Ahead Today

G3: US Leading Index

Asia: China loan prime rate, India infra index

Market Highlights

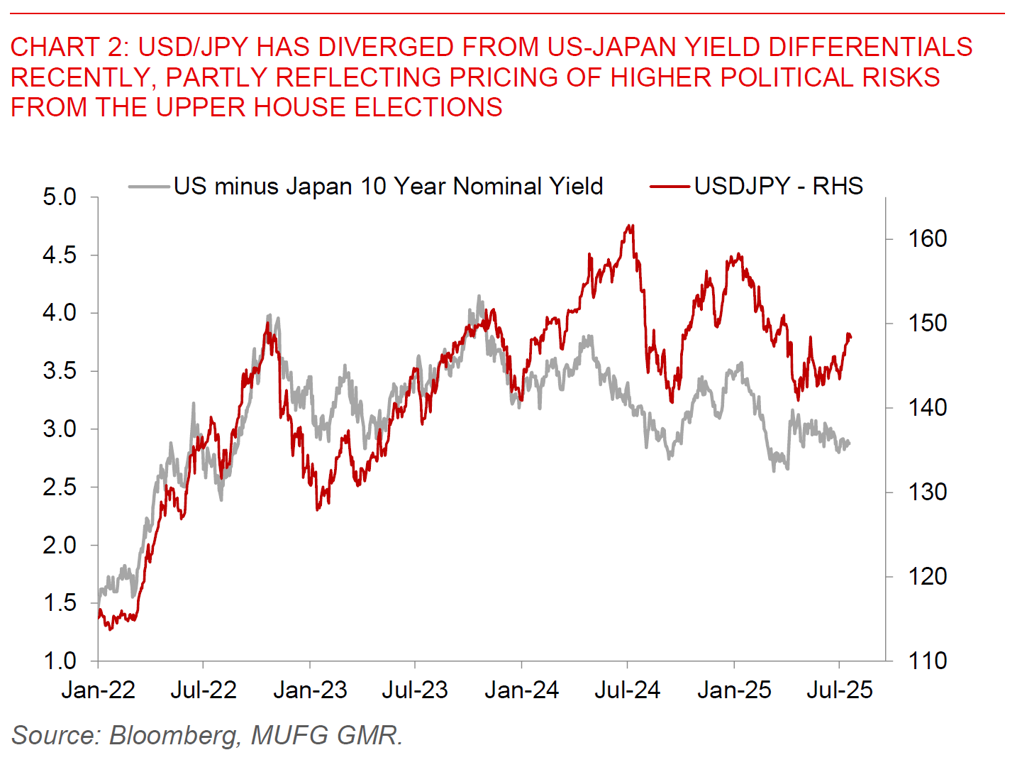

In Japan’s Upper House Elections, the ruling Liberal Democratic Party along with partner New Komeito lost its majority in the chamber, according to public broadcaster NHK. This marks the first since 1955 that the LDP-led government has fallen below a majority in both the lower and upper house, potentially increasing political instability in Japan. The latest seat count by NHK had LDP and Komeito combining for 47 seats in this election (LDP: 39 and Komeito: 8). If upheld, this seems to have fallen short of perhaps more disastrous scenarios indicated in Initial exit polls (32-51 seats), but is overall likely a repudiation still for Prime Minister Ishiba.

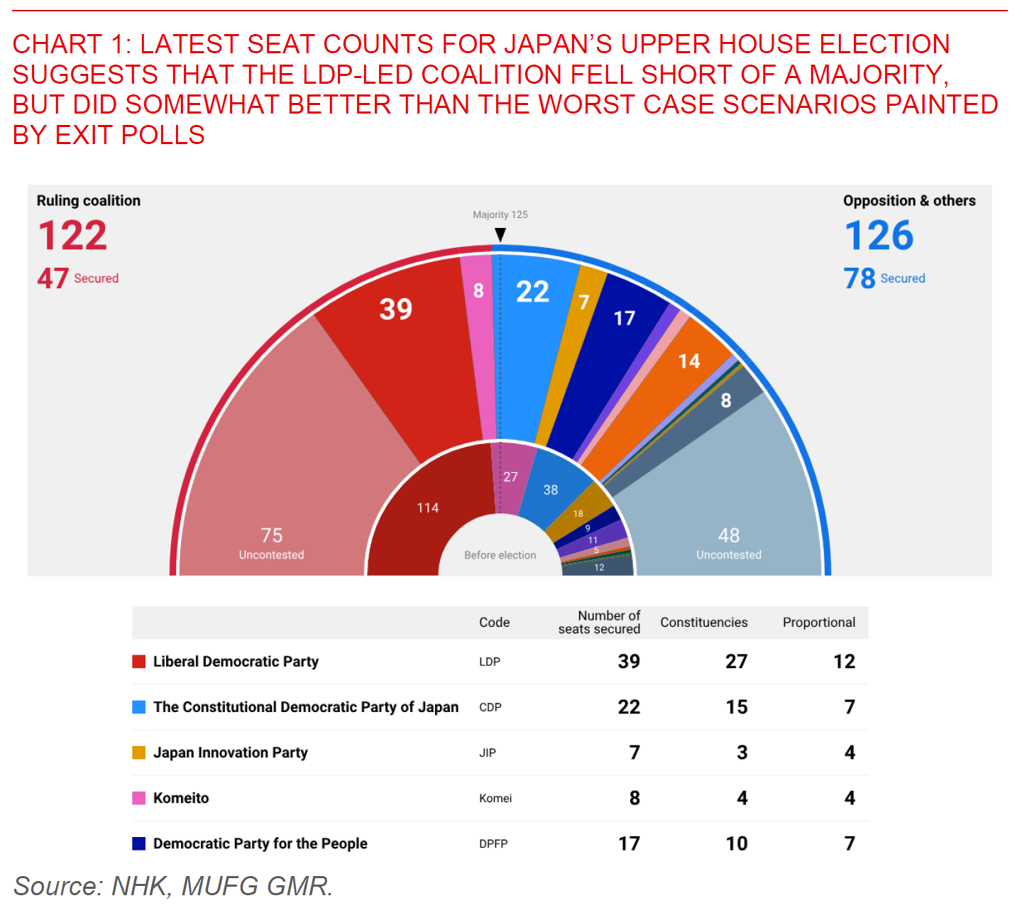

In the very near-term, the Japanese Yen strengthened by as much as 0.7% to 147.80 against the US Dollar on the back of the election results, before paring back some gains to 148.32 levels at the time of writing. It’s unclear whether this was driven just by positioning adjustments, or perhaps some initial relief by market that worst case scenarios as indicated by the exit polls did not come to pass. While there has no doubt been some pricing of a loss in JPY FX and rates markets heading into the Upper House Elections, what will be key for markets beyond the near-term will be whether Prime Minister Ishiba can hang onto power, and if not, the length of the transition process and the new leader. Japanese Prime Minister Shigeru Ishiba said he intended to stay on despite his ruling coalition suffering the Upper House Election setback.

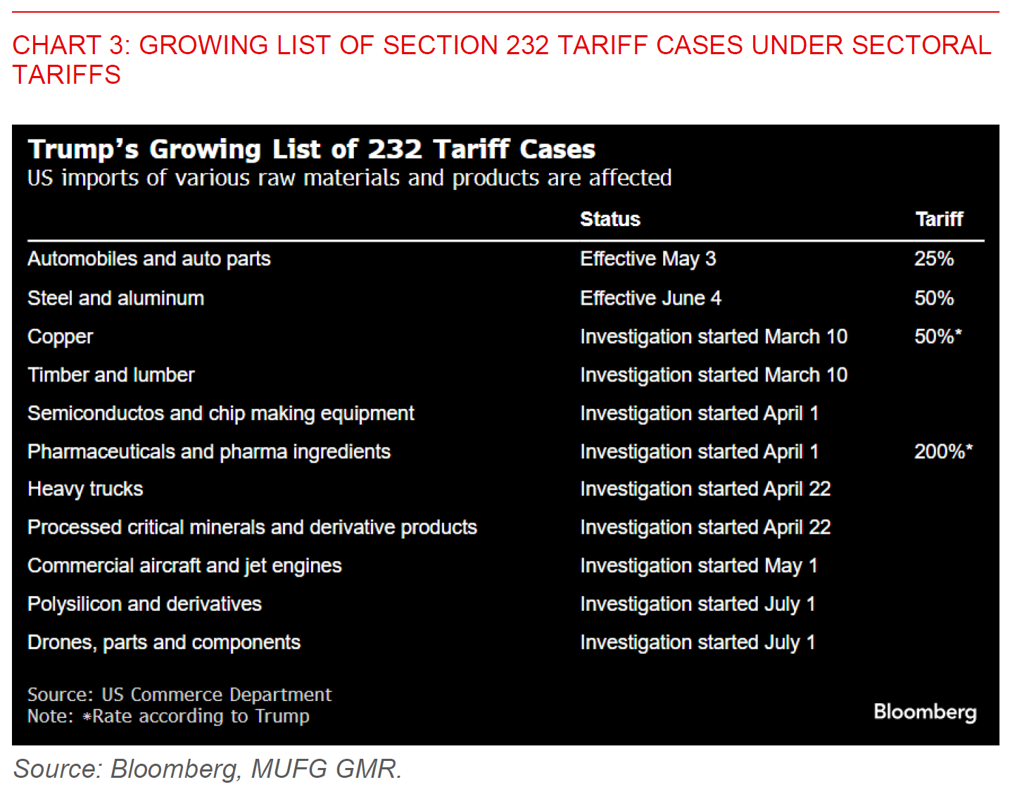

Beyond the Japan Upper House Elections, Bloomberg News reported that President Trump is readying plans for industry-specific tariffs to kick in alongside his country-by-country duties in two weeks. Details of Trump’s planned 50% duty on copper could be released before 1 Aug, tariffs on pharmaceuticals could be imposed by month’s end, while import taxes on semiconductors could come soon as well. Overall, the sectoral tariffs could cover 30% to 70% of a country’s exports under these Section 232 investigations, with the rest being hit by country specific reciprocal tariffs.

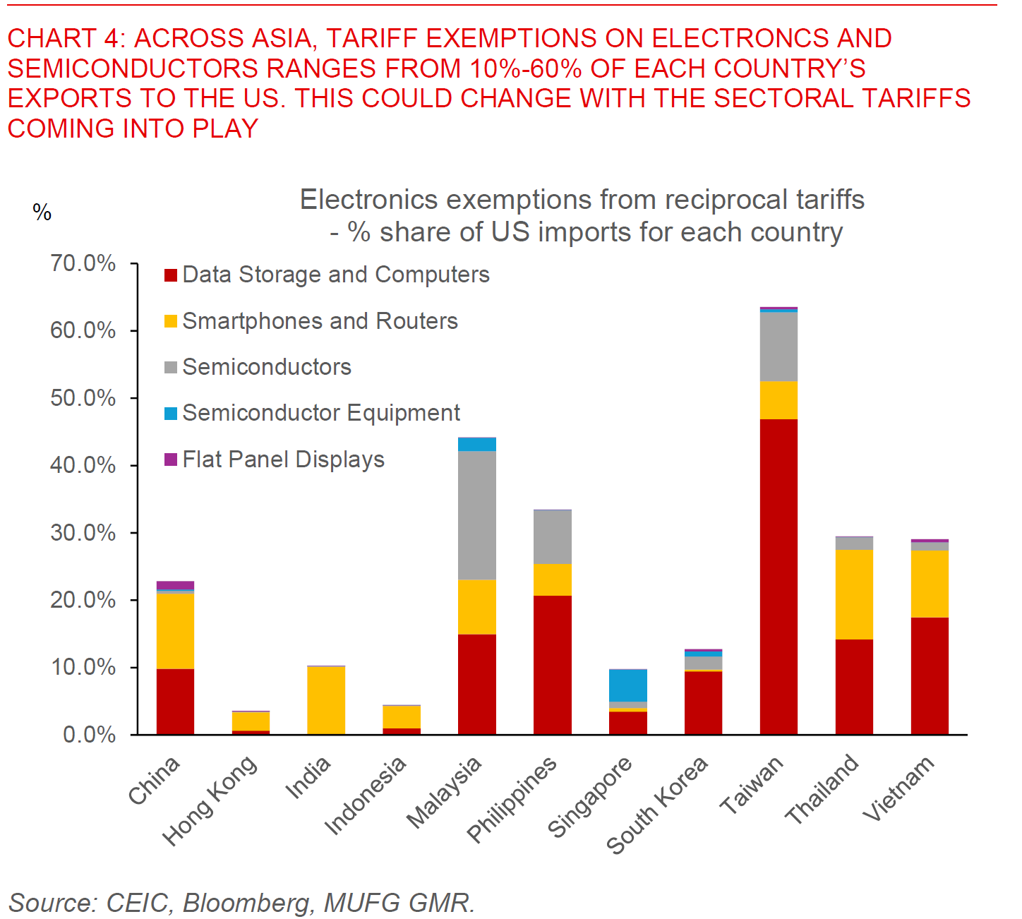

To provide some context in Asia, there are current exemptions such as on electronics and semiconductors which ranges from 10% to 60% of a country’s exports to the US depending on individual countries. The exact definitions for pharmaceuticals and other products under Section 232 investigations have not been set yet, but the trend so far seems to be a broad and expansive definition of products if the steel and aluminium tariffs are anything to go by.

Bottomline, we may have a situation over time where the Section 232 tariffs effective prove to be more important than the reciprocal tariffs, with country variation in tariffs determined by product mix of each country and which products are deemed more important in reshoring to the US and hence receive higher tariffs perhaps.