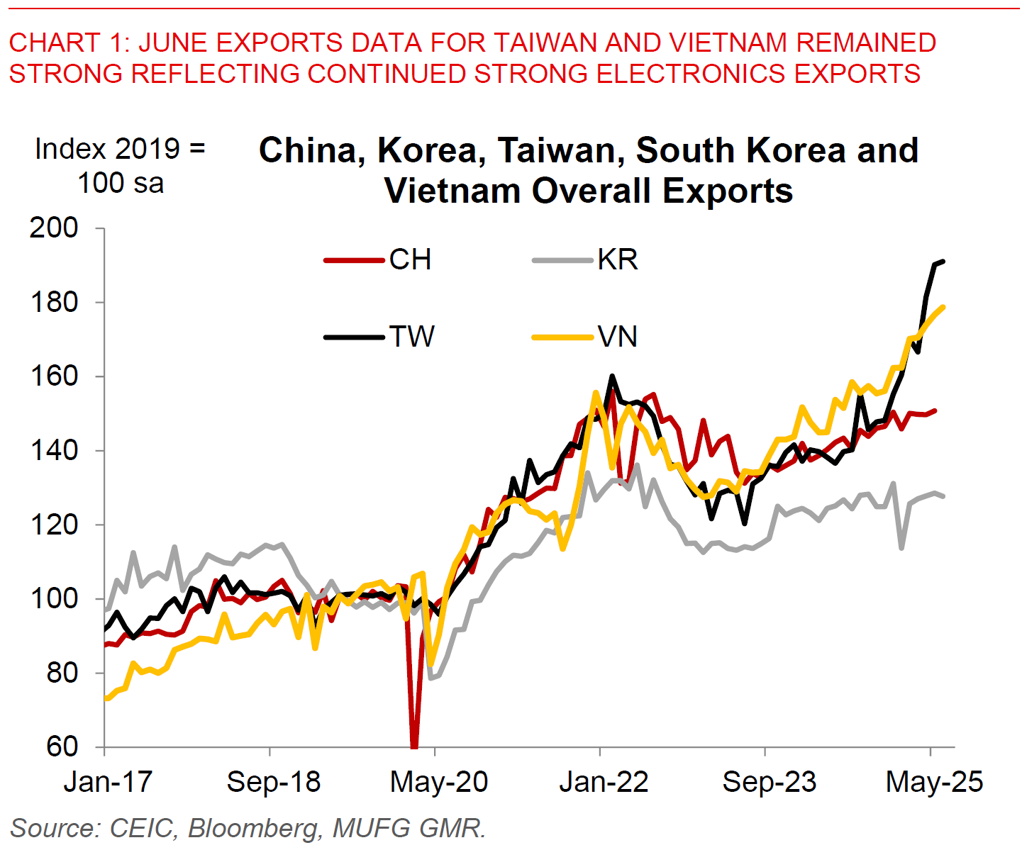

Across Asia FX, we saw weakness generally, with the likes of INR and TWD underperforming declining around 0.4%, the likes of VND, PHP and KRW outperformed with USD/CNH inching up closer to 7.1850 levels. The macro data released yesterday continued to show impressive strength in Taiwan’s exports for the month of June, with exports rising 34%yoy and a monthly trade surplus of US$12bn and led by strong AI chip and semiconductor exports. Across the early reporters that have announced export data for June, Vietnam also saw a strong performance in exports rising 16%yoy, with some underperformance in South Korea’s export performance. Both Taiwan and Vietnam’s exports were driven by still robust exports to the US, perhaps some continued front-loading ahead of the 90-day reciprocal tariff deadline. Our base case is for some moderation in Asia’s exports activity into 2H2025, reflecting both payback from front-loading to the US, and also as higher tariffs increasingly weigh on end-consumer demand in the US and hence also the prospects for new orders. Nonetheless some of the divergence in eventual export performance will also be dependent on the tariff rates that different countries receive, although we note that with details still sparse at this point and the rates still in flux actual manufacturing investment decisions are likely to be postponed by corporates until we get better clarity on the steady state.