Ahead Today

G3: FOMC meeting, US initial jobless claims, eurozone CPI

Asia: Thailand trade, Bank Indonesia policy rate decision

Market Highlights

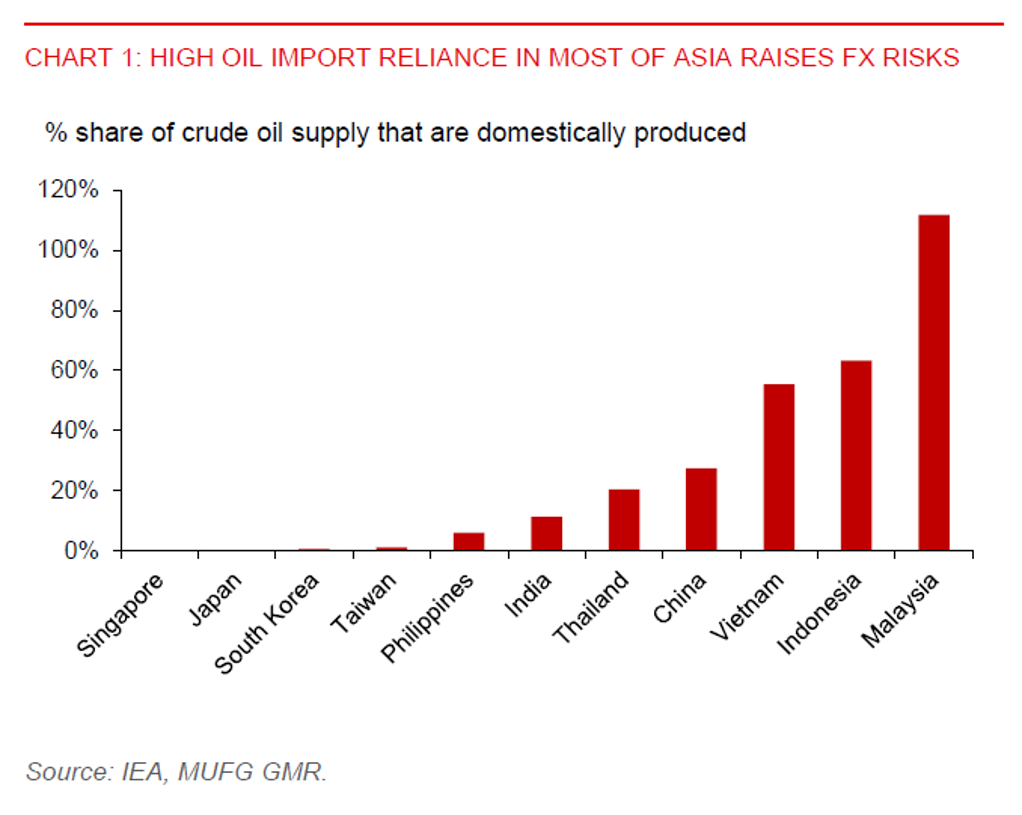

Geopolitical developments in the Middle East region will continue to drive FX moves across Asia. The US dollar has strengthened due to safe-haven flows following last Friday’s escalation, amid rising market concerns about potential direct US involvement in the Israel-Iran conflict. Meanwhile, US 10-year yield fell about 6bps to 4.388% yesterday, while oil prices rose by up to 10% since last Friday.

President Trump has called for Iran’s unconditional surrender in its confrontation with Israel, while Israel has announced plans to strike significant targets in Iran. In a notable development, Israel has reportedly struck Iran’s state-run broadcast TV, delivering a major blow to the Iranian regime’s communication infrastructure.

On the economic front, US macro data showed signs of weakness. Retail sales declined by 0.9%mom in May, worse than Bloomberg consensus forecast of a 0.6% drop. Excluding autos, retail sales fell 0.3%mom, missing market expectations of a 0.2%mom increase. But the retail sales control group rose by 0.4%mom, rebounding from -0.2%mom in April and beating market expectations of a 0.3% increase. Additionally, industrial production and capacity utilization were slightly below market expectations.

Looking ahead, markets will also focus on the FOMC meeting. The Fed is likely to hold rates, while policymakers will update their quarterly dot plot. The Fed could continue to adopt a wait-and-see approach as it seeks more clarity on President Trump’s economic policy direction.

In Japan, the BoJ left its policy rate unchanged at 0.5% yesterday, in line with expectations, while announcing that it will cut its monthly JGB purchases to JPY200bn per quarter from next fiscal year starting April 2026, down from JPY400bn currently, in a bid to improve bond market functioning.

Regional FX

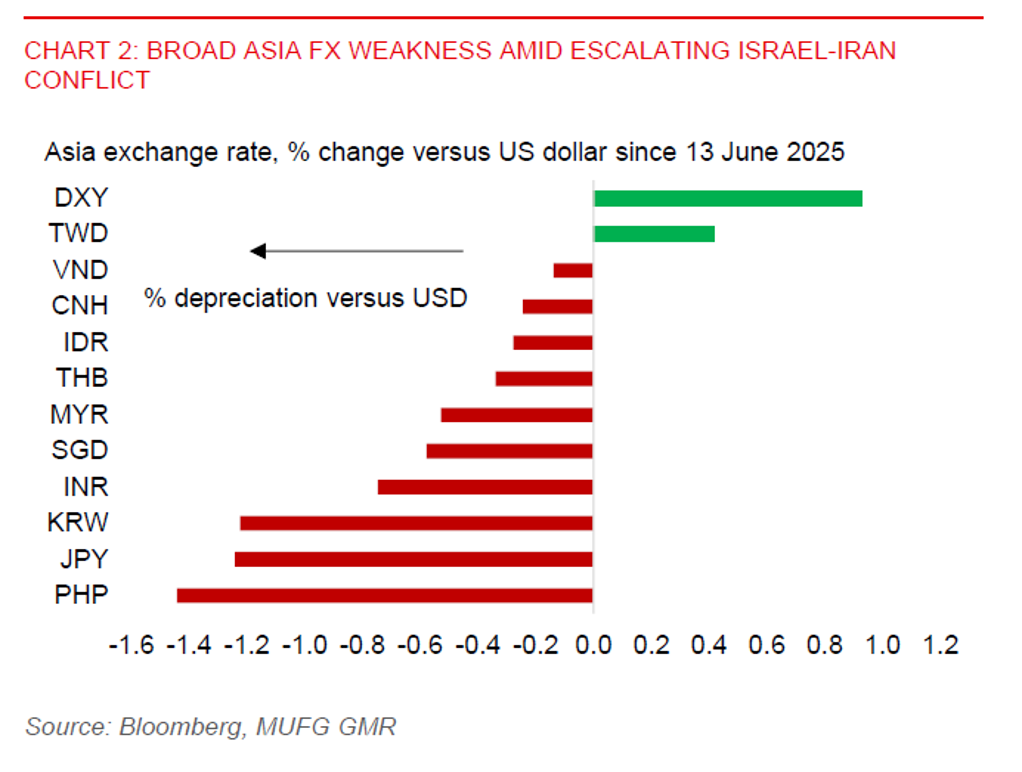

Asian currencies have broadly weakened against the US dollar following the escalation in the Israel-Iran conflict last Friday. KRW (-1.2%), PHP (-1.4%), and INR (-0.7%) have led losses in the region since last Friday, driven by risk aversion and rising oil prices. Oil prices have surged by up to 10%, while a prolonged conflict in the Middle East could further hurt global risk sentiment. Singapore’s weak trade data in May also adds to regional concerns.

The key focus in Asia today is the Bank Indonesia policy meeting. We expect the central bank to keep its benchmark policy rate unchanged at 5.50%, following a 25bps rate cut in May. A back-to-back rate cut appears unlikely. While the rupiah has recently stabilized, policymakers are likely to remain cautious amid heightened global geopolitical risks and signals from Trump that he will set unilateral tariffs on trading partners within the next 2 weeks. The rupiah has declined by 0.3% against the US dollar since last Friday, broadly in line with the Bloomberg Asia Dollar Index.