Ahead Today

G3: US ISM Manufacturing, Eurozone CPI

Asia: Singapore PMI

Market Highlights

The US Court of Appeals ruled that Trump’s use of the International Emergency Economic Powers Act (IEEPA) exceeded the limits of the law in his imposition of the reciprocal and “fentanyal” tariffs. The additional tariffs for India and Brazil were not part of this specific ruling but could come up in subsequent lawsuits. This decision has been stayed till 14 Oct, with the Court of Appeals asking the Lower Courts to rule on how broadly this should hold, while also allowing time for the Trump administration to appeal to the Supreme Court – which seems the most likely scenario. A decision by the Supreme Court could eventually come later in 1Q2026 or 4Q2025 at the earliest. Meanwhile, the tariffs remain in place at least for now.

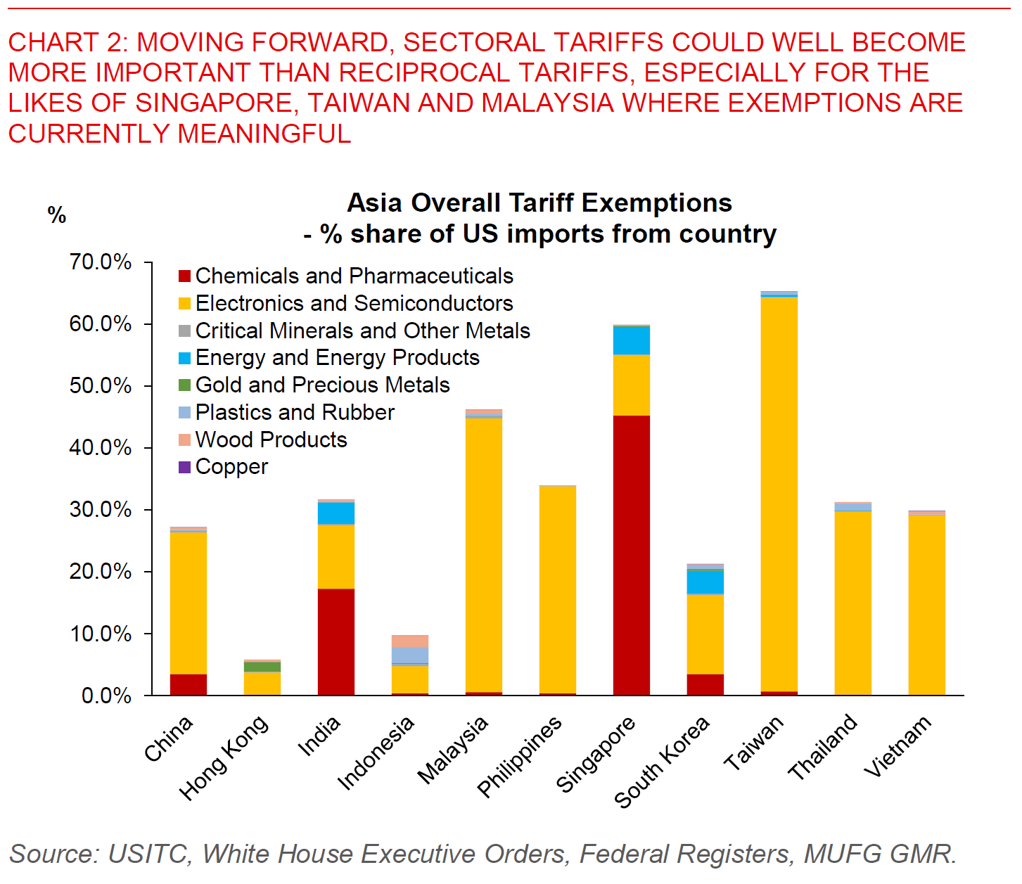

These legal proceedings raises several key questions, and will ultimately have potentially important implications over the medium-term. First, while the Trump administration will likely lean on alternative legal tools to recreate his existing tariffs if the usage of IEEPA is deemed illegal, these legal tools come with some constraints. For instance, the legal statues allowing for broad-based tariffs such as Section 122 only provides for tariffs up to 15% and up to 150 days. Meanwhile, Section 338 allows for up to 50% tariffs in theory – but is a little known and never used statue with no historical precedent. Other tools such as Section 232, Section 301, and Section 201 have very strong legal footing, but are narrower in scope focusing on specific sectors and countries. Second, the legal proceedings also add a cloud of uncertainty and complexity for countries currently negotiating the finer details of the implementation of trade deals, including the likes of Japan, South Korea, among many others. Lastly, companies would also have significant costs involved in tracking all the tariffs paid so far if they were to seek for refunds down the line depending on the results of these Court rulings.

Overall, Trump may ultimately lean more on sectoral tariffs such as Section 232 to impose tariffs (which have stronger legal footing), while using other legal tools (eg. Section 122 and Section 338) to at least temporarily impose broad-based tariffs, in the hopes to be able to recreate his existing tariffs if the usage of IEEPA is deemed illegal. Presumably tariff revenues are also an important consideration here.

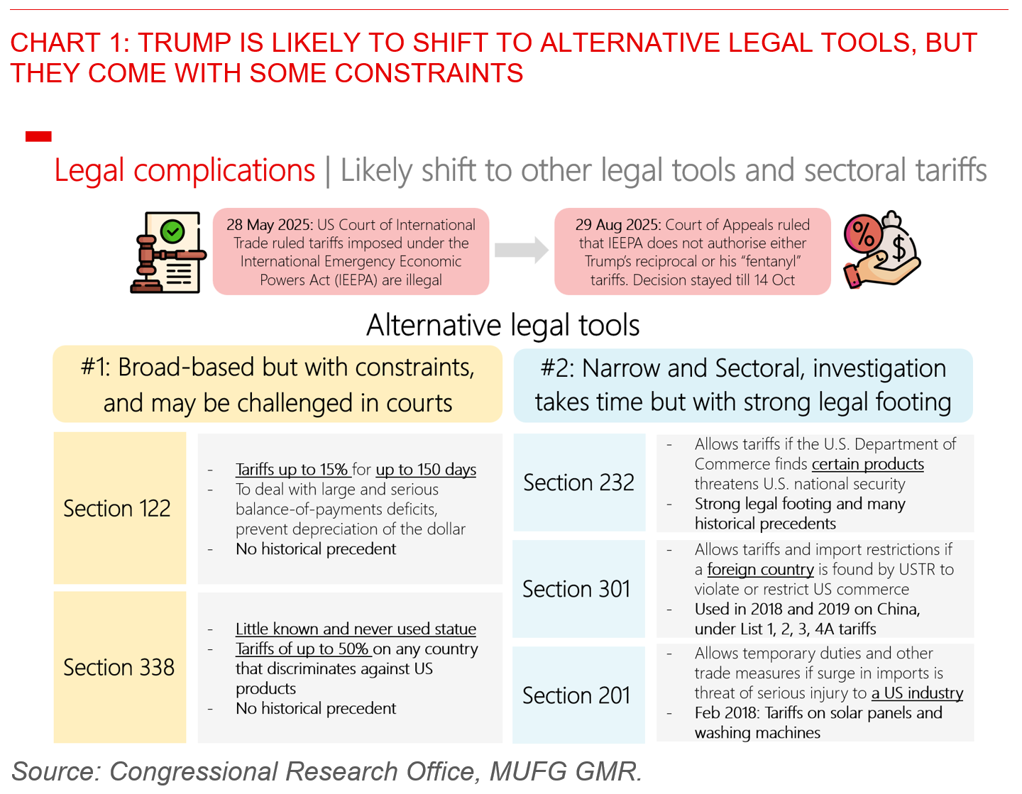

As such, sectoral tariffs including on semiconductors, pharmaceuticals, furniture, among many others may well become more important than reciprocal tariffs moving forward, and especially for the likes of markets where these exemptions are currently meaningful such as Singapore (pharmaceuticals), and Taiwan and Malaysia (electronics and semiconductors) just to provide some examples.