Ahead Today

G3: US mortgage applications, new home sales, Germany IFO business climate

Asia: Thailand exports, Taiwan industrial production

Market Highlights

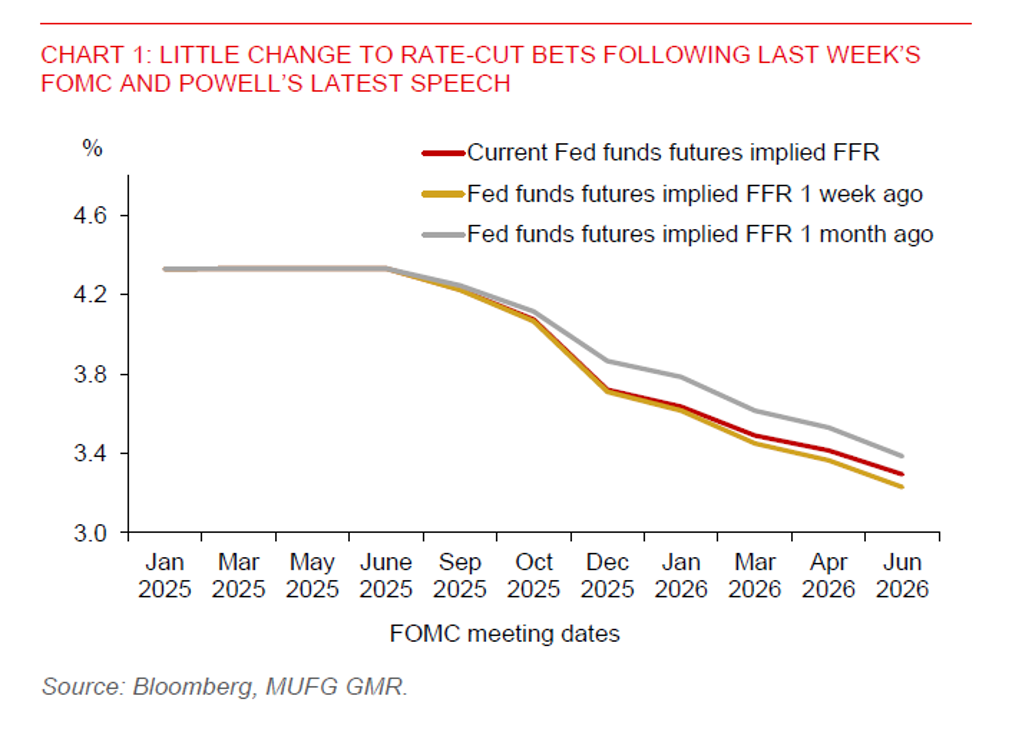

The broad US dollar index (DXY) softened a bit overnight, while gold prices held its record advance. Fed Chair Powell has reiterated that there is “no risk-free policy path” ahead as the labour market faces downside risks while inflation faces upside risks. He has described the current monetary policy stance as remaining “modestly restrictive,” even after last week’s 25bps rate cut. This suggests that the Fed remains open to future policy rate cuts, amid signs of weakness in the labour market. While Powell sticks with the view that tariffs could be a one-off event, he has warned about the need to stay attentive to potentially persistent inflationary pressures resulting from President Trump’s tariff policies. Moreover, US consumer inflation has stayed above the Fed’s 2% target for a prolonged period of time. Powell’s speech appears to have leaned on the cautious side.

On the macro data front, US September PMIs softened, with manufacturing at 52.0 and services at 53.9, both down from prior readings of 53.0 and 54.5, respectively. The Richmond Fed Manufacturing Index fell to -17, extending its broad slowdown, suggesting regional factory weakness.

Asian currencies were broadly weaker against the US dollar though, with higher-yielding currencies such as INR (-0.5%), IDR (-0.4%), and PHP (-0.4%) leading losses in the region. India’s flash PMIs softened, with manufacturing at 61.9 and services at 58.5, both down from prior readings of 63.2 and 59.3, respectively. The rupiah has been weighed down by market perception of increased sovereign credit risks. The government is set to review the State finance Law next year, which currently caps the budget deficit at 3% of GDP and the government debt to GDP at 60%. With USDIDR breaching the 16,600-level and market sentiment remaining fragile, the pair could consolidate above our initial year-end forecast of 16,400 in Q4, unless there is a meaningful shift in policy clarity.

Elsewhere, Singapore’s core inflation slowed to 0.3%yoy in August, from 0.5%yoy in July. Taiwan’s export orders remained robust at 19.5%yoy in August, suggesting sustained demand for semiconductors and other electronics products in the coming months. A continuation of the tech upcycle will have positive spillover effects on Malaysia’s economy and the ringgit, given its integral role in the chip supply chain.