Ahead Today

G3: Eurozone PMIs, US S&P PMI, Richmond Fed Index

Asia: Singapore CPI, HSBC India PMI, Taiwan Export Orders

Market Highlights

The LDP Presidential election contest formally kicked off yesterday, and ahead of the vote set to take place on 4 October. The top two favourites are Sanae Takaichi and Shinijiro Koizumi, with other candidates being Yoshimasa Hayashi, Takayuki Kobayashi and Toshimitsu Motegi. The polls so far point to Koizumi junior having a lead over Takaichi-san. Koizumi junior is perceived to be the somewhat more reformist candidate, and from a markets perspective importantly seen as willing and supportive of Bank of Japan to continue hiking rates. Nonetheless, there have also been local perceptions that his policy proposals and communication of policy details have been quite shallow in the past LDP elections, and so that will be important to watch moving forward. Takaichi-san is perceived to be the closest to Abe-nomics and supportive of monetary policy easing, but interestingly in this election has moderated her past positions and for instance refrained from calling out Bank of Japan monetary policy unless explicitly asked. Her past positions on fiscal stimulus seems to also have been toned down to some extent, retracting her stance on lowering consumption tax, and emphasized fiscal stimulus through refundable tax credit program of tax cuts and direct cash benefits, while also raising minimum taxable income threshold.

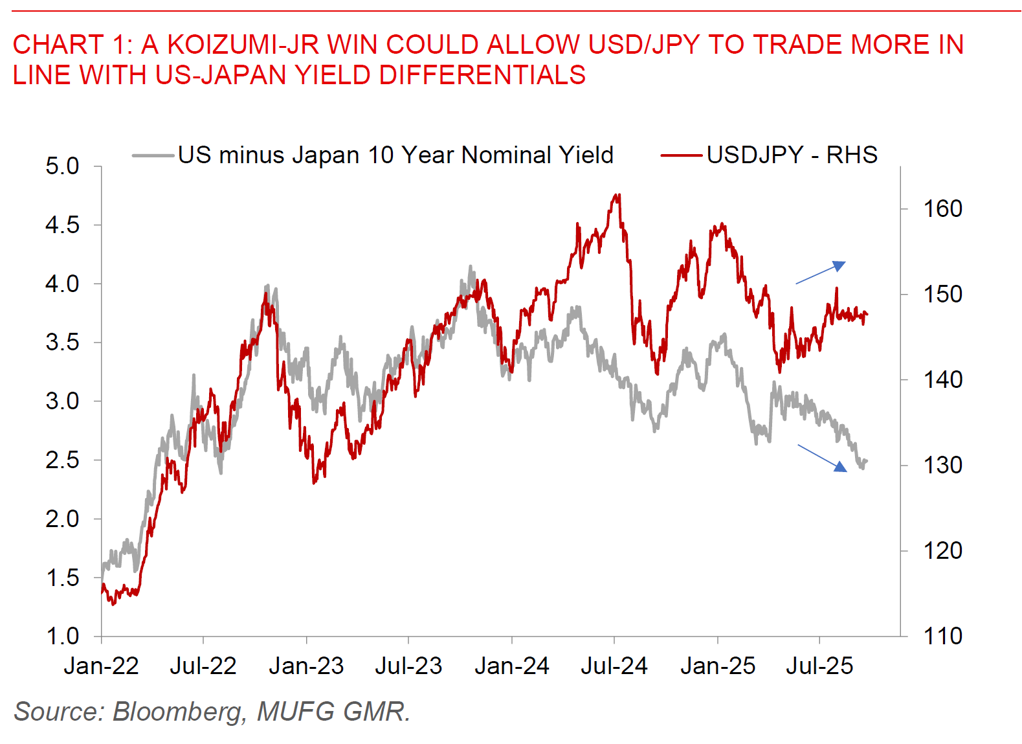

Overall, if Koizumi-junior does win as polls and as our G10 team thinks, this should be good for the Japanese Yen and should allow USD/JPY to resume its downtrend moving forward (see G10 FX Weekly). We are currently forecasting USD/JPY at 140 by 2Q2026 with two more rate hikes by BOJ through our forecast horizon.

Meanwhile, Chinese authorities including PBOC Governor Pan Gongsheng and CSRC held a press conference. The content of the press conference was more backward looking rather than forward looking on details of any stimulus down the line. From a monetary policy perspective the PBOC Governor said that China’s monetary policy will continue to focus on domestic economy while striking a balance between domestic and international conditions, making use of a variety of monetary policy tools based on economic conditions. Overall, the key message seems to be no urgency for a rate cut in the near-term, but directionally still biased towards lower rates and supportive of the Chinese economy through a range of tools, even as the stock market has been quite supportive of the wealth effects so far this year.

Last but not least, the European Union and Indonesia have secured a trade deal that will eliminate tariffs or bring them close to zero on nearly all goods, with the EU’s trade chief Maros Sefcovic telling Bloomberg news that around US$700 million of tariffs will be saved by European exporters as a result of the deal. In particular the deal will reduce tariffs to zero on 96% of goods within five years, with duties on EU cars reduced from 50% to zero in five years, while duties for machinery and appliances will go down from 30% to zero in a short period of time. In regard to materials such as chemicals, the deal will also remove licensing and other restrictions.