Ahead Today

G3: University of Michigan sentiment, Japan industrial production

Asia: Thailand international reserves, India CPI

Market Highlights

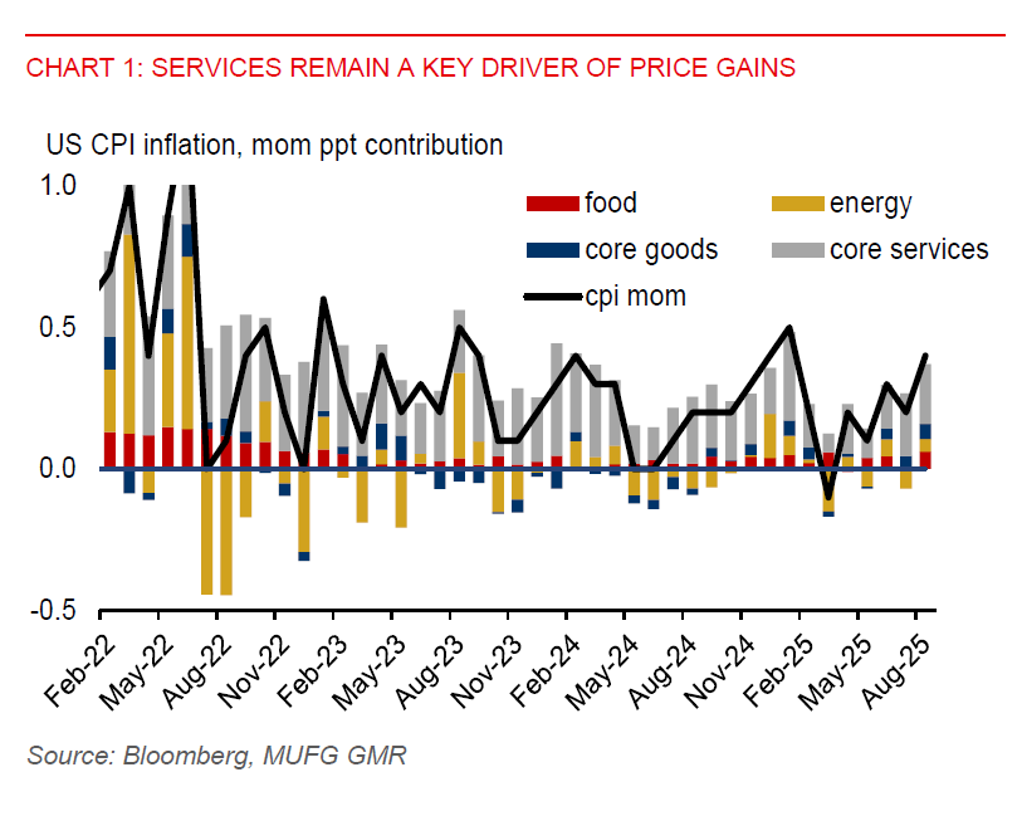

Headline US CPI rose by 0.4%mom in August, up from 0.2%mom in July. Core CPI increased by 0.3%mom, matching July’s pace and in line with market expectations. On a year-on-year basis, headline inflation was 2.9%, while the core gauge remained sticky at 3.1%yoy. The tariff effects on inflation appears contained for now, with core goods inflation rising 0.28%mom, from 0.21%mom in July, contributing 5bps to month-on-month core CPI. The uptick was underpinned by a 1%mom increase in used car inflation. Meanwhile, core services less energy rose 0.35%mom, down from 0.36%mom in July. Notably, airfares and lodging were among key drivers of price gains, rising 5.9%mom (vs. 4.0% prior) and 2.3%mom (vs. -1% prior) respectively.

Despite inflation remaining above the Fed’s 2% target, growing risks to labour market health are likely to prompt a 25bps Fed rate cut this month. Initial jobless claims jumped by 27k to 263k in the first week of September, the highest level in four years. This comes on top of the Bureau of Labor Statistics’ record downward revision of job growth by 911,000 for the period from March 2024 to March 2025.

The latest spike in US initial jobless claims has nudged markets to price in 72bps of Fed rate cuts for the rest of 2025, slightly higher than the 68bps prior to the release. However, market expectations for cumulative easing through mid-2026 remain largely unchanged. The DXY dip and dovish market pricing could continue to offer support for Asian currencies broadly. Moreover, the PBOC has guided the USDCNY fixing rate lower, supporting the yuan and regional sentiment. In addition, the strength of the Thai baht is likely attributed to the strong performance in gold prices, which help support its balance of payment position. However, there remains selective weakness in the rupiah and the rupee. Foreign market sentiment remains weak on the rupiah following recent protests and a change of finance minister, though Bank Indonesia’s FX intervention and the government’s increased fiscal support via its cash reserves could limit rupiah weakness to the 16,500 level against the US dollar.