Ahead Today

G3: Germany Zew Expectations, US Empire Manufacturing, Governor Waller speaks

Asia:

Market Highlights

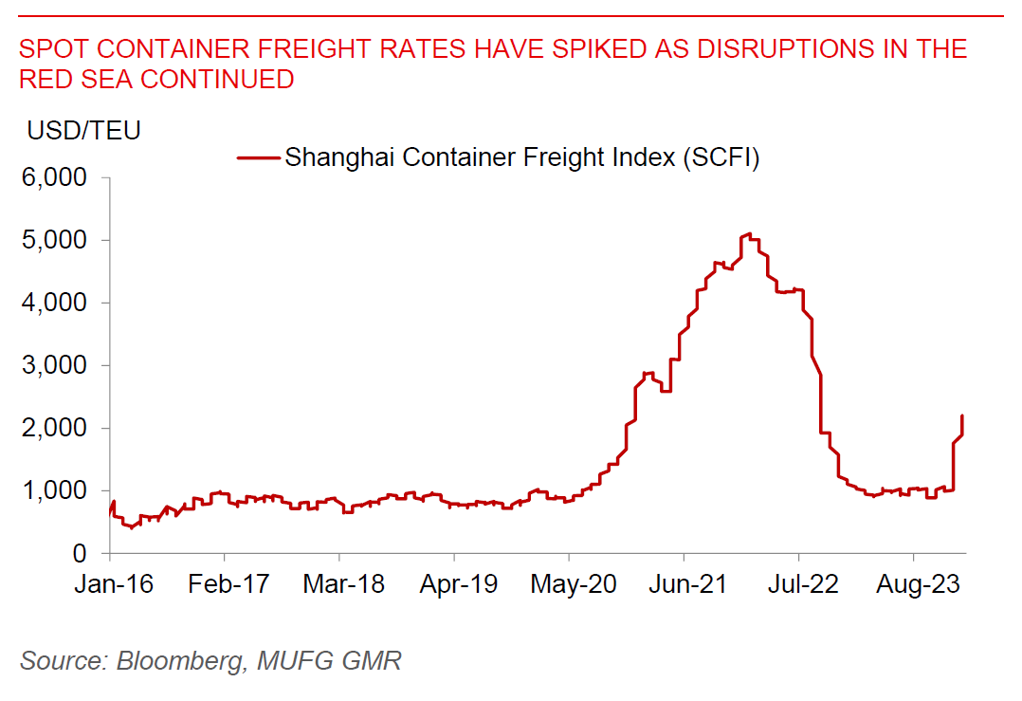

Tensions in the Middle East and the Red Sea escalated. Houthi militants hit a US-owned container vessel with a missile in the Gulf of Aden, although the ship did not suffer significant damage. Meanwhile Iran launched attacks against targets in Syria and Northern Iraq, including against an alleged Israel intelligence centre. The overall impact has been felt in spot container freight rates, which have more than doubled although remaining far below the peak seen in 2022, and much more so for the Asia-to-Europe journeys as ships diverted through the longer Cape of Good Hope route. If these spikes in freight rates are sustained, this could have some impact on goods inflation.

Over in Europe, we had hawkish comments by ECB with Governing Council members Holzmann saying that no one should count on rate cuts this year, although Joachim Nagel suggested that summer may be the time to talk about easing. Germany narrowly escapes recession, with GDP falling 0.3% in 4Q but with a upward revision to 3Q. The good news for Europe’s growth is that the winter has thus far been mild and gas inventories elevated, with European gas prices plunging below €30 yesterday.

Markets will focus on Governor Waller’s speech later today, given his seniority and stance as a traditionally more hawkish member of the FOMC.

Regional FX

Asian FX were generally weaker against the Dollar, with KRW underperforming (-0.46%) and USDCNH at 7.189. China kept its 1 year MLF rate unchanged at 2.5%, against consensus expectations for a 10bps rate cut, although the PBOC injected more liquidity into the banking system. Meanwhile, India’s goods trade deficit came in a touch lower than expected at US$19bn, and down from US$20bn the previous month, driven in part by lower oil prices. Post the release of the data, India’s Commerce Secretary said that imported goods are likely to become “significantly more expensive” due to the combined impact of higher freight costs, insurance premiums, and longer transit times. While the Red Sea disruptions are a risk we are watching out very closely for, our analysis shows that the impact to India’s current account deficit should be manageable, and even after incorporating a rise in oil prices (see IndiaPulse – The Tide Has Shifted).