Ahead Today

G3: Italy CPI

Asia: -

Market Highlights

The DXY US dollar index fell by about 1% last week, resuming its decline amid growing market expectations that the Fed could resume rate cuts as early as the September FOMC meeting. This follows from weaker-than-expected labour market data and a soft ISM services print. US trade policy uncertainty also persists, with President Trump shifting his focus to sector-specific tariffs. He has threatened to impose an initial small levy on pharmaceutical imports that could rise to 150%-200% over the next two years, and he is also considering a 100% tariff on semiconductor imports.

The current US-China trade truce is also set to expire on 12 August, and while a further 90-day pause is under discussion, Trump has threatened to punish China for buying Russian oil, after imposing additional 25% tariffs on India for similar actions. However, Trump’s chief trade advisor Peter Navarro has suggested that such measures may be tempered by their potential economic fallout. More details on Trump’s tariff agenda are expected in the week ahead.

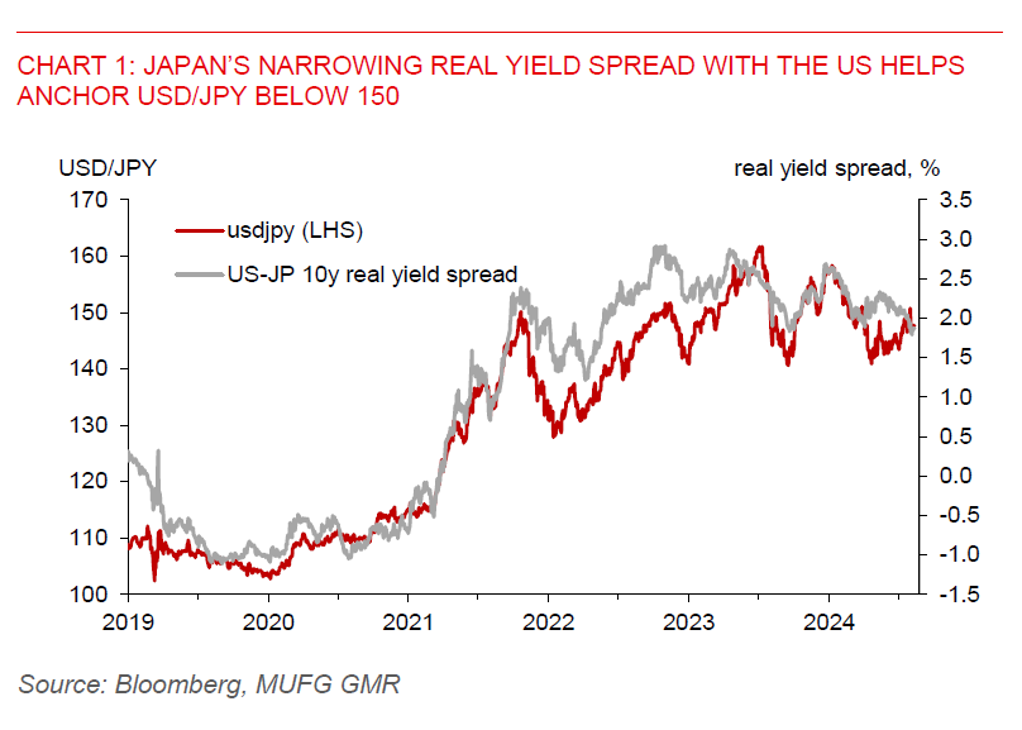

Meanwhile, the new 15% US reciprocal tariff on goods from Japan will not stack up on existing levies, according to Japan’s chief trade negotiator Ryosei Akazawa. The US will look to correct this. This means that Japanese goods with a tariff rate above 15% will not be subject to an additional 15% tariff, while those products with a tariff rate lower than 15% will see levy adjust up to 15%. Any excess tariff already being collected by the US will reportedly be refunded. On the monetary policy front, a summary of opinions from the BoJ indicated that the central bank may consider raising rates before year-end, depending on the economic impact of US tariffs, which will need at least 2-3 months to assess.

Regional FX

Last week, several Asian currencies recorded their strongest weekly gains against the US dollar since late June, including the IDR (+1.2%), MYR (+0.8%), PHP (+1.8%), and THB (+1.6%). This resilience came despite the implementation of US reciprocal tariffs in August and the recent threat of sectoral tariffs. Export-oriented Asian economies may face greater trade headwinds in H2, as the boost from earlier export frontloading may fade in the coming months. However, currencies of domestic oriented economies with higher yields may be better positioned to benefit from USD weakness. For instance, the rupiah has been supported by foreign bond inflows and stronger-than-expected Q2 GDP growth of 5.1%yoy.