Ahead Today

G3: US NFIB small business optimism, France industrial production

Asia: Taiwan exports

Market Highlights

Political risks have risen in Japan and Indonesia. Japan is facing policy uncertainty following Prime Minister Ishiba’s announcement to step down after his Liberal Democratic Party (LDP) lost its majority in the upper house election, his second electoral setback after losing the lower house majority last year. The LDP is expected to hold a leadership contest, but a new prime minister may not be selected until October, leaving a temporary vacuum in fiscal leadership.

In the interim, concerns over Japan’s fiscal outlook have surfaced, reflected in a sharp rise in long-end yields. The 30-year JGB yield has surged to record highs above 3.20%, significantly widening the spread against 5-year JGBs, potentially underscoring investor anxiety over fiscal policy direction. USDJPY continues to trade above the 145.00 level against the US dollar, despite further declines in the US-Japan 10-year real yield differential.

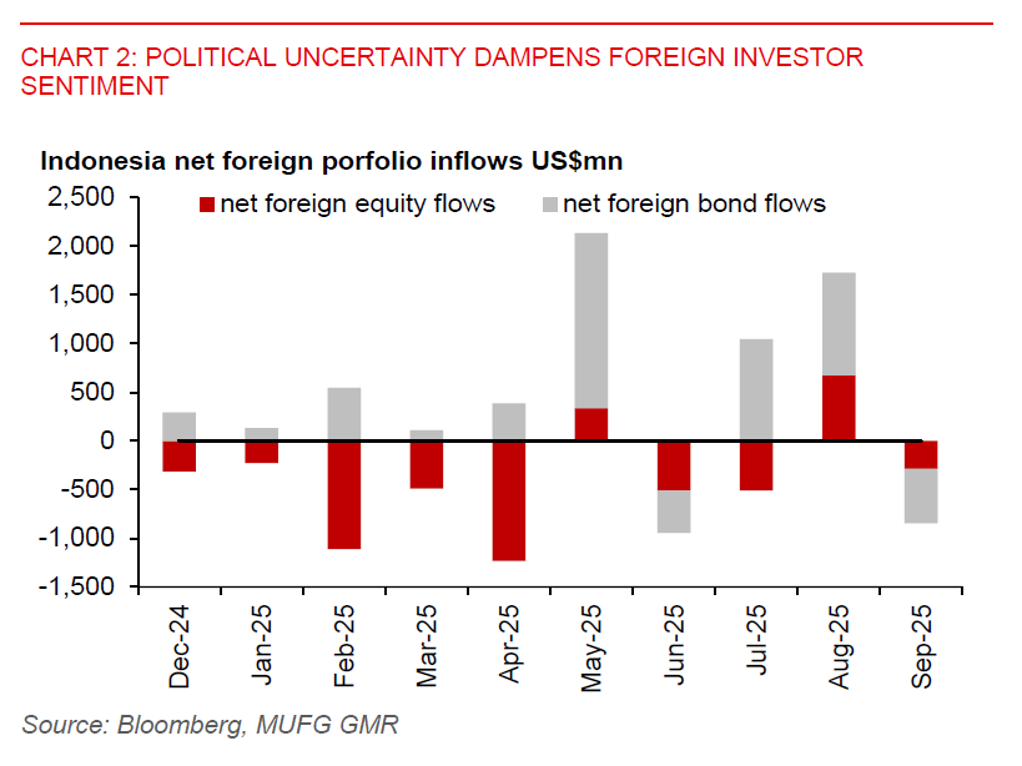

In Indonesia, the rupiah has come under renewed pressure following the 8 September cabinet reshuffle, which saw the replacement of long-serving Finance Minister Sri Mulyani, a figure highly regarded by international investors, with the lesser-known Purbaya Yudi Sadewa. Purbaya is an experienced economist and also the Chairman of the Deposit Insurance Corporation. This leadership change at the finance ministry has raised concerns over the country’s fiscal policy outlook, given the lack of clarity around Purbaya’s policy stance in the near term.

Following the announcement of the reshuffle, the rupiah fell about 1.3% against the US dollar in the offshore NDF market to above 16,500/USD, and there could be more downsides in the days ahead given policy uncertainty. The reshuffle also comes on the heel of recent public protests over proposed increases in lawmakers’ household allowances, adding to investor unease. Purbaya now faces the challenge of balancing President Prabowo’s expansive social agenda, including funding the free nutritious meals and free healthcare programmes, with maintaining fiscal sustainability.

The key question is whether Purbaya will maintain Indonesia’s fiscal deficit within the legal ceiling of 3% of GDP. While he has yet to unveil a formal fiscal roadmap, our assessment is that he may adopt a technocratic yet pragmatic approach - one that aligns more closely with President Prabowo’s social priorities while preserving investor confidence. This could involve reallocating resources and improving budget efficiency to fund key initiatives such as Makan Bergizi Gratis and free healthcare programs, without breaching the statutory fiscal deficit limit of 3% of GDP. His background as Chairman of the Deposit Insurance Corporation (LPS) suggests a strong orientation toward risk management and systemic stability, which could help anchor investor expectations. The pressure on the rupiah could ease once Purbaya is able to build investor confidence in the credibility of Indonesia’s fiscal policy.