Ahead Today

G3: Eurozone consumer confidence, Germany PPI

Asia: China loan prime rates, Malaysia trade, Taiwan export orders

Market Highlights

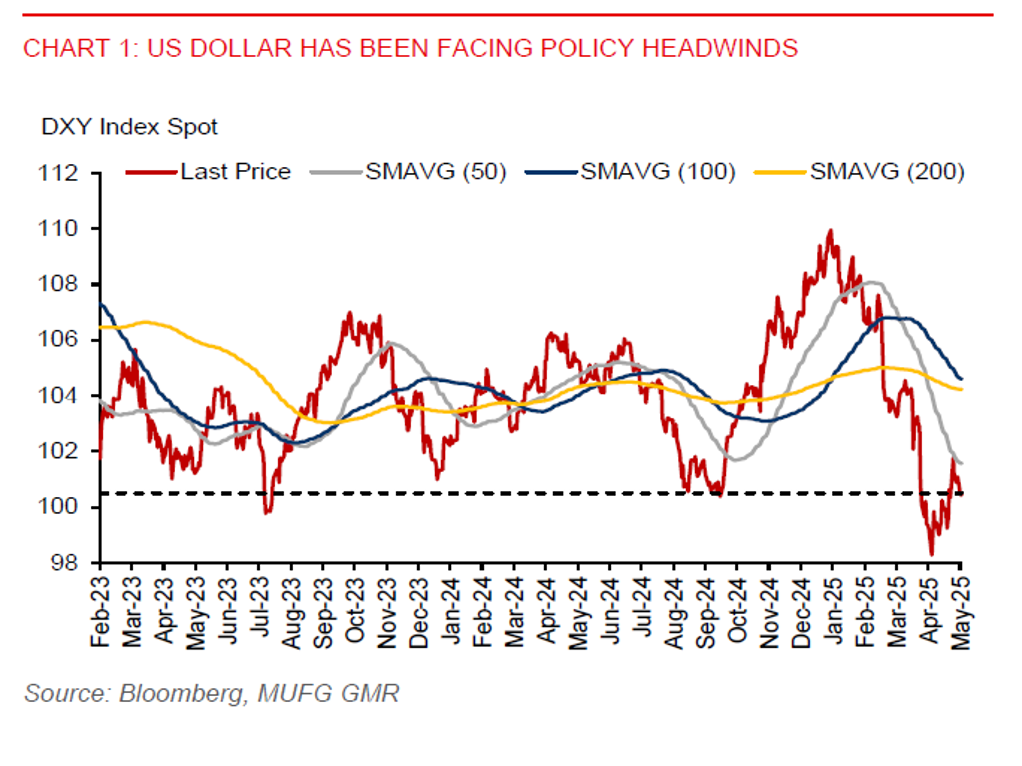

The broad US dollar index (DXY) has stayed on the backfoot, falling 0.8% in yesterday’s session. This follows from Moody’s downgrade of US sovereign credit rating by one notch to Aa1 last week. There were broad based gains for DXY constituents, notably the EUR (+0.7%) and SEK (+0.9%). ECB President Christine Lagarde said a stronger euro is not a threat but a reflection of a shift in global capital away from the US dollar and fading confidence in US economic policies.

Meanwhile, Fed’s Williams has said that policy uncertainty has led to the Fed keeping policy rate on hold. There’s a lack of clarity in the path forward for monetary policy over the coming months. He thinks a rate cut in June is unlikely, while the Fed will remain data dependent when determining the next policy move. The US leading index fell 1%mom in April, worsening from a 0.8% drop in March. A potential slowdown in the US economy in H2 due to higher tariffs could lead the Fed to ease policy.

In addition, Fed’s Vice Chair Jefferson has supported a patient approach to adjusting policy rate, while adding the need for vigilance to avoid potential tariff induced rise in inflation from becoming persistent. He has further described that the Fed is in a good place with a moderately restrictive policy to anchor long-term inflation expectations. Markets have continued to price in 2 US rate cuts in H2.

Regional FX

Asian currencies have strengthened against the US dollar, with KRW (+0.9%), SGD (+0.5%), and THB (+0.5%) leading gains in the Asia region.

China retail sales grew 5.1%yoy in April, down from +5.9%yoy in March and missing Bloomberg estimates of 5.8%yoy growth. This suggests the need for more supportive macro policy to revive private consumption. After the PBOC adjusted lower the 7-day reverse repurchase rate by 10bps on 8 May, it could potentially lower both the 1-year and 5-year loan prime rates today by 10bps each.

Meanwhile, Thailand’s GDP grew 0.7%qoq in Q1, from 0.4%qoq in Q4 2024, beating our and market expectations of a 0.6% increase. From a year ago, Thailand’s GDP rose 3.1%yoy in Q1 versus Bloomberg consensus of +2.9%yoy. Still, we maintain our GDP growth forecast at 2.2% in 2025, given the potential negative impact of the earthquake in March on tourist arrivals over coming months and the impact from higher US tariffs. Thai officials have lowered their growth outlook to 1.3%-2.3% in 2025, down by 1ppt from their previous outlook. Thailand’s economy also faces the risk of the 36% reciprocal tariffs being implemented on 9 July, given the country is not on the priority list scheduled to talk with US on trade.