Ahead Today

G3: US nonfarm payrolls, unemployment rate, ISM services; eurozone PMI

Asia: Singapore retail sales, Thailand international reserves

Market Highlights

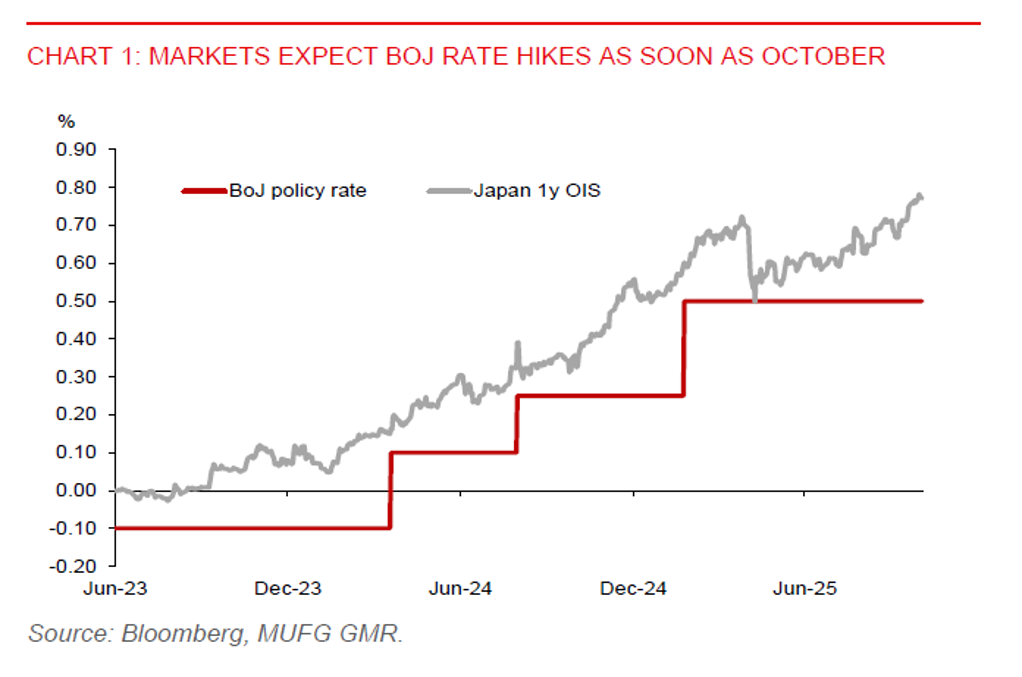

BOJ Deputy Governor Uchida has signalled that the central bank stays committed to raising the policy rate, provided that economic performance aligns with its forecasts. Notably, the Tankan survey showed improving business sentiment among large manufacturers in Q3, while sentiment among large non-manufacturers held steady. The swaps market is currently pricing in about 60% probability of a BOJ rate hike this month. At the September meeting, two board members dissented from the decision to hold the policy rate steady, advocating for a policy rate hike. While Uchida stopped short of committing to a rate hike, his remarks could be paving the way for a potential rate hike in October. This could further widen the divergence in monetary policy between the Fed and the BoJ.

Meanwhile, the yen paused its advance yesterday, after gaining 1.6% against the US dollar earlier in the week. Uncertainty surrounds whether the US nonfarm payrolls data will be released today due to the ongoing US government shutdown, which may keep markets cautious. Recent declines in ADP employment and a slowdown in hiring rate suggest downside risk for the jobs report. In addition, markets will be attentive to the upcoming Liberal Democratic Party (LDP) presidential election on 4 October, which could also sway the outlook for BOJ policy.

Asian currencies were broadly muted against the US dollar yesterday, given a lack of fresh catalysts amid China’s Golden Week holiday and a potential delay of the US nonfarm payrolls release scheduled for today.

While USDIDR has pulled back in recent days, fiscal policy risk remains high. The Indonesian government’s plan to review the state finance law early next year could lead markets to reassess the outlook for the rupiah. We expect the rupiah to underperform regional currencies, depreciating to the 16,900 level against the US dollar by end-year.

In contrast, we maintain a sanguine outlook on the ringgit, supported by our expectation of narrowing US-Malaysia yield differentials. We expect the Fed to cut rates in Q4 while BNM is likely to hold steady at 2.75%. In addition, the upcoming Budget 2026 may signal a pro-growth stance, which could support sentiment toward the ringgit. We forecast the ringgit to appreciate to 4.15 against the US dollar by end-year.