Ahead Today

G3: US New Home Sales, Germany GDP

Asia: Singapore CPI, Taiwan Industrial Production

Market Highlights

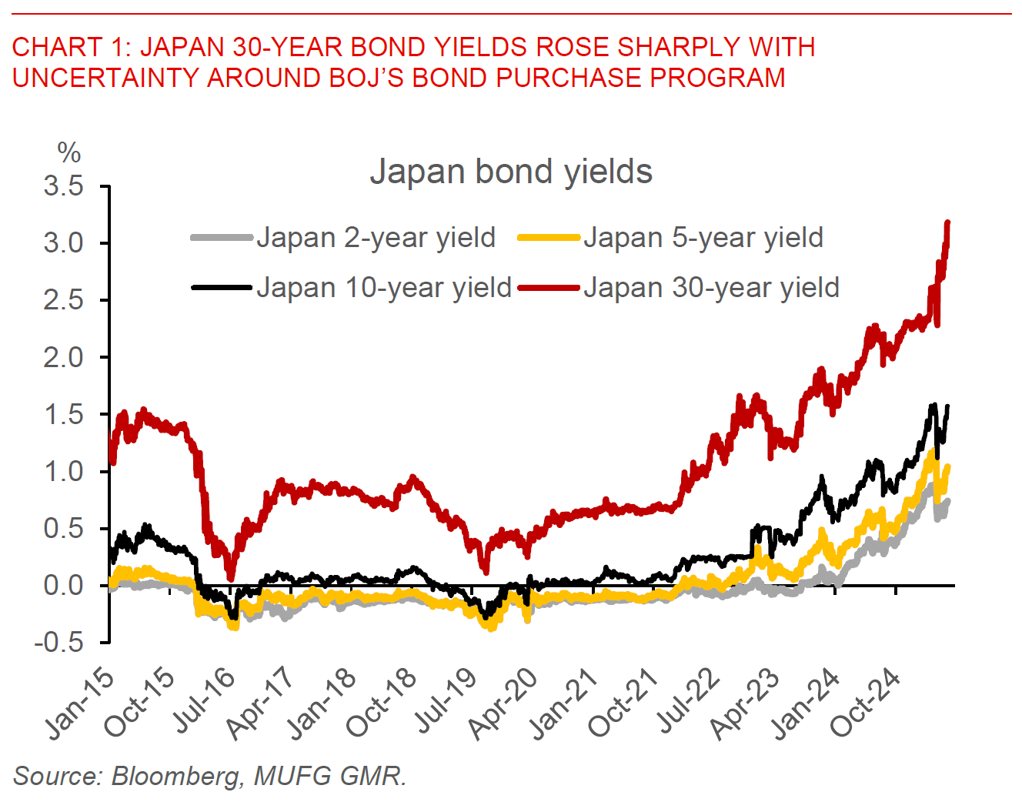

The big global macro development this week has certainly been the sharp rise in longer-end yields in developed markets, and in particular out of US and Japan. Part of this is driven by concerns around the long-term trajectory of the fiscal deficit and debt in the US. On that front, the House narrowly passed President Trump’s signature tax bill yesterday, which would extend Trump’s first-term tax cuts, while raise the US debt ceiling by US$4 trillion. The Congressional Budget Office estimates that annual deficits will rise by north of US$500bn annually, while the impact of the tax bill to households will be highly regressive with the benefits flowing to the top 10% with the lowest 10% of income seeing 4% decline in incomes annually. While this analysis has likely not incorporated the revenue and growth impact from tariffs, the broader concerns of markets on the US fiscal trajectory still stands. Meanwhile, JGB 30-year yields rose further to 3.18%, and this has also led to uncertainty around whether BOJ will maintain the same pace of bond tapering plans into 2026. BOJ Governor Kazuo Ueda refrained from commenting on short-term moves in bond yields, but said that he is keeping a close watch on them, with recent hearings with Japan’s bond market participants throwing up mixed results on whether BOJ should change its bond purchase plans.

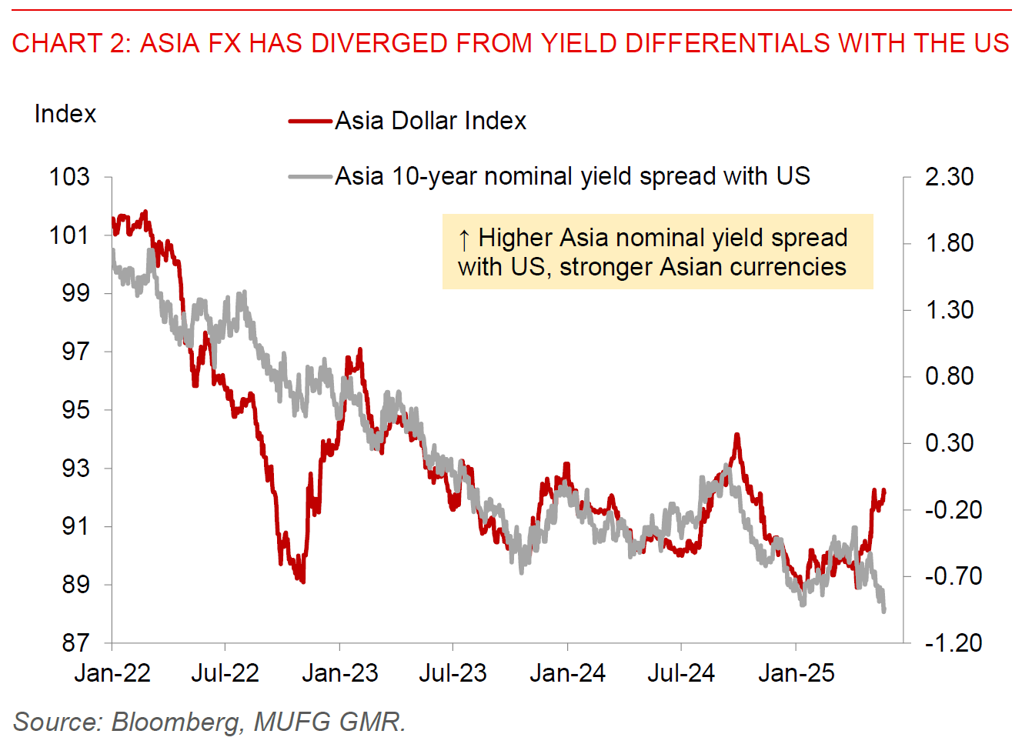

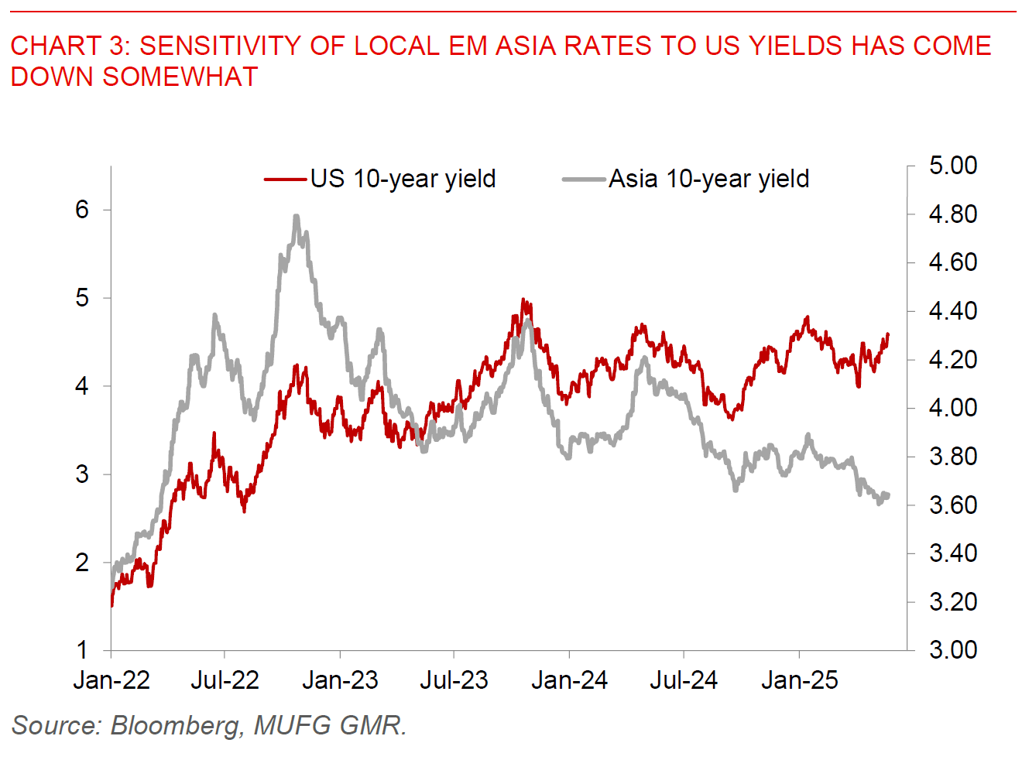

What’s interesting in Asia as well is that the sharp rise in longer-end yields has not spilled over to the EM Asia local currency rates and EM Asia FX space, at least so far. Part of this is understandable given that the turmoil has been concentrated much more on DM bond duration above 10 years given longer-term fiscal worries, and with most USD funding requirements in EM Asia not likely taking place at those longer tenors the transmission is thereby smaller. Nonetheless, it’s also fair to say the sensitivity of Asia local rates to US 10-year yields have also come down somewhat, while if anything Asia FX has also strengthened despite the grind higher in US 10-year yields thus far. Some of this is driven by country-specific factors such as the sharp rise in the Taiwan Dollar, but also driven by expectation of trade and FX deals. Whether this divergence can continue will likely be determined by future trajectory of tariffs and also whether the extent of US yields increase increasingly constrain growth and global risk sentiment.