Ahead Today

G3: US Non-Farm payrolls

Asia: RBI Monetary Policy Decision, Philippines CPI

Market Highlights

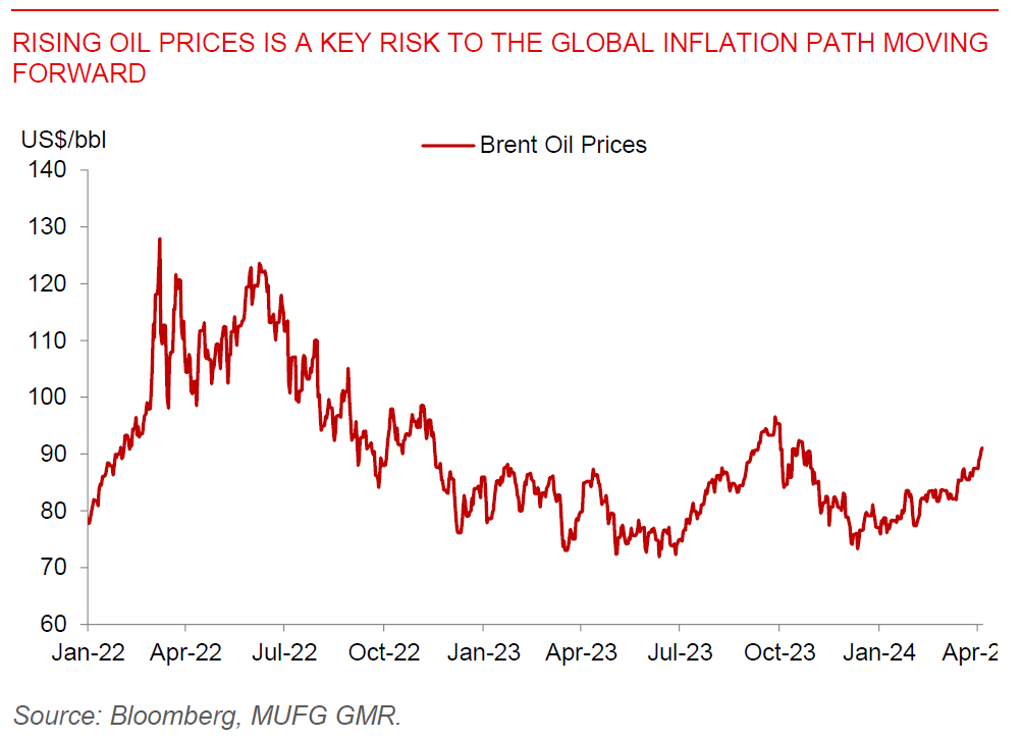

The Dollar weakened before reversing during the US session while US equities sold off by 1%, with a combination of better-than-expected European data coupled with somewhat hawkish Fedspeak and higher oil prices. The final estimate of Eurozone’s Services PMI was stronger than expected, rising 51.5 from the earlier estimate of 51.1, boosted by better numbers across Germany, France, Italy and Spain. The account of ECB’s March policy meeting released yesterday showed ECB officials saw a strengthening case for considering rate cuts, and this also comes ahead of next week’s policy meeting where there could be more signals on the path forward.

Despite better data outside the US, the tug of war on the Dollar continues given the resilience of the US economy thus far. Minneapolis Fed President Neel Kashkari said rate cuts may not be needed if progress on inflation stalls and economy remains robust. Meanwhile, Richmond Fed President Barkin said the Fed has time to gain clarity, while Philadelphia Fed President said inflation remains too high.

Today’s NFP will be important for markets. Beyond the headline print, markets will also focus on the labour force participation rate, hourly earnings, coupled with employment change in the household survey, to help disentangle between supply and demand, and especially given reports of strong immigration growth into the United States.

Regional FX

Asian FX markets traded mixed against the Dollar as the USD weakened marginally, with USDCNH at 7.247 and USDSGD at 1.3479. RBI will announce its monetary policy decision today. We expect RBI to keep rates on hold at 6.50%, keep its stance of withdrawal of liquidity while maintaining a hawkish tone. This comes as there is some uncertainty about the trajectory for food prices in India moving forward given the likelihood of heatwaves and low reservoir levels especially in South India. On the markets front, the RBI delayed implementing rules on exchange-traded currency derivatives to May 3, which has resulted in significant confusion especially among retail participants. Overall, we maintain our constructive view on INR given positive flow impact from bond index inclusion, coupled with a manageable current account deficit, and are forecasting USDINR at 82.0 by end-2024 notwithstanding uncertainty on oil prices and the Dollar’s trajectory. The Philippines will release its CPI numbers for March, which is expected to rise to 3.8%yoy from 3.4%yoy previously.