Ahead Today

G3: US nonfarm payrolls, unemployment rate, ISM survey, University of Michigan consumer confidence; eurozone CPI and PMI

Asia: Manufacturing PMI for several economies, Indonesia trade and inflation

Market Highlights

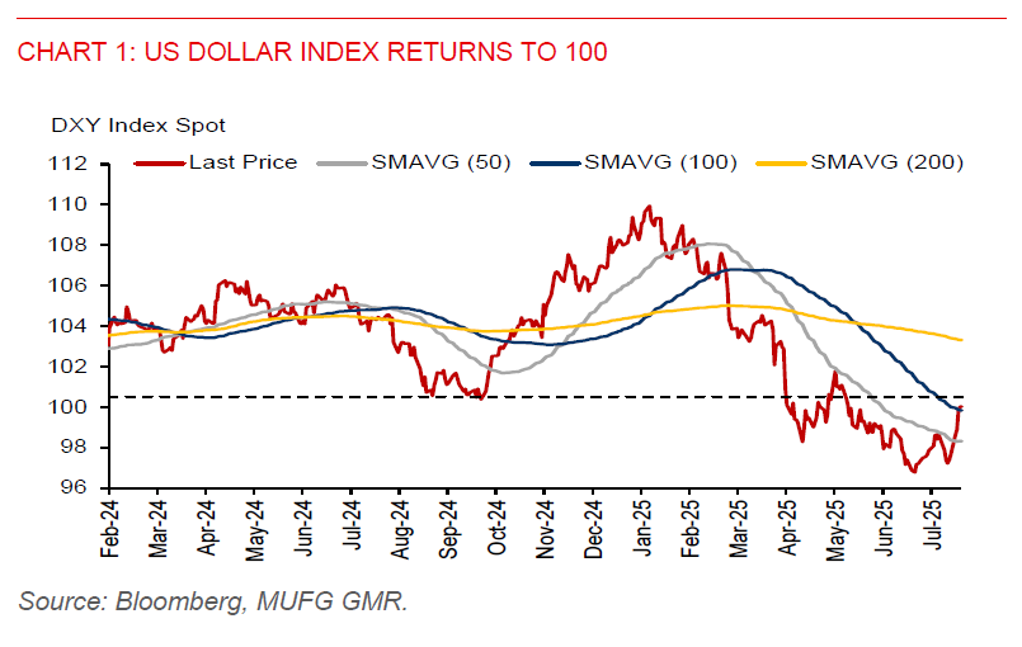

Markets have paused the de-dollarization narrative for now, with the US dollar index (DXY) strengthening by 0.2%, reaching the key 100.00 level. New reciprocal tariffs are set to take effect today, and recent US trade agreements feature reciprocal tariff rates that are generally lower than those announced during US Liberation Day, signalling a softening in trade tensions. The latest US trade agreement, forged with Korea, includes a 15% tariff on Korea, including on automobiles. Additionally, a $350bn Korean investment fund will be established for US-bound investments, with 90% of the profits flowing to the US, echoing elements of the US-Japan deal. President Trump also announced 19% tariff on goods from Thailand, Malaysia, and Cambodia, and 20% on Taiwan. He also announced a 90-day extension to the tariff pause for Mexico, providing additional time for trade negotiations. This, combined with signs of continued US economic resilience and a cautious stance from the Fed at yesterday’s FOMC meeting, has supported the US dollar’s strength. US real GDP grew at an annualized rate of 3% in Q2, rebounding from a 0.5% contraction in Q1. The Fed also remains in a wait-and-see mode, citing uncertainty around the inflationary impact of tariffs.

USDJPY climbed 0.8%, outpacing the broader rise in DXY. The move was partly driven by comments from BoJ Governor Ueda, who asserted that the central bank is not behind the curve on inflation. This came despite the BoJ raising its median forecast for core inflation (CPI ex fresh food) to 2.7% for the current fiscal year, up from 2.2%.

Regional FX

Asian currencies weakened amid a stronger US dollar, a cautious Federal Reserve, and resilient US economic data. The Philippine peso led regional losses, depreciating by 1.3% against the dollar, followed by 0.6% declines in the Malaysian ringgit, Thai baht, and Taiwan dollar.

The Philippine central bank projected July inflation to range between 0.5% and 1.3%, potentially opening the door for further rate cuts.

Bank Negara Malaysia revised its 2025 growth forecast downward to 4.0%–4.8%, from a previous range of 4.5%–5.5%, citing global tariff uncertainties. PM Anwar also unveiled a five-year development plan targeting annual growth of 4.5%–5.5%, backed by MYR430 billion in development spending between 2026 and 2030.

Taiwan’s economy showed strong momentum, with Q2 GDP expanding by 7.96%yoy, up from 5.5% in Q1, driven by AI-fueled export growth.