Ahead Today

G3: US Personal Income and Personal Spending, US University of Michigan Sentiment

Asia: Philippines Trade Balance, India 1Q GDP, Thailand IP, Thailand Current account

Market Highlights

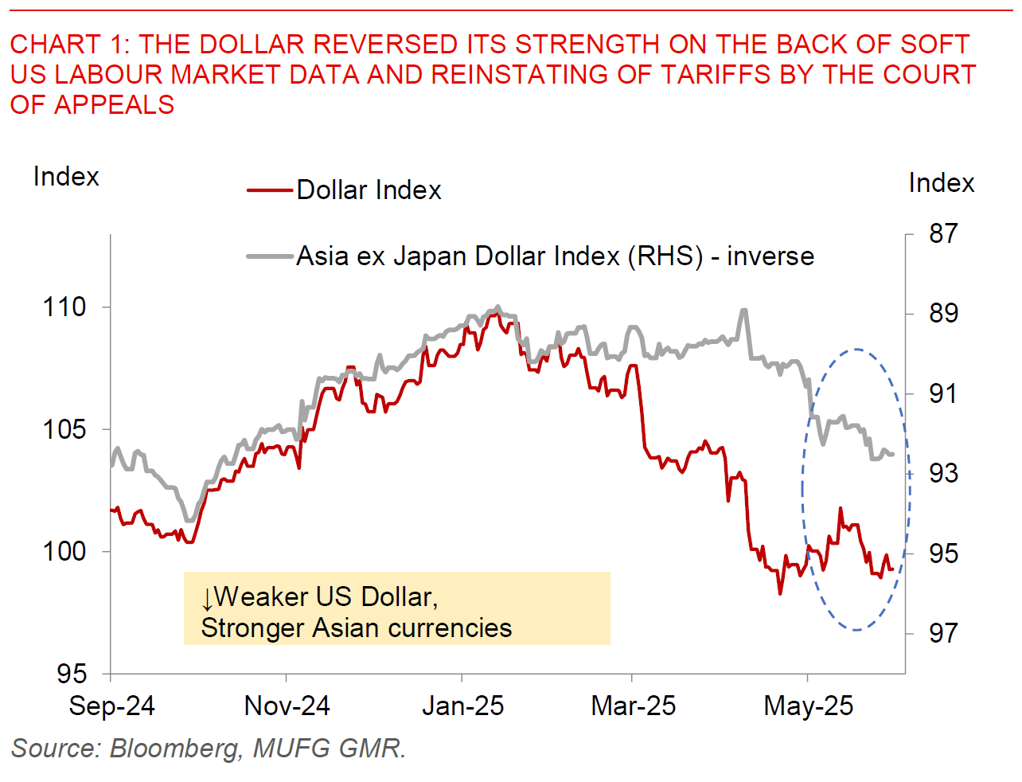

The US Dollar weakened and Asian currencies strengthened, by and large reversing the sizeable moves seen after the court ruling yesterday blocking President Trump’s Liberation Day tariffs. Part of this market move reflects weaker than expected labour market data and US consumption numbers out overnight. In particular, initial jobless claims rose 240k and continuing claims rose 1919k, both higher than expected, while the personal consumption component of US GDP was softer than expected at 1.2%. Meanwhile, the US Court of Appeals announced that it has reinstated the Trump’s tariffs temporarily, pending a ruling by the appeals court and likely to go all the way up to the Supreme Court, and this has also helped cement the Dollar weakness tone.

The developments overnight including on the court ruling fits in well with what our team has mentioned, with tariffs on Asia staying amidst the legal battle, coupled with legal uncertainty also potentially crimping US growth and investment plans further (see Asia – will tariffs stay or go and US further dollar gains to be limited). From a global perspective, our G10 team has been emphasizing as well Dollar-bearish reasons beyond Trump – including a US cyclical slowdown becoming more apparent in the data and an overvalued dollar - and the labour market numbers yesterday are consistent with that overall expectation for the path ahead. From Asia’s perspective, our view is that tariffs are likely to hurt Asia much more than others given our region’s export-oriented nature as a broad generalization, and as such we continue to expect Asian FX underperformance against G10.

Regional FX

Of course, this paints quite a broad brush on Asia, and there will be country specific divergence. The case in point is certainly the huge moves that we have seen in the Taiwan Dollar, which is to some extent driven by reversal of US Dollar hoarding by exporters coupled with LHS hedging activity in the life insurance industry. On that front, we think that the factors affecting TWD are unlikely to apply in full to South Korean won, and as such we do not expect KRW to catch-up to Taiwan’s recent massive FX gains (see KRW: will it catch up to TWD’s recent gain). Domestically, a weak economy in South Korea, coupled with continued Bank of Korea rate cuts are likely to reduce support as well for its currency and as such we forecast USD/KRW at 1400 by 1Q2026.

Meanwhile, latest news out of India seems reasonably positive and cordial on the trade deal front, with Bloomberg news reporting that a team of US officials will visit India next week to hammer out an interim trade agreement before July 9. Our expectation for a trade deal to be struck between India and US beyond the day-to-day uncertainty is a factor underpinning our view for USD/INR to grind lower to 83.50 by 1Q2026, coupled with lower inflation and more supportive domestic policies including rate cuts by RBI (see India: Art of the deal). In the very near-term however, we see some chance of the 1Q GDP numbers out later today surprising consensus expectations on the downside, although this is to some extent backward looking and with growth likely to improve in the months and quarters ahead in our view.