Ahead Today

G3: US ISM Manufacturing, US JOLTS Jobs Opening

Asia: Indonesia CPI, Indonesia Trade, China Caixin Manufacturing PMI

Market Highlights

The Dollar weakened further at the start of the week, led by strength in the likes of EUR, and this also spilled over to other Asian currencies as well. In our region, KRW, THB, and MYR led the strength, while the likes of USD/CNH fell below the 7.16 levels. There are multiple cross currents here but the big macro shifts we mentioned previously of deals, deficits and diversification still very much stands (see Asia FX Talk - Three macro shifts). US National Economic Council Director Kevin Hasset said the administration aims to finalise deals with trade partners after the 4 July holiday, even as President Trump threatened to impose fresh tariffs on specific partners such as Japan due to Japan’s pushback on more sensitive issues such as rice and automobiles. On that front, the White House also said that we should be hearing about a trade deal with India soon. Meanwhile, on deficits, Senate leaders are struggling to gather enough votes to pass Trump’s tax and spending bill, although the big picture remains one of large deficits and higher US public debt on current trajectories

Last but not least, Trump continued to raise concerns about the impact to Fed independence, sending a note to Federal Reserve Chair Jerome Powell with a list of interest rate cuts in countries around the world and a call to cut rates, while also expanding his criticism beyond Chair Powell to also the Fed Board of Governors.

Regional FX

Across Asia, Asian FX generally followed the trend of a weaker US Dollar, with a key exception being the Taiwan Dollar, which weakened closer to 29.58 levels. There is speculation as widely reported in the media that the central bank bought US Dollars to prevent Taiwan Dollar strength below the 29.00 levels. Meanwhile, the regulator eased rules to help its insurers access additional reserves to offset foreign currency losses, allowing insurers to use six-month average exchange rates when calculating risk-based capital. A combination of other factors such as dividends repatriation may also have contributed to the moves seen.

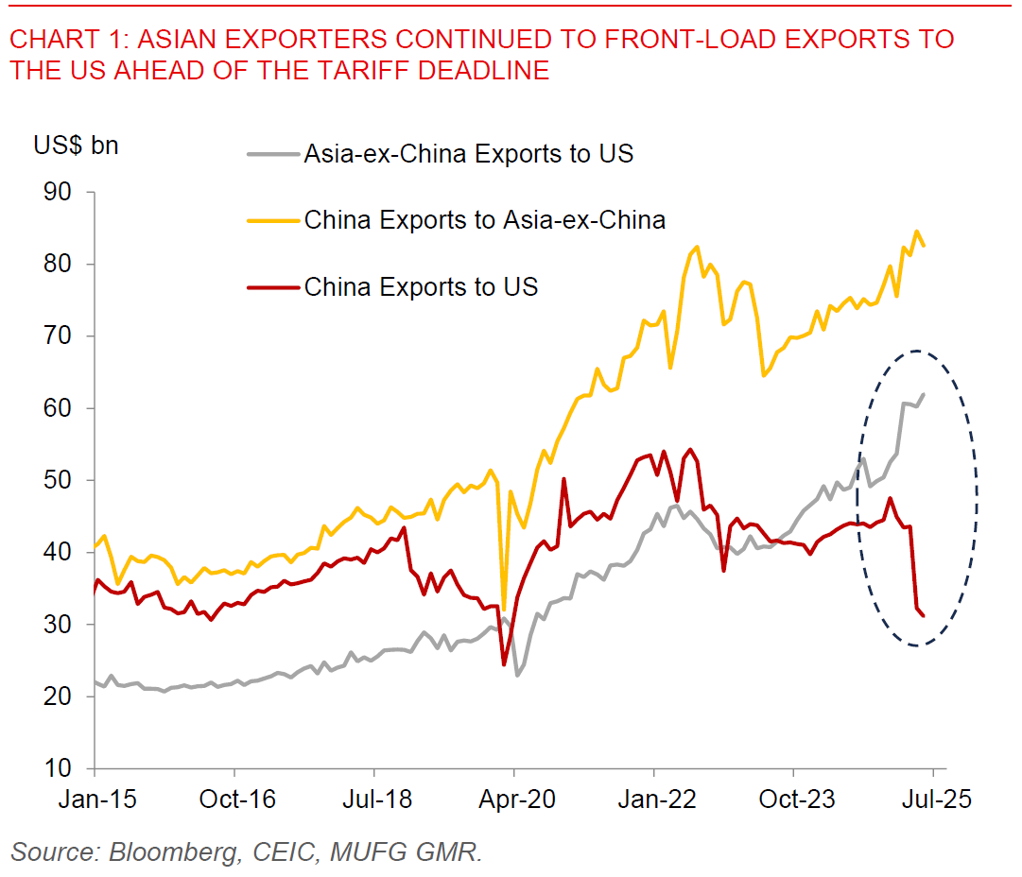

Beyond Taiwan, the macro data from Asia was slightly better than expected, with a pickup in non-manufacturing PMI from China to 50.7, a surge in Thailand’s exports for May and continued growth in South Korea’s exports. We think that quite a bit of this is due to export front-loading due to the 90-day tariff pause, and as such our base case calls for some export moderation in 2H2025 as Asia exporters see some payback later this year and as US demand increasingly slows. Nonetheless, this will also be differentiated by level of tariffs announced in the coming week across different Asian countries.