Ahead Today

G3: US JOLTS Job Openings and Quit Rate

Asia: China Money Supply

Market Highlights

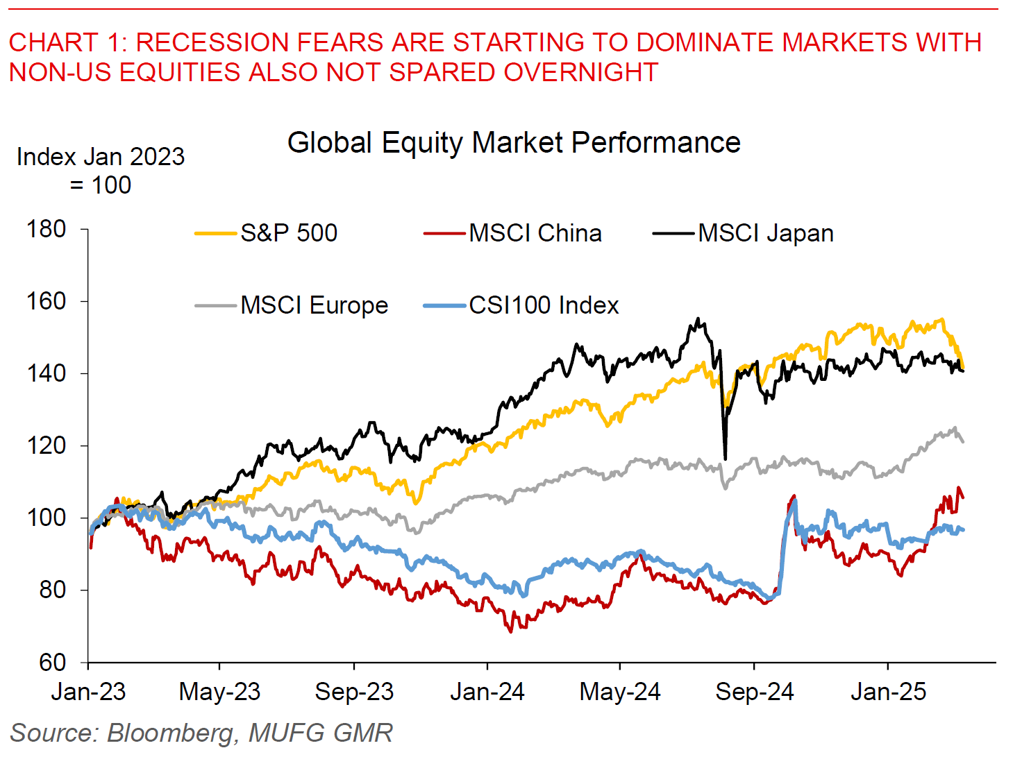

Recession fears increasingly gripped markets, with the S&P500 and NASDAQ falling sharply by 2.7% and 4% respectively, while non-US equities were not spared too with Eurostoxx and MSCI Asia declining by 1.5%. We saw a further rally and steepening in US Treasuries with markets now pricing for more than 3 Fed cuts by 2025.

We have been of the view that markets were complacent on the absolute downside risks to global growth and risk assets from Trump’s tariffs for some time, and this view is continuing to play out (see Asia – Markets complacent on growth? for instance). For Asia specifically, while tariff and trade policy uncertainty has already had an impact on US growth indicators, this will over time also feed through to our region through slowing investments into manufacturing factories and also weaker exports as US consumers adjust to a potential new reality of higher prices and lower supply. Of course, much will also depend on the magnitude and severity of Trump’s tariffs, but our North Star is that Trump 2.0’s tariffs will be larger and more pervasive beyond the day-to-day whiplash.

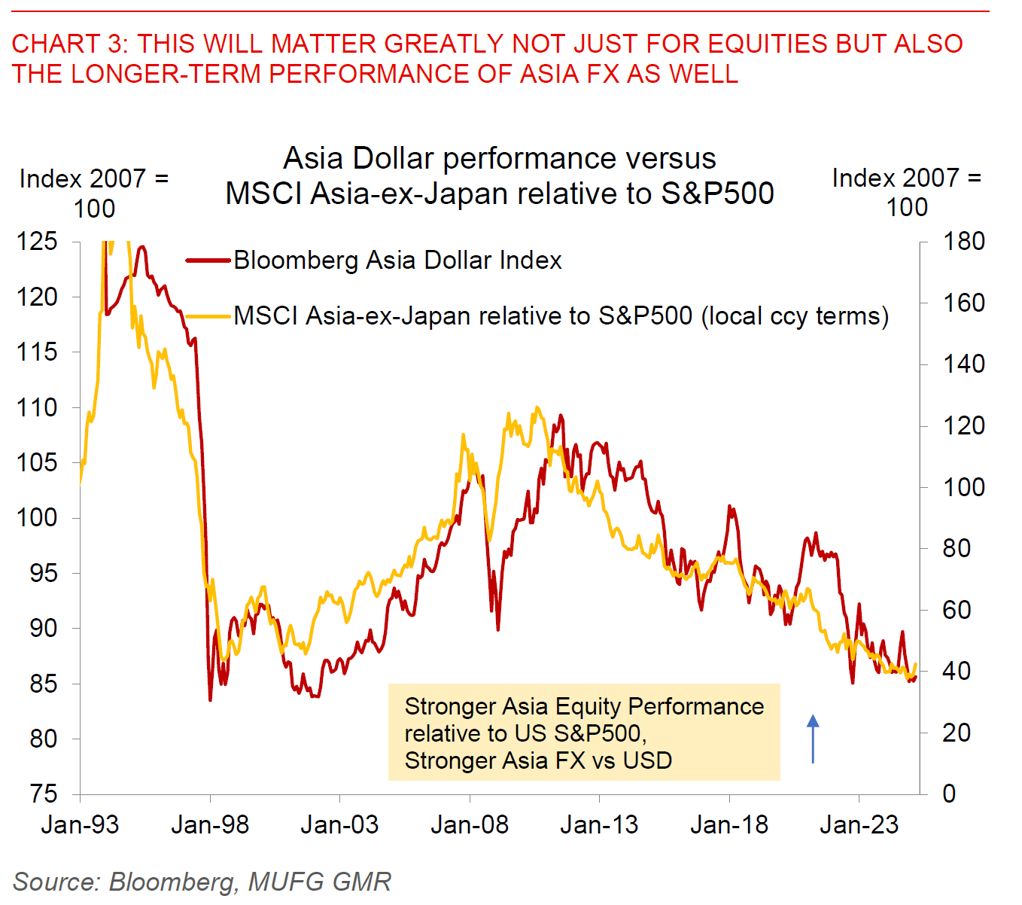

For FX markets in particular, the impact is more complicated as it is a relative and not an absolute asset class. Our previous study of three decades of Fed easing cycle on Asian FX markets shows that three factors matter most for Asian currencies – growth differentials, yield differentials, and risk sentiment (see Asia FX – The impact of Fed’s easing cycle and more). Put differently, how Asia FX responds will depend on the severity of Asia’s growth slowdown and also how much further risk appetite declines.

Our best sense right now is that markets are still underpricing the downside risks to Asia’s growth and so it makes sense to position for Asian currency weakness at least in the near-term.

Regional FX

Asian currencies were generally weaker, while underperforming the EUR and JPY overnight. The key underperformers were the higher-beta currencies of KRW (-0.54%), THB (-0.7%), while PHP was more resilient (-0.12%). While Chinese equities and tech names also fell overnight likely due to global risk-off, it’s also important to place this in context of important developments seen in recent weeks.

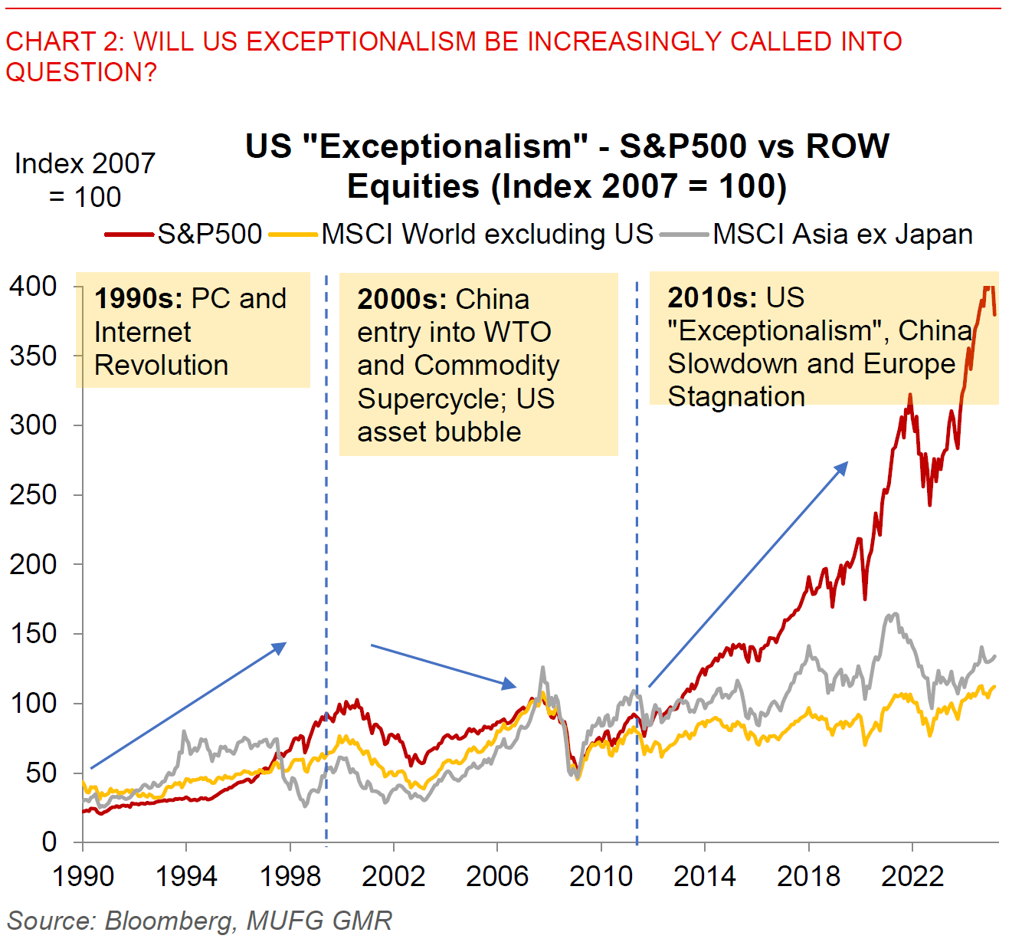

In what some are calling “China’s second Deepseek moment”, Manus AI was released in a limited fashion last week by Chinese start-up Monica, and is definitely something to watch closely for, with interesting market and macro implications, including possibly calling into question the longer-term trend of US exceptionalism. Manus AI seems to be able to do a combination of deep research, synthesis, analytics, drawing insights, creation and outputs of dashboards and visualisations, operation of websites, and much much more. Based on existing models, Manus is akin to a combination of OpenAI's Deep Research, OpenAI's Operator, Claude's Artifacts, together with a really good user interface.

There are nonetheless important caveats. For one, Manus was released to the public only in a limited fashion last week through invitation-only codes. Second, server capacity is limited at the moment and so there are reports of slow performance at times by users who currently have access. Third, it's not clear what technology is happening under the hood and whether Manus is amalgamating a variety of existing LLMs. The analogy in my mind is that the model is able to marry a bunch of very competent PHD level research assistants, make them work very well together, and is also increasingly general purpose across multiple domains and mediums.

This development raises at least three important implications, and building on insights seen from Deepseek:

- First, is China now going beyond just catching up on generative AI to innovating in its own way, and is as such a better way to creation of models beyond just brute force compute?

- Second, will AI models be increasingly commoditised and what does that portend for the monetisation models of frontier models such as from OpenAI?

- Third, the extremely fast pace at which AI models are moving raises important questions on how to both permeate its benefits through society and mitigate its possible negative impact.

The crucial question for both the Dollar and CNY is whether these developments in Chinese tech further calls into question US exceptionalism and with that the high valuation of the Dollar, and also whether this is the spark that the Chinese economy is waiting for, and is able to resolve the binding constraints plaguing its economy.

Our best sense right now is that it is a necessary but perhaps not sufficient condition (even as we keep an open mind on the path forward). In a weird sense, Manus AI also raises important questions on possible replacement of labour in China at a time when the labour market and consumption in China is already quite weak, even as it will likely also raise animal spirits, investment and employment in the tech sector, and possibly also some productivity boost medium term.