Ahead Today

G3: US ADP employment, initial jobless claims, ISM services index

Asia: Thailand CPI, BNM policy rate decision

Market Highlights

Recent US macro data for July has reinforced signs of a slowing economy, with factory orders falling 1.3%mom, durable goods orders down 2.8%mom, and job openings easing to 7.18 million (vs 7.44 million prior and Bloomberg consensus of 7.38 million). These data points add weight to market expectations for Fed rate cuts, which could exert downward pressure on the US dollar. Fed Governor Christopher Waller has said that the Fed should cut rates in September, with multiple cuts to come in the months ahead.

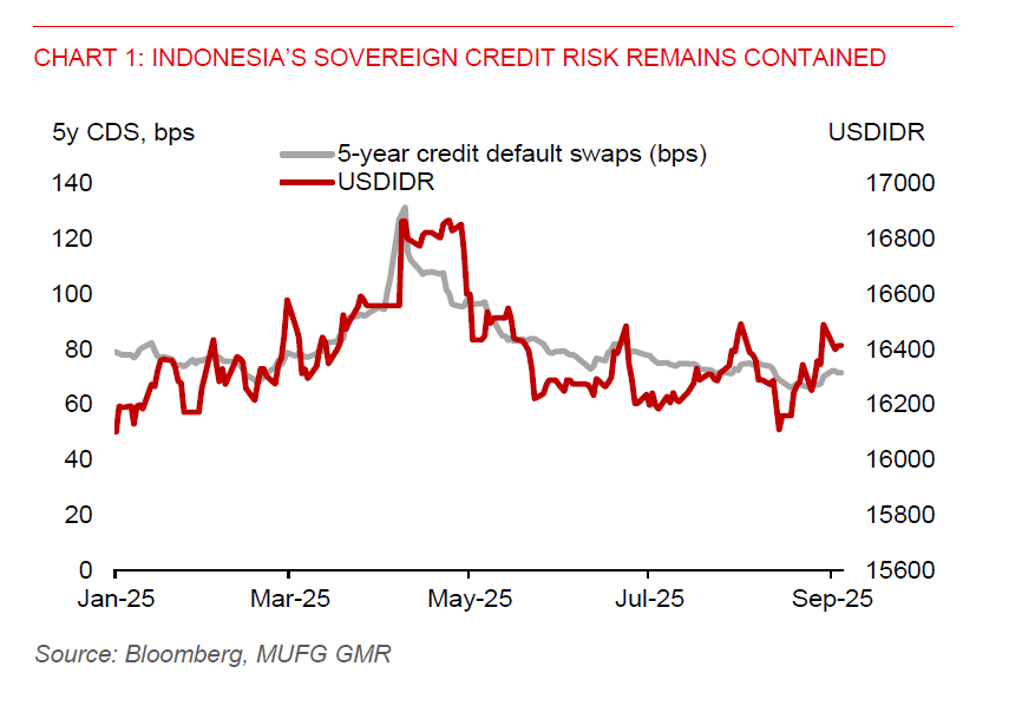

In Indonesia and Thailand, political uncertainty has risen, weighing on their currencies. However, market sentiment on the rupiah and Thai baht may benefit from a soft dollar backdrop.

In Indonesia, recent street protests have weighed on sentiment. However, heightened law enforcement and the government’s rollback of its controversial policy have helped restore a degree of normalcy. Assuming no sharp escalation in social unrest, we maintain our GDP growth forecast at 4.8% for both 2025 and 2026. Bank Indonesia’s FX intervention should also help stabilize the rupiah, particularly in the context of a softer USD.

In Thailand, political dynamics have become volatile following the Constitutional Court’s ousting of Prime Minister Paetongtarn. Despite this, markets have not priced in a significant deterioration in sovereign credit risk. Anutin Charnvirakul, leader of the conservative Bhumjaithai Party, has emerged as a potential successor, backed by the People’s Party, the largest party in the lower house. Efforts by Pheu Thai to dissolve parliament and block Anutin’s potential appointment failed to secure royal endorsement. That said, Anutin will need to dissolve parliament within four months of being sworn-in, in exchange for the support from People’s Party. On the fiscal front, Thailand’s Senate has approved the FY2025 budget (starting October 1), totalling THB 3.78 trillion (USD 117 billion). The budget targets a deficit of 4.3% of GDP, aimed at supporting growth. This helps ease concerns about potential budget delays amid political instability.

Looking ahead, US ADP employment data will be closely watched. Bloomberg consensus expects a slowdown to +68k in August, down from +104k in July. A downside surprise could intensify rate cut expectations, providing further support for Asian currencies. The USD may come under renewed pressure ahead of key labour market releases later this week.

In Malaysia, we expect Bank Negara Malaysia to hold its policy rate at 2.75% today, maintaining a neutral stance as it awaits greater clarity on President Trump’s semiconductor tariff plans.