Ahead Today

G3: US nonfarm payroll, unemployment rate

Asia: Philippines CPI, Thailand international reserves, Taiwan CPI, Vietnam CPI, trade, and other activity indicators

Market Highlights

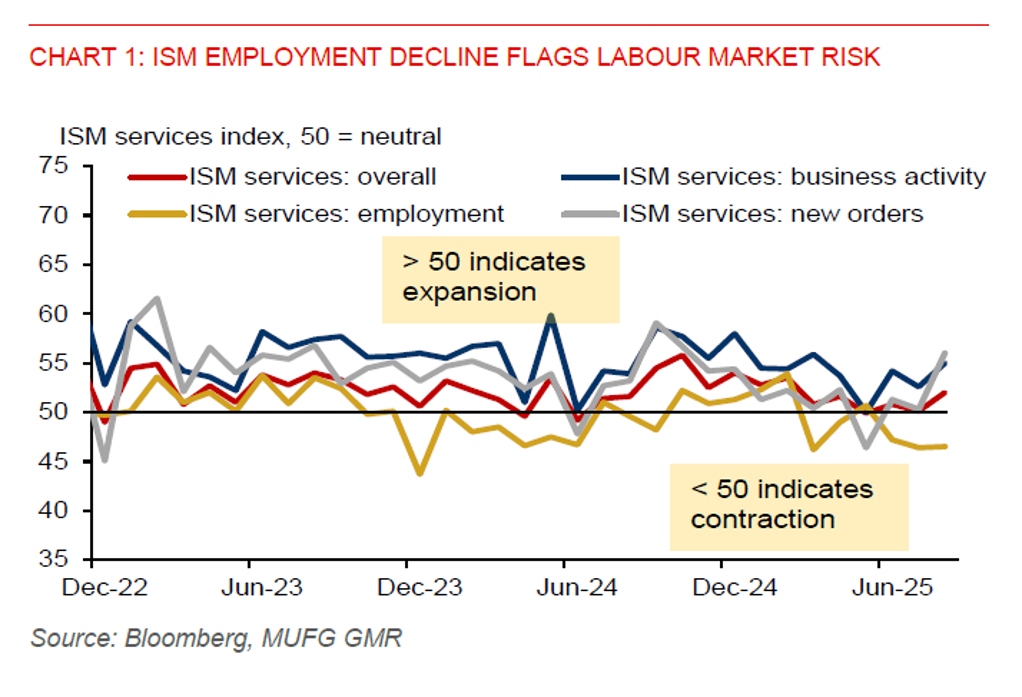

US macro signals were mixed ahead of nonfarm payrolls. US initial jobless claims rose to 237k in the final week of August, up from 229k in the prior week, while ADP employment slowed sharply to 54k, missing Bloomberg consensus (+68k) and July’s +106k. Meanwhile, the ISM services index surprised to the upside, rising to 52.0 from 50.1, driven by stronger new orders. However, the ISM services employment sub-index remained in contraction at 46.5, pointing to underlying labour market softness. The Fed’s Beige Book showed little to no growth across most districts, reinforcing signs of a cooling economy. US yields fell modestly on weaker jobs data, while the USD edged higher, likely driven by the stronger ISM services reading.

Fed President John Williams noted the delicate balance between inflation and employment risks. He added that keeping policy restrictive for too long will pose risk to employment, while there has not been any early second round effects of tariff on inflation. A September rate cut is likely, though it may be a hawkish cut, as the Fed navigates uncertain growth-inflation dynamics.

All eyes now turn to the August nonfarm payrolls. A negative surprise or sharp downward revision to July’s figure could put downward pressure on the USD.

The ringgit, along with several regional currencies, has weakened modestly since early September as the USD regained strength. However, with the Fed likely to cut rates in the coming months, the US-MY rate differential should narrow, supporting a ringgit rebound towards 4.1500/USD by year-end.

BNM held its policy rate steady at 2.75%, in line with expectations. The central bank views the current rate as appropriate to sustain growth and price stability. We expect BNM to remain on hold through 2025 as it monitors the impact of July’s rate cut and awaits clarity on Trump’s semiconductor tariff plan. Domestic demand remains robust, with investment approvals in manufacturing and services up 21%yoy in H1, reinforcing the outlook for private investment. Inflation should stay contained, with only modest impact expected from the sales and services tax (SST) base expansion and RON95 fuel subsidy rationalisation.

In contrast, Thailand’s CPI fell deeper into deflation, hitting -0.79%yoy in August, down from -0.7% in July, while core inflation stayed muted at +0.8%yoy. Rising growth risks could prompt one or two more rate cuts by BoT. Despite political uncertainty, the baht has remained resilient, supported by strong FX reserves including gold.