Ahead Today

G3: US NFIB Small Business Optimism

Asia: Taiwan Inflation, Taiwan Exports

Market Highlights

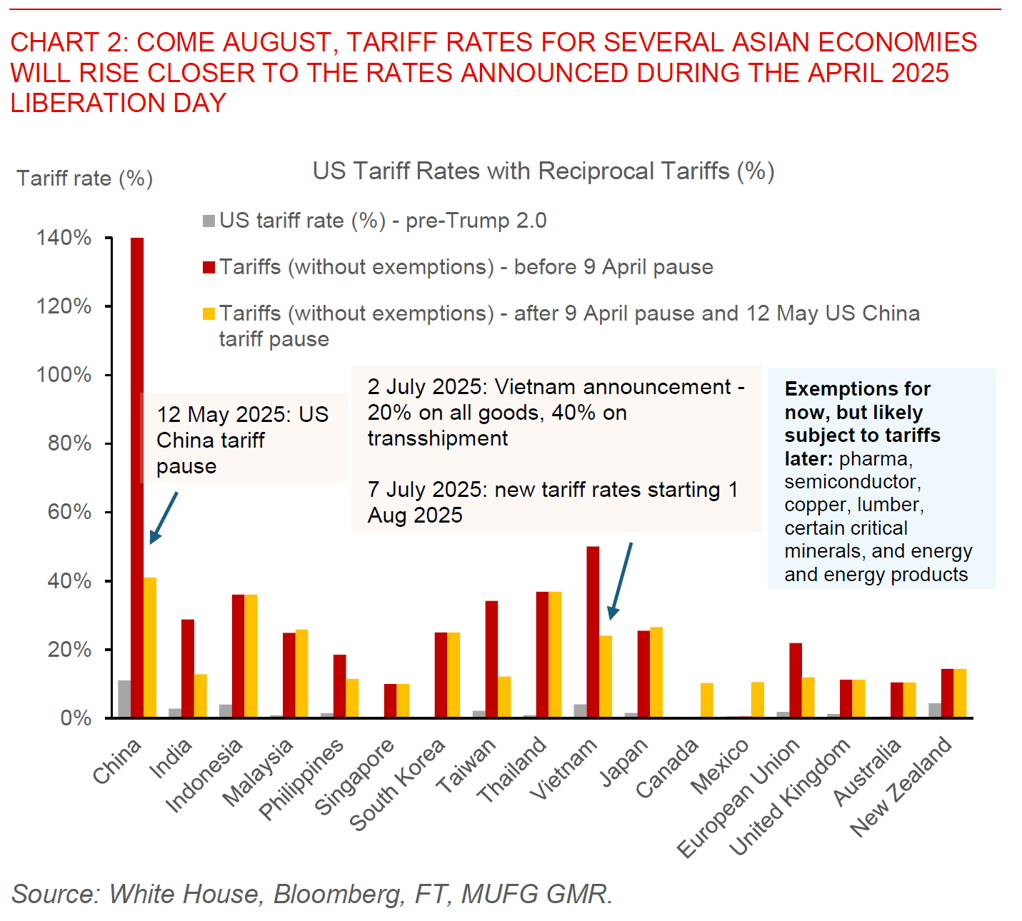

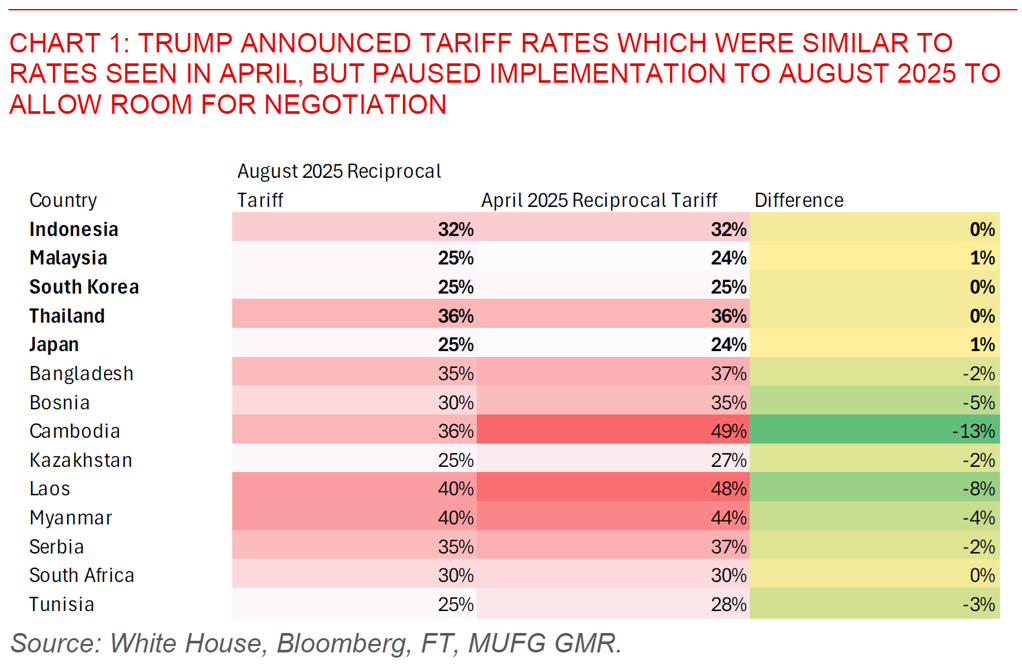

President Trump announced a new set of tariffs for around 14 countries post the 90-Day Liberation-day tariff pause, while also postponing the implementation to 1 August to provide some time for further negotiations. Across the key Asian markets we cover, the tariff rates are essentially the same as what was announced in April, including for Japan (25%), South Korea (25%), Indonesia (32%), Malaysia (25%), and Thailand (36%), coupled with some small rounding adjustments. The likes of Cambodia and Laos saw bigger cuts to tariffs but the absolute rates remain high at close to 40%.

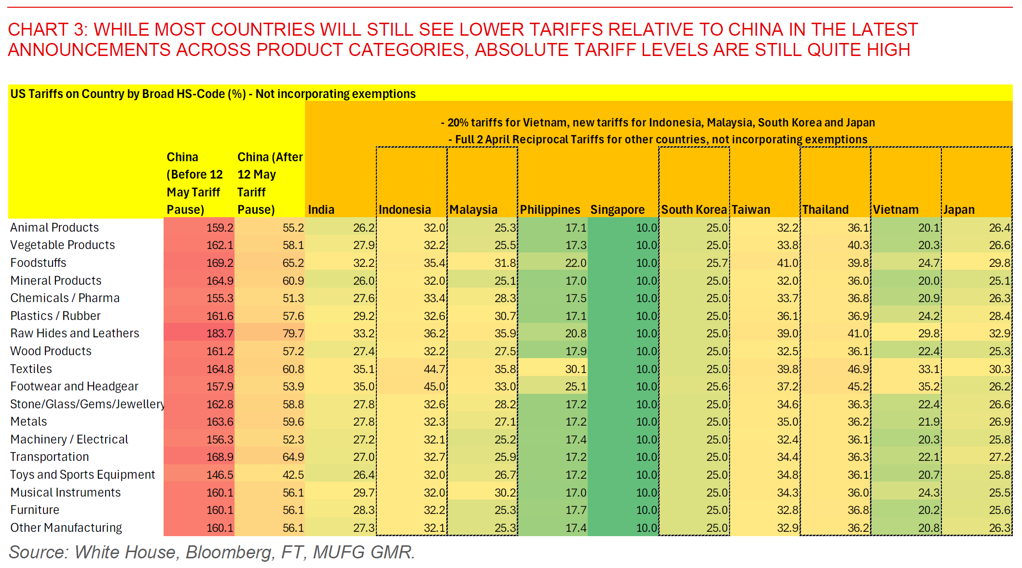

Moving forward, there are three key questions to gauge the macro and market impact. First, how much room is there really for negotiations in reality ahead of the August deadline. While Trump said that the tariff rates are not 100% firm, it is unclear what else smaller Asian countries can offer the US beyond what has already been discussed over the past 3 months. South Korea meanwhile mentioned that it will fix non-tariff barriers including rules and regulations, and so this could perhaps be one avenue for negotiations. Second, the likes of India, Philippines and Singapore may have a higher chance of seeing a trade deal given that their rates have not been announced yet, even as we acknowledge it may just be a matter of administrative capacity in pushing out the letters. Third, all the letters highlighted imposing higher tariff rates on “transshipment” goods, but as with the US-Vietnam agreement how that is defined and enforced and is still massively unclear. We personally suspect that the US will define transshipment as a certain threshold of foreign content but to do so would also require tracking of which country the foreign content comes from and is clearly a rewriting of the existing rules of origin for global trade.

The market reaction was quite modest, with the Dollar strengthening with some initial underperformance in KRW and JPY as their rates were announced first. Risk assets such as the S&P 500 fell 0.8%, while some of the initial dollar strength during the US session retraced somewhat during the Asian trading time. Meanwhile EUR outperformed on the back of reports that Europe may face a 10% tariffs while negotiators discuss details on a US-EU trade deal.

This modest reaction is perhaps a function of the market pricing in the ability to negotiate down tariffs, or perhaps a continuation of the TACO trade (Trump Always Chickens Out). We are not so sure on our end, and it does seem to us like overall risk assets seem too sanguine to these tariff rates which are essentially quite similar to Liberation Day. We will of course have to wait for more clarity on the rates for other countries, but the key message from the latest announcement is relatively similar rates to April 2025 at least so far.

The impact to FX markets is much more complicated than general risk assets. As we saw during Liberation Day 1.0, the Dollar weakened sharply (and to some extent Asian currencies strengthened) even as risk assets sold off. The transmission mechanism is in part through higher US policy uncertainty, and also because the broad-based nature of the tariffs imply a hard hit to US growth prospects. Whether the FX price action remains as such moving forward we think therefore lies in the details on who else gets hit with high tariffs and the impact to policy uncertainty.