Ahead Today

G3: US federal budget balance, France CPI

Asia: Malaysia industrial production, Thailand foreign reserves

Market Highlights

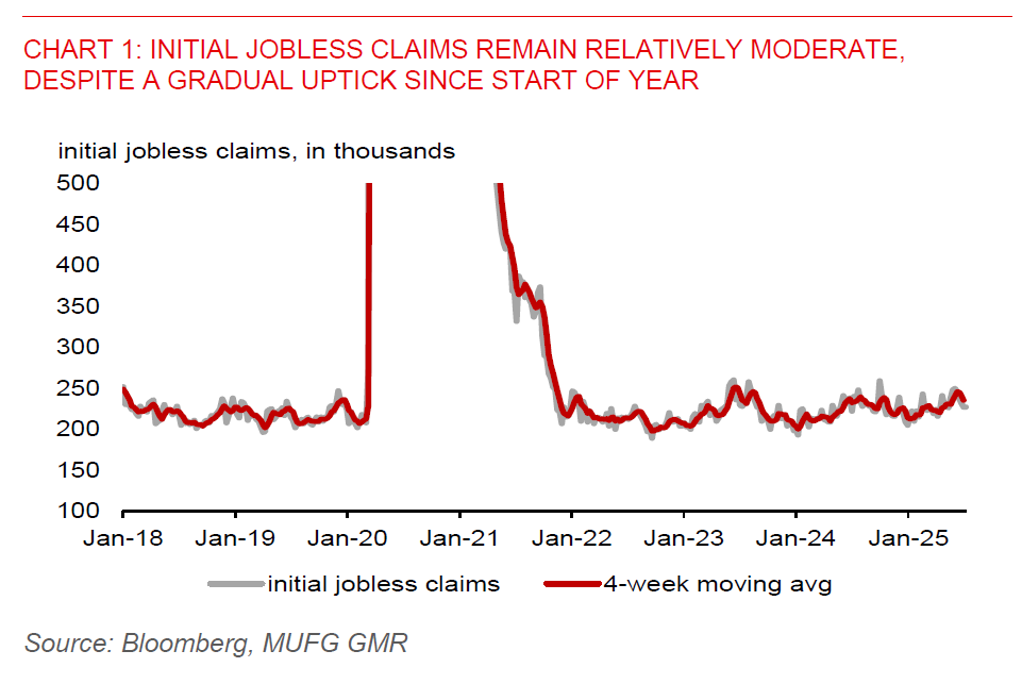

US Treasury yields rose across the curve and the US dollar index (DXY) extended gains by 0.2%. Initial jobless claims fell to 227,000 last week, the lowest level in 2 months, and down from the 232,000 in the prior week. However, continuing claims edged up to 1965k from a downward revised 1955k in the prior week. This may reflect slower hiring or it’s getting harder to find jobs. Still, the moderation in initial jobless claims may keep the Fed in a wait-and-see mode as it observes the potential impact of tariffs on inflation. With Trump imposing 50% tariff on copper, starting 1 August, along with higher reciprocal tariffs on trading partners, the risks to inflation are tilted to the upside. While markets still anticipate a Fed rate cut in September, expectations have moderated somewhat following the stronger than expected June non-farm payrolls report released on 3 July.

In terms of Fed speak, Fed’s Musalem has said that he sees upside risks to inflation, but thinks it is too early to determine whether tariff will induce persistent price pressures. In contrast, Fed’s Waller thinks that tariffs will only lead to a one-off inflation shock, the monetary policy stance is ‘pretty restrictive’, and the Fed can consider a July rate cut. But most officials have stayed patient with rate adjustments for now. Our view is for the Fed to resume rate cuts in September.

Regional FX

Asian currencies had a relatively quiet session yesterday, posting only muted gains against the U.S. dollar. Taiwan dollar was a notable exception, weakening by 0.3% against the US dollar. USDTWD continues to find a floor at the 29.00-level, as volatility moderates.

The Bank of Korea kept the policy rate unchanged, in line with our and market expectations. There’s limited reaction in USDKRW. BoK Governor Rhee said that limiting rate-cut expectations could help to contain rising house prices and household debt. The policy decision is a dovish rate hold, with the governor saying that 4 out of 6 members are open to rate cuts over the next three months.

Meanwhile, the PBOC has been setting a lower USDCNY daily fixing rate amid broad US dollar weakness. This has helped to manage depreciation expectations, amid US-China trade tensions, limiting negative spillovers to other regional currencies.

The Thai baht was an underperformer in the Asia region so far this week, down by 1.1% against the US dollar. There remain concerns about the economic outlook amid fresh political troubles and US tariffs. Finance Minister Pichai has reassured markets that the $115bn budget bill for FY26 starting 1 October will be passed by end August, while the government intends to spend an additional THB48bn ($1.5bn) in Q3 to support growth. A delay in the passage of the budget would be a drag on growth heading into next year. There appears to be investor interest in Thailand’s long-end bonds, with the 30-year government debt auction last week notably attracting strong demand.