Ahead Today

G3: US CPI

Asia: China CPI and PPI

Market Highlights

US job growth was much less robust than previously estimated, with the number of workers on payrolls revised down by 911,000 according to the preliminary benchmark revision out yesterday. With the revisions, average job growth for the period in the year through March was roughly half of 149,000 per month. This is as such another data pointing towards a US softer labour market – a trend which predates the tariffs imposed in Trump 2.0, but likely also exacerbated this year by the significant rise in policy uncertainty seen this year. This should also cement the doves on the FOMC to get on with rate cuts and reduce Fed rates by at least 25bps in the September meeting.

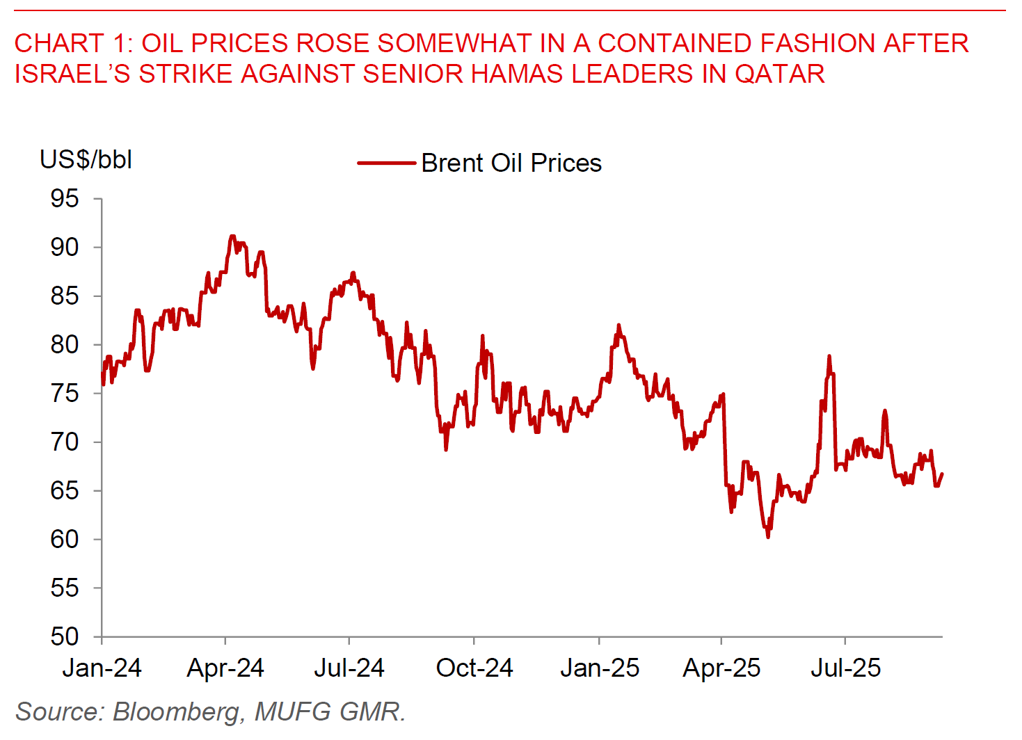

The market reaction was interesting, with a counterintuitive selloff in US bonds, marginal rise in US dollar, coupled with some softness in risk sentiment. The payrolls downward revision might have been offset to some extent by geopolitical risks. In particular, Israel conducted a strike against senior Hamas leaders in the Qatari capital of Doha, escalating tensions between Israel and Arab nations over the war in Gaza. Qatar condemned the strike, calling it a “flagrant violation” of international law, while President Trump criticized the attack while saying he learnt about the attack too late to stop it. Oil prices did rise somewhat after the news albeit in a contained fashion, but this is something to certainly for moving forward on risks.

Meanwhile, both the FT and Bloomberg reported that Trump told European officials he is willing to impose sweeping new tariffs on India and China to push Russia President Vladimir Putin to the negotiating table, but only if EU countries do so as well. Other potential measures discussed by US and EU officials include further sanctions on Russia’s shadow fleet of oil tankers as well as restrictions on its banks, financial sector and major oil companies. For India in particular, this would be a risk to watch for although not a high probability in our view, given that India is also negotiating a FTA with other countries including the EU, and also the broader context of 50% tariffs that India is facing from the US right now due to its purchase of Russia oil.

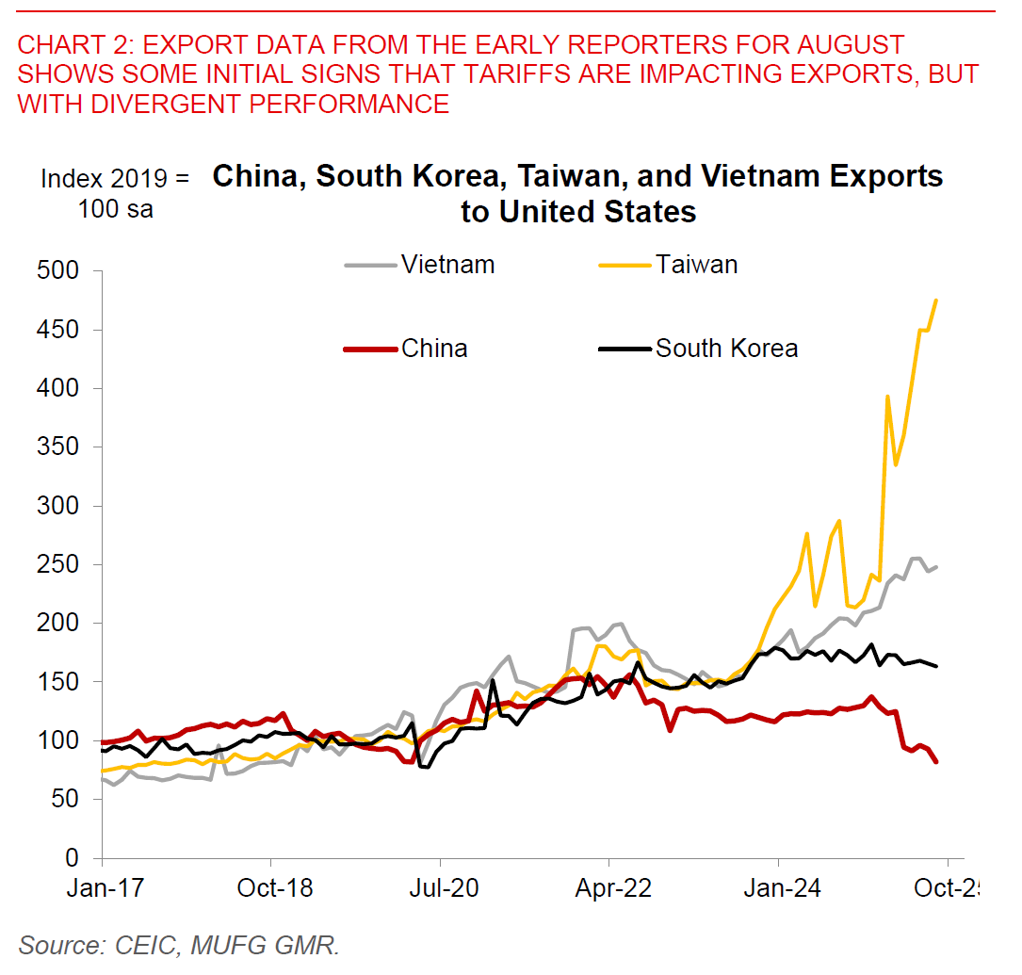

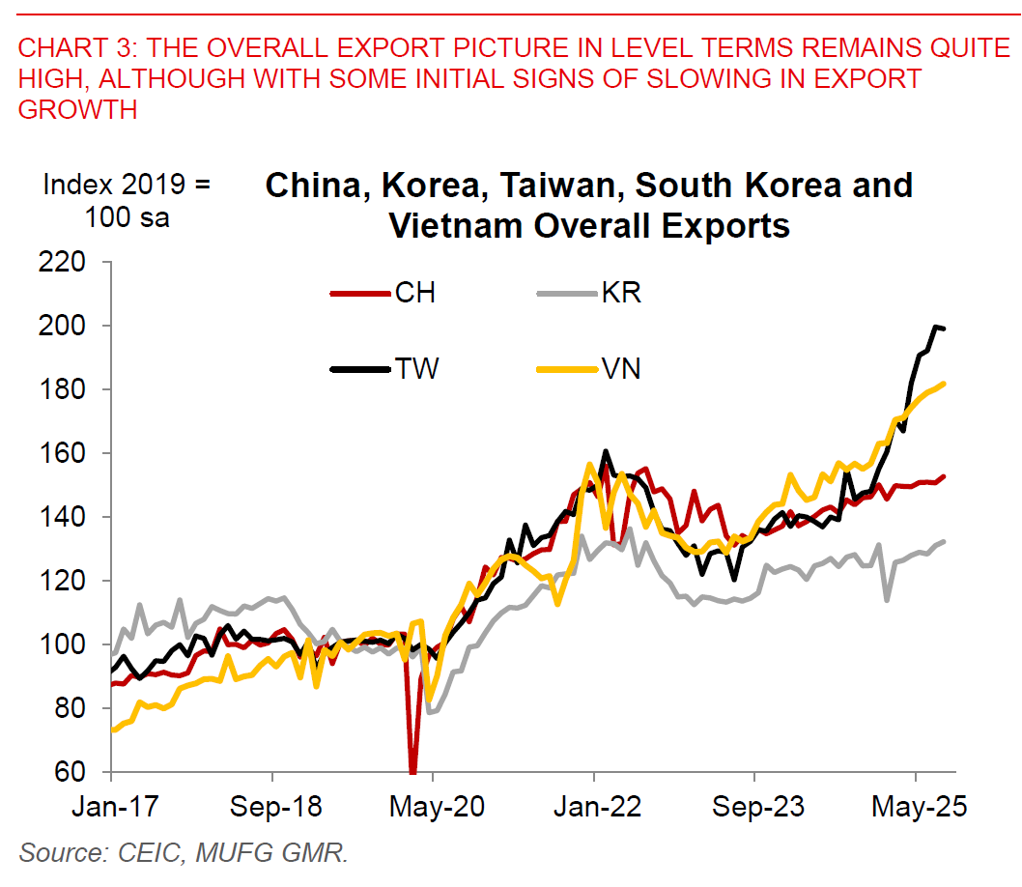

Last but not least, the early reporters on August exports across Asia pointed to a reasonably decent picture still despite tariffs being imposed since August, although it may still be too early to tell for now given that some goods could have been shipped before that and also that goods in the process of moving to the US on the water can still avoid tariffs up to October. In particular, China’s exports to the US fell further in August, but the rise to other countries including to the rest of Asia helped to cushion that fall to some extent. Taiwan’s exports to the US actually rose further in August, but of course it is important to note that semiconductors and electronics are exempt from tariffs for now and so as such this is unlikely to be sustainable. This strength could also reflect robust demand for AI chips and data centers, something which Taiwan certainly benefits very much from. Last but not least, Vietnam’s exports slowed down to around 14%yoy, but in absolute terms remains at quite a high level.

Overall, our key message and expectation based on both lead indicators and expectation for tariff impact is still Asia’s exports will increasingly slow moving forward, and this is also reflected in our FX forecasts for Asian currencies to underperform core G10 FX such as EUR through our forecast horizon.