Ahead Today

G3: US Housing starts

Asia: Malaysia Trade, Philippines BOP

Market Highlights

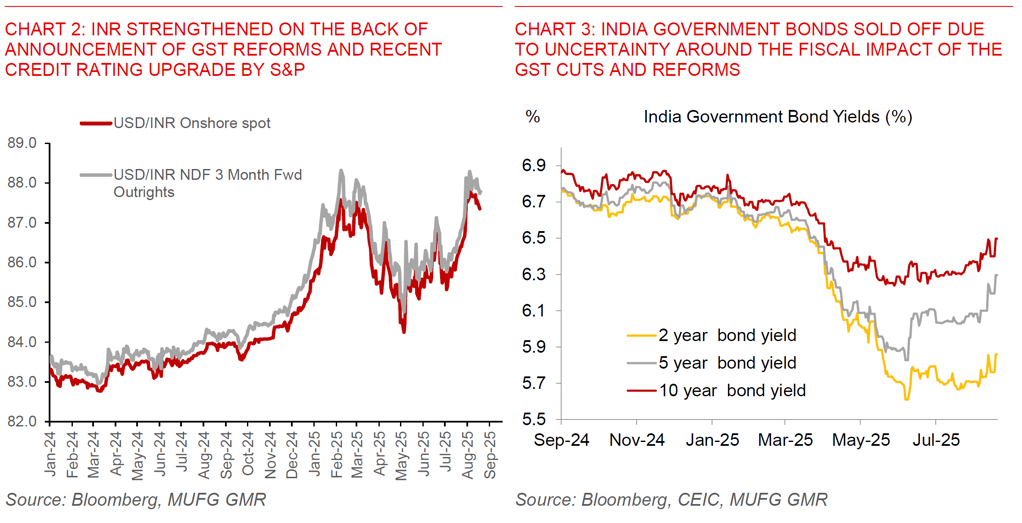

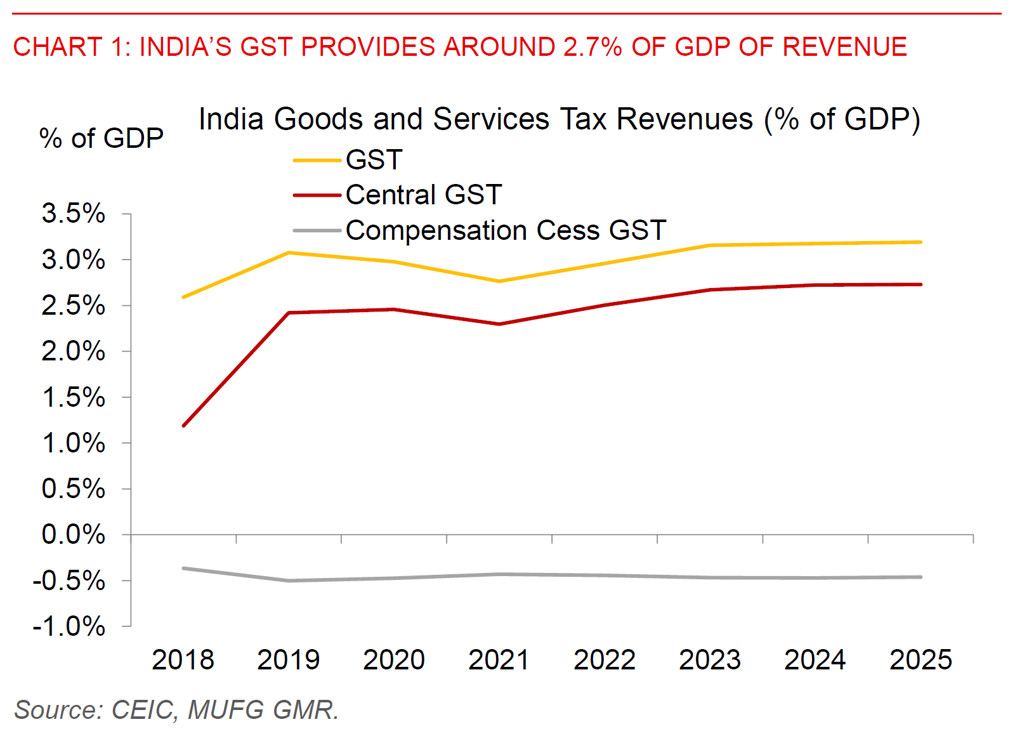

India’s Prime Minister Modi announced over India’s Independence Day that his government will introduce Goods and Services tax reforms to support consumers, while among other things also announcing a task-force to recommend next-generation reforms in a time-bound manner. While the exact contours and details of the GST cuts are unknown, media reports suggest that the new GST structure could see taxes move to a simpler 2 slab structure of 5% and 18%, with some select sin and luxury goods subject to higher rates of 40%. In comparison, the existing GST has a complex multi-tier system of 5%, 12%, 18%, 28%, and 40%, together with some exemptions for essential goods. The most classic example of the current complexity of India’s GST system is that non-branded popcorn mixed with salt and spices attract a 5% GST, pre-packed popcorn 12%, and caramel popcorn at 18% - due to its added sugar content.

We as such see the announcement of India’s GST reform as a domestic positive, with an important caveat that eventual details will matter. Beyond the consumption boost from GST cuts, the simplification and reduction in complexity and hence ultimately also revenue efficiency should be good for India’s long-term growth potential. The ultimate impact to revenues and the fiscal deficit will also depend on other offsetting spending cuts and reductions in revenues to states (compensation cess).

There are certainly multiple moving parts right now for our USD/INR forecasts, and to help provide clients with some clarity we recently published some sensitivity analysis of how tariffs may impact India’s macro and markets (see India tariffs: Restore, Rebalance and Reform?). Our analysis shows that a sustained 50% tariff could cut India’s GDP growth by 1% over time, with the biggest hit to employment sensitive sectors such as textiles. Meanwhile with 50% tariffs sustained we could well see USD/INR above the 89 handle with further underperformance against Asian and G10 FX peers.

Of course not all things are equal in life and we also importantly emphasised in our report that there are many crucial domestic reforms that India can and should do, with our hope that the external challenges brought about from tariffs ultimately catalyse a greater impetus for domestic structural reforms in India.

These GST reforms are a potential example of such a reform, and if India can meaningfully push through more changes, they could potentially be an offset for tariffs imposed by the US administration, and could matter far more over the long-run for India than where tariffs ultimately settle.

Meanwhile, even as we wait for developments in the Russia-Ukraine war and what comes out of the Alaska Summit between Trump and Putin, China’s Foreign Minister Wang Yi met with India’s External Affairs Minister Jaishankar, and ahead of a likely visit by India’s Prime Minister Modi to China for the Shanghai Cooperation Organisation Summit later this month. In this dance between the Elephant and the Dragon, we may well see some nascent signs of a thaw with the two giants, perhaps catalysed by changes in US tariffs.