Ahead Today

G3: Eurozone Money Supply

Asia: Malaysia Trade, Taiwan Export Orders

Market Highlights

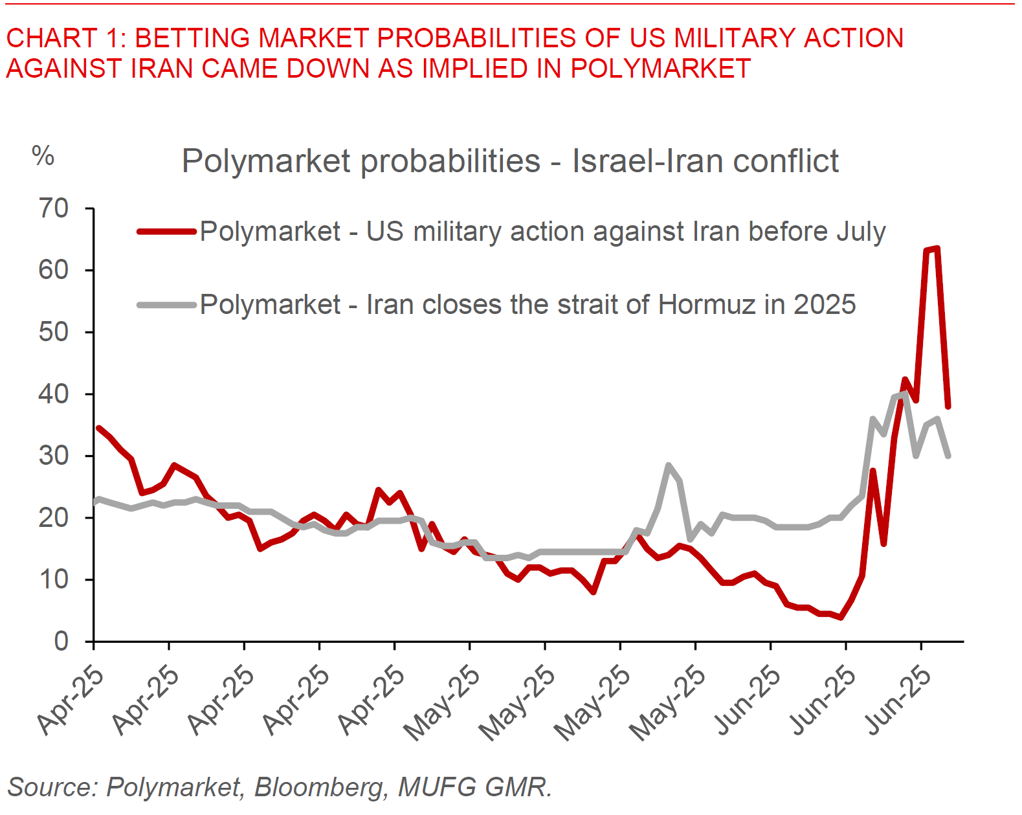

Overnight oil prices and the Dollar sold off slightly, as US President Trump said that there could be new talks with Iran in the “near future”, and that he would decide whether to join Israel’s attacks on the country “within the next two weeks”. For what it’s worth, post the White House statement by the US President, betting market probabilities as implied by Polymarket on US military action on Iran before July fell from a high of 64% down to 38% at the time of writing. Our previous framework to gauge the market impact on Israel-Iran conflict still holds true: first, whether there are actual physical disruptions to global oil supplies including out of Iran. Second, whether the Strait of Hormuz is disrupted – a key chokepoint where a third of all seaborn oil and gas supplies go through. Lastly, the possible involvement of the US on the conflict. On the first 2 points, the good news is that there has not been so far any signs of physical disruptions in oil markets and the Strait of Hormuz, although we note that the possible involvement of the US is a key uncertainty moving forward.

Regional FX

The BSP cut rates by 25bps in its policy meeting on 19 June as we and the market anticipated, bringing the policy rate to 5.25%. Nonetheless, this policy meeting was happening in the broader context of the Israel-Iran conflict, with the key market development being the rise in oil to US$77/bbl at the time of writing, from a trough of US$60/bbl earlier this year.

We have been reasonably sanguine on the Philippines Peso and are currently forecasting USD/PHP at 54.50 by end-2025, supported by our expectations of a weaker US Dollar, coupled with domestic positives such as the surge in FDI approvals, and lower domestic rice prices and manageable inflation.

Nonetheless, the spike in oil prices changes at least part of this thesis, with PHP anything but steady recently, rising quickly to 57.500 levels from 55.800 just within the past week (see Philippines: Steady as she goes).

Suffice to say, we’ll likely have to adjust our PHP forecasts weaker if oil prices continue to rise further moving forward.

Our estimates suggest that every US$10/bbl rise in oil prices boosts the Philippines current account deficit by 0.4% of GDP.

With the Philippines current account deficit already quite large at 3.5% of GDP in 2025 due to infrastructure and capital goods import needs, this deficit could easily rise above 4% of GDP if oil prices were to rise further, with the change at the margin being the external oil price shock, and as such making it more difficult to finance the current account deficit even with our expectation of FDI increases.

From a policy rate perspective, we think that the BSP continues to be biased towards rate cuts at current oil price levels.

We are forecasting BSP to cut rates by another 50bps, bringing the policy rate to 4.75% by the end of 2025, but the central bank could be more constrained if oil prices rise closer to US$90/bbl and also coupled with sharp PHP depreciation.

It’s important to point out that the starting point of inflation in the Philippines is very manageable, with inflation likely to average just 1.8% for 2025. Our estimates suggest that every US$10/bbl rise in oil prices boosts inflation in the Philippines directly by around 0.6pp, with inflation likely to average ~3.5% with oil at US$90/bbl.

We think the key takeaway from the BSP meeting is still a dovish one for now, but keeping a close eye on global oil prices and sharp PHP depreciation. The central bank lowered its 2025 inflation forecasts, expects slower global and domestic growth, and highlighted the continued need for more accommodative monetary policy. However, this was also combined with a higher 2026 inflation forecast, with need for closer monitoring of inflation.

BSP Governor Remolona also mentioned that while moderate PHP depreciation won’t affect the inflation environment, it will likely have to intervene if FX depreciation continues at a sharp pace.

We think there’s a good chance BSP will start to intervene more aggressively if PHP weakness continues unabated towards the 58-59.00 levels within a short space of time.