Ahead Today

G3: US University of Michigan Sentiment and Inflation Expectations, UK Industrial Production

Asia: India Industrial Production, Hong Kong GDP

Market Highlights

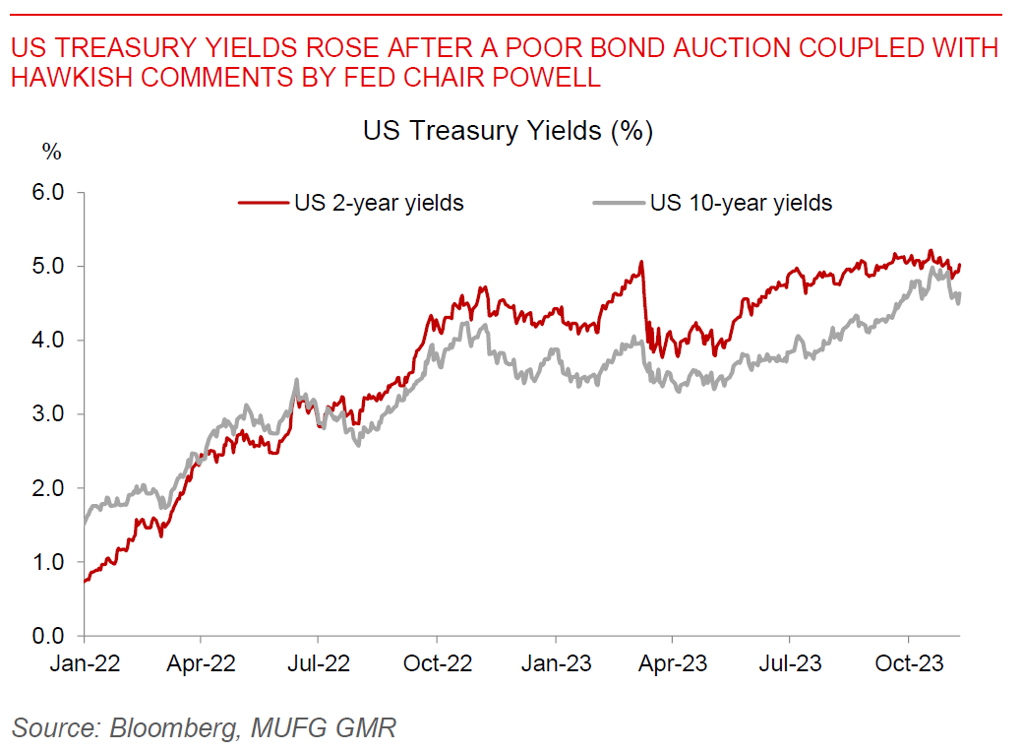

US Treasury yields spiked after a poor 30-year bond auction, coupled with hawkish comments by Fed Chair Powell. Powell said that the central bank will continue to move carefully but will not hesitate to tighten policy further if appropriate, while also highlighting that the Fed is not confident policy is tight enough for 2% inflation. Meanwhile, the US$24bn 30-year US Treasury auction was 5 bps higher than expected, highlighting the continued difficult demand and supply dynamic in the world’s risk-free asset. The poor Treasury auction may also have been due to a cybersecurity-led disruption at ICBC which impacted clearing of trades, but the extent to which it contributed was unclear.

Overall the US Dollar strengthened some by 0.3%, while risk assets such as the S&P500 fell by 0.84%. Looking ahead, markets will focus on the University of Michigan inflation expectations and sentiment datapoints.

Regional FX

Asian currencies were weaker against the Dollar, following broader Dollar strength. China’s CPI inflation came in lower than expected at -0.2%yoy, while PPI remained in negative territory at -2.6%yoy, highlighting continued concerns around weak demand and spare capacity in the country. Meanwhile the Philippines’ 3Q GDP bounced back to 5.9%yoy from 4.3%yoy in 2Q, helped by an improvement in government consumption and fixed investment by 6.7%yoy and 7.9%yoy respectively. Private consumption slowed down further to 5%yoy from 5.5%yoy on the back of sticky and elevated inflation. Looking ahead markets will focus on India’s industrial production numbers, which are expected to remain robust at around 7%yoy.