Ahead Today

G3: US eurozone manufacturing PMI

Asia: China Ratingdog manufacturing PMI, Indonesia trade and CPI

Market Highlights

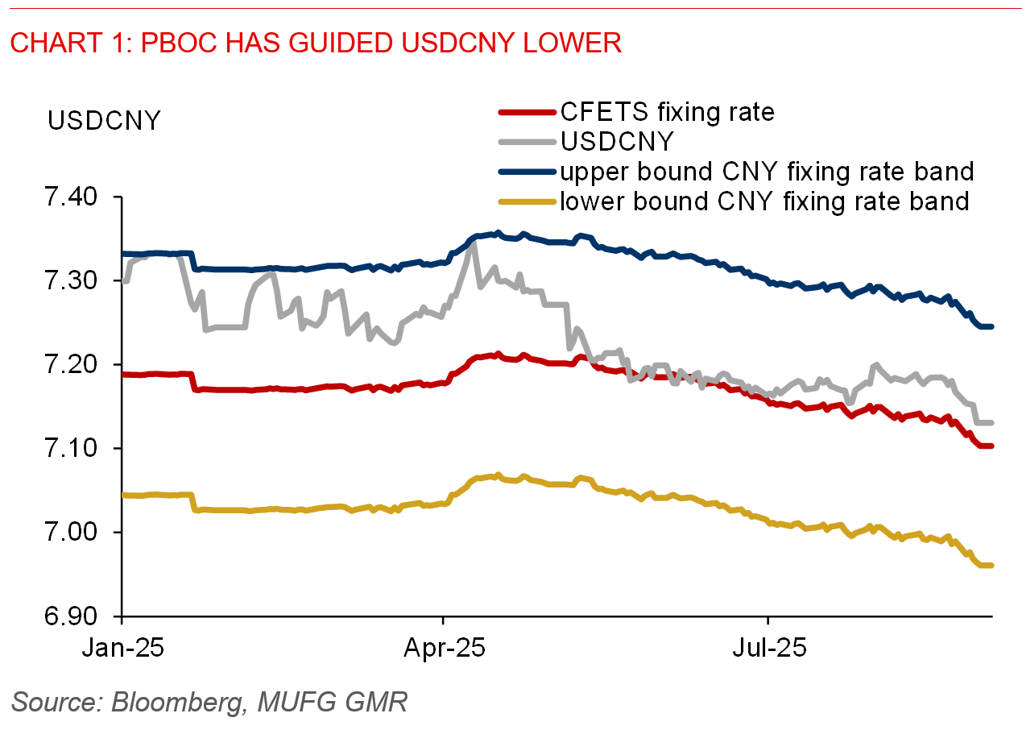

Since the Jackson Hole symposium last week, USDCNH has declined by 0.8%, supported by dovish signals from Fed Chair Powell and proactive measures by the PBOC. The PBOC has lowered the daily USDCNY fixing rate to around 7.1030, helping to contain depreciation pressures on the yuan. However, underlying growth concerns remain, underscoring the need for further macro policy support. The official NBS manufacturing PMI for August, released over the weekend, came in at 49.4 - still in contraction territory. On a more positive note, services activity held up at 50.3, indicating modest expansion. Meanwhile, the US federal appeals court has also ruled that most of President Trump's tariffs are illegal.

In Tokyo, headline inflation slowed to 2.6%yoy in August, down from 2.9% in July, largely due to government utility subsidies. The core measure (excluding fresh food and energy) eased slightly to 3.0% from 3.1% but remains above the BoJ’s 2% target. These readings support the case for a gradual rate hike path by the BoJ. Business sentiment remains firm, with large enterprises holding steady at elevated levels, and improvements seen among medium and small enterprises, suggesting resilience in corporate confidence.

On US data front, core PCE inflation rose by 0.3%mom (2.6yoy), in line with market expectations. Meanwhile, consumer sentiment edged down to 58.2 from 58.6, suggesting some caution among households.

Regional FX

In Asia, the Indonesian rupiah (IDR) and Indian rupee (INR) led losses against the US dollar last week, depreciating by 0.9% and 0.8%, respectively.

Political risk likely weighs on rupiah. The rupiah weakened toward the 16,500 level as markets reassessed political risk amid street protests triggered by government plans to raise lawmakers’ housing allowances. Over the weekend, demonstrations spread beyond Jakarta. In response, President Prabowo addressed the nation and announced that the proposed perks would be scrapped in an effort to calm public unrest. Assuming the situation stabilizes, markets may begin to unwind the risk premium priced into the rupiah last week.

Thailand’s current account surplus support baht. The monthly trade surplus widened to $2.5bn in July compared to $1.1bn a year ago. Despite net outflows in services and income, the current account surplus rose to $2.2bn, significantly higher than the $43mn recorded a year earlier. The Thai baht remained resilient against the US dollar, even after the court ousted Prime Minister Paetongtarn. The caretaker government has since met with the opposition People’s Party to seek support for its prime ministerial candidate, aiming to retain power. It has also agreed to dissolve parliament within four months to pave the way for new elections.

India’s Q2 GDP surprises to the upside. Q2 GDP growth accelerated to 7.8%yoy, up from 7.4% in Q1 and well above Bloomberg consensus of 6.7%. India’s 10-year government bond yield briefly rose 11bps to 6.64% before easing, as markets likely scaled back expectations for near-term rate cuts.