Ahead Today

G3: Eurozone retail sales, US Trade Balance, Bank of Canada Rate

Asia: Taiwan CPI, Singapore COE

Market Highlights

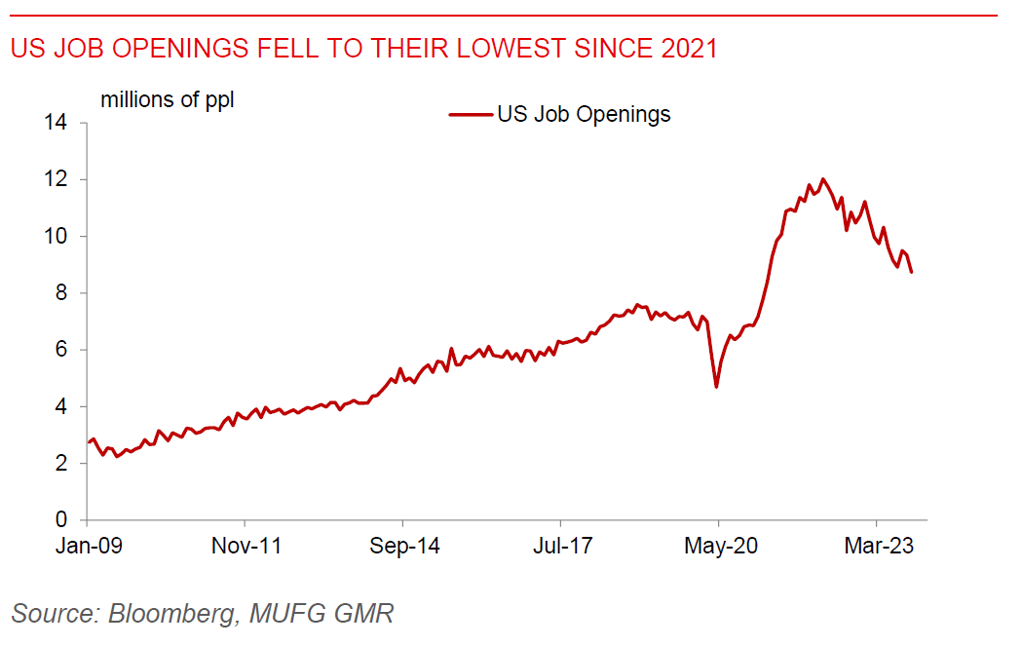

US jobs openings fell to the lowest since 2021 to 8.7 million, from a downwardly revised 9.4 million. The declines were broad-based across sectors, with notable drops in healthcare, financial services, and accommodation and food services. Broader labour data showed that hiring edged lower while layoffs remained unchanged, reinforcing a soft landing scenario. The data had a significant impact on US yields, with 10-year Treasury yields declining to 4.16%.

The Dollar nonetheless strengthened by 0.3% despite the US data, perhaps due to two factors. First, ECB members turned somewhat less hawkish, with Governing Council member Boris Vujcic saying that there will be rate cuts, but it’s too early to talk about that. Second, Moody’s cut China’s sovereign credit outlook to negative on rising debt. Third, the Israel-Hamas conflict escalated in Southern Gaza, with Israel rebuffing calls to halt the war while international organisations continued to raise concerns about the significant human toll.

Regional FX

Asian FX pairs were generally weaker against the Dollar on back of USD strength, with USDCNH rising to 7.16 while MYR and KRW declining 0.4% and 0.6%. Moody’s Investor Service cut its outlook for Chinese sovereign bonds to negative, while retaining its long-term rating of A1. The credit rating agency said that China’s usage of fiscal stimulus to support local governments and the property downturn is posing risks to the nation’s economy. Chinese authorities pushed back, saying it was “disappointed” with Moody’s decision. Meanwhile the Philippines’ inflation was lower than expected at 4.1%yoy from 4.9%yoy the previous month, helped by easing supply shocks from food and energy prices. We continue to see BSP keeping rates on hold amidst sticky and volatile inflation, and see the 1st rate cut coming in 4Q2024.