Ahead Today

G3: US wholesale inventories, JOLTS jobs opening, Conference Board consumer confidence index

Asia: -

Market Highlights

The US dollar index (DXY) rebounded strongly by 1%, amid market optimism that the 12 August tariff deadline on China will be extended, further easing tensions between the US and China. The euro dropped below 1.1600 level against the US dollar, reflecting some concerns about the impact of 15% US reciprocal tariff on Europe’s economy. The yen has also weakened by 0.6% to around 148.50 level against the US dollar, dragged down by political uncertainty. Some ruling party lawmakers have intensified calls for Prime Minister Ishiba to step down following the setback in last week’s upper house election, where the party lost its majority.

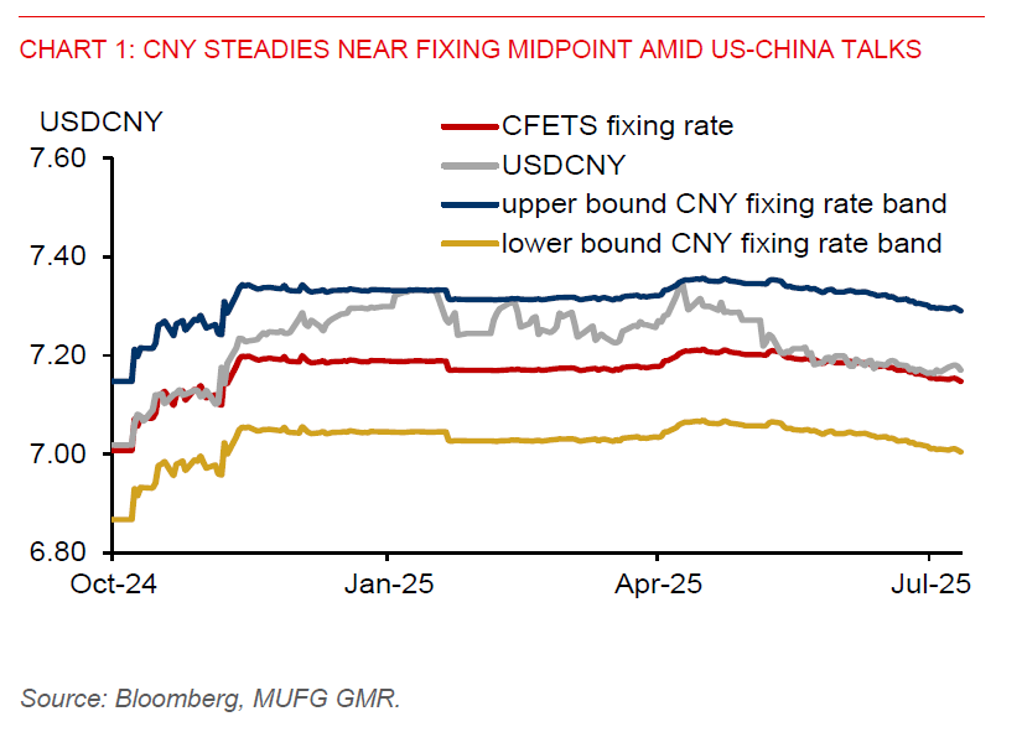

Both US and China have held the first of a two-day dialogue, reportedly aimed at securing a 90-day extension to the current tariff pause. Strategic issues are likely to be central in trade talks, including China’s leverage on rare earth magnets – critical components in electric vehicles and advanced weaponry - and US curbs on AI chips exports. However, the likelihood of removing the 20% US fentanyl tariff may be low in this latest round of trade talks, despite China’s recent efforts to tighten control of 2 key chemicals used in the drug’s production.

Looking ahead, market attention will turn to major policy events, including the FOMC and BoJ policy meetings on 31 July, and the 1 August deadline for the implementation of reciprocal tariffs.

Regional FX

Asian currencies have broadly weakened on the back of renewed US dollar strength. This was led by a 0.5% drop in KRW, followed by 0.4% decline in SGD. With net short dollar positions looking crowded and easing, the US dollar could get some reprieve in the near term. However, if there is a dovish tilt at the upcoming FOMC policy meeting, it could lead to renewed US dollar weakness, supporting the broader Asian FX outlook.

A key development yesterday was the ceasefire agreement between Thailand and Cambodia, following heightened tensions along their shared border. Diplomatic efforts have helped de-escalate the situation. Despite the geopolitical backdrop, the Thai baht has remained relatively resilient against the US dollar, with limited pricing of political or cross-border risks.

Meanwhile, Indonesia’s top economic policymakers convened for their quarterly meeting, signalling a continued commitment to supporting growth and maintaining financial stability. The government is preparing a stimulus package aimed at boosting tourism, domestic transportation, and other key sectors of the economy, while Bank Indonesia Governor Warjiyo has reiterated that he will continue to find room to cut rates to support the economy.