Ahead Today

G3: US Q2 GDP third estimates, wholesale inventories, durable goods orders, initial jobless claims

Asia: Hong Kong exports

Market Highlights

The broad US index (DXY) strengthened further overnight on stronger-than-expected housing data. August new home sales surged to 800k, from 664k in July, and well above Bloomberg consensus of 650k. Building permits of 1.33 million also surpassed market expectations of 1.31 million. These figures possibly reflect the impact of easing mortgage rates on property sales. Nonetheless, elevated housing inventories and a broad deceleration in house prices suggest the housing sector still faces headwinds.

Meanwhile, Sanae Takaichi, a leading contender in the upcoming Liberal Democratic Party (LDP) presidential election, has sought to distance herself from the dovish monetary policy stance she expressed last year. That said, she remains cautious about the pace of Bank of Japan (BOJ) rate hikes, warning that aggressive tightening could deter corporate investment in new technologies. The LDP vote is scheduled for 4 October, while the next BOJ policy meeting will take place on 30 October. Notably, two BOJ board members dissented in the September decision to hold rates steady. Japan’s 10-year yield remains elevated above 1.60%, yet the yen continues to trade weaker than implied by its real yield differential versus the US.

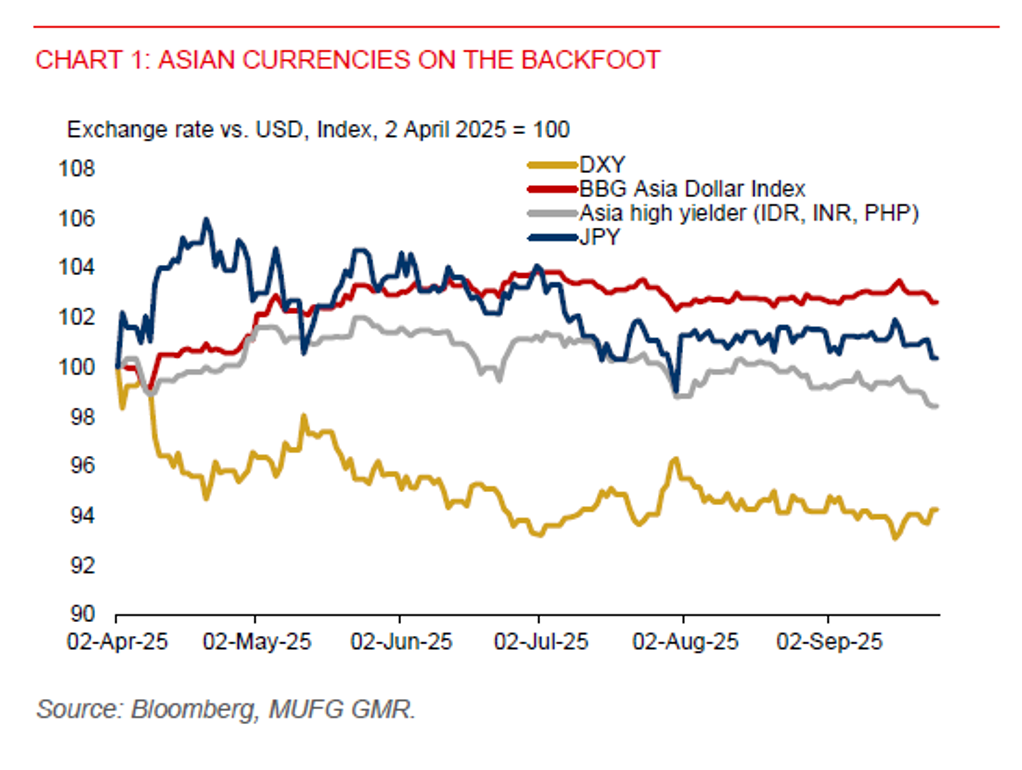

Asian currencies weakened against the US dollar, with the Japanese yen (-0.8%) and Korean won (-0.7%) leading regional declines. The Thai baht (-0.6%) and Singapore dollar (-0.5%) followed, while high-yielding currencies such as the Indian rupee and Indonesian rupiah remained under pressure.

In Thailand, August export data showed signs of moderation. However, the baht’s recent softness appears more closely tied to verbal intervention from Thai authorities, who have voiced concerns over its strength. Officials may also consider measures to reduce the baht’s correlation with gold prices. Still, Thailand’s robust external buffers, including sizable international reserves and a balance of payments surplus, should help anchor the currency within the 32.00–32.50 range against the US dollar in Q4.

Meanwhile, USDIDR has breached the 16,600 level, with market sentiment still fragile. Without a meaningful shift in domestic policy clarity, particularly regarding the fiscal outlook for 2026, the pair may continue to underperform in Q4, consolidating above our initial year-end forecast of 16,400. While anticipated Fed rate cuts could offer some relief, they are unlikely to fully offset pressure on the rupiah.