Ahead Today

G3: ECB Guindos speech

Asia:Vietnam: retail sales, industrial production, and CPI; Singapore: export and import prices

Market Highlights

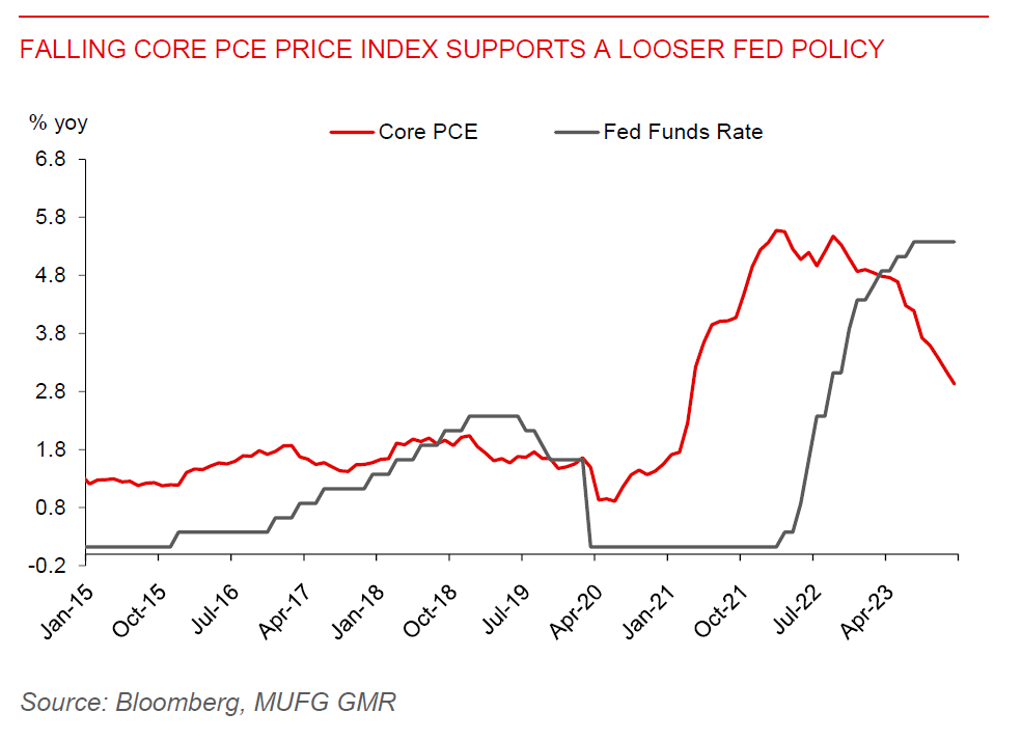

In line with market expectation, core PCE inflation – the US Fed’s preferred inflation metrics – rose 0.2% m/m in December. And it was 2.9% higher compared to a year ago, extending the moderation in price pressures since the 5.3% peak in March 2022. This adds to evidence that disinflation is continuing, which will allow the US Fed to eventually pivot to a rate cut later this year. Markets are currently pricing in a 46% chance of a Fed rate cut in March and a 51% chance that it would occur in May. Easing core inflation, coupled with solid US Q4 GDP growth of 3.3% y/y (market consensus is for 2% growth), have made a US “soft-landing” looks likely. December personal income and spending rose 0.3% m/m and 0.7% m/m respectively. S&P500 index held on to gains in the past week, while easing core inflation has helped softened the US 10-year yield to 4.14% from a peak of 4.2% seen in the middle of last week. Markets will be focused on the FOMC meeting on 30-31 January, including Fed Chair Powell’s comments, for any guidance of the timing and pace of rate cuts this year.

Japan’s leading economic index was 107.6 in November 2023, the lowest level since October 2020, suggesting that the Japan’s economic recovery in the months ahead will remain fragile. The Japanese economy fell 0.7% q/q in Q3 2023.

China will suspend the lending of restricted shares today to limit short-selling and halt the slump in its equity markets. This follows calls from Chinese premier to support the stock market, which could possibly also include a rescue package of RMB2 trillion of offshore fund and RMB300billion of onshore capital. The PBOC will lower the reserve requirement ratio by 50bp (effective from 5 February). China’s industrial profits were down 2.3% in 2023, marking the second straight year of decline (2022: -4%) and reflecting weak domestic and external demand.

Regional FX

Majority EM Asian currencies had a muted net change against the USD amid a 0.3% appreciation of DXY Index last week. Indonesia rupiah and Philippines peso were the worst performers with a loss of 1.3% and 0.6% against the dollar respectively. Against the dollar, TWD, CNY and KRW strengthened by a net 0.4% or less; INR, MYR, THB and VND depreciated very mildly by 0.1%-0.3% versus the US dollar.

The MAS left its monetary policy setting unchanged at its first quarterly review of the year, as core inflation remains high. It will maintain the prevailing rate of appreciation of the S$NEER policy band (MUFG estimate: 1.5% pa) with no change to the width of the band or the level at which it was centered. Meanwhile, Singapore’s industrial production (IP) fell 2.5% y/y, weaker than Bloomberg consensus for a 1% increase. This brings IP to a 4.3% contraction in 2023. The decline was mainly driven by the volatile pharmaceutical sector and weakness in non-electronics output.

Elsewhere in the region, Philippine exports fell 0.5% y/y in December, easing from a 13.7% y/y fall in November, while registering a trade deficit of US$4bn. Thailand’s exports fared better, up 4.7% y/y in December, marking the fifth straight month of increase.