Ahead Today

G3: Trump and Putin summit in Alaska

Asia: Malaysia GDP, China Monthly data

Market Highlights

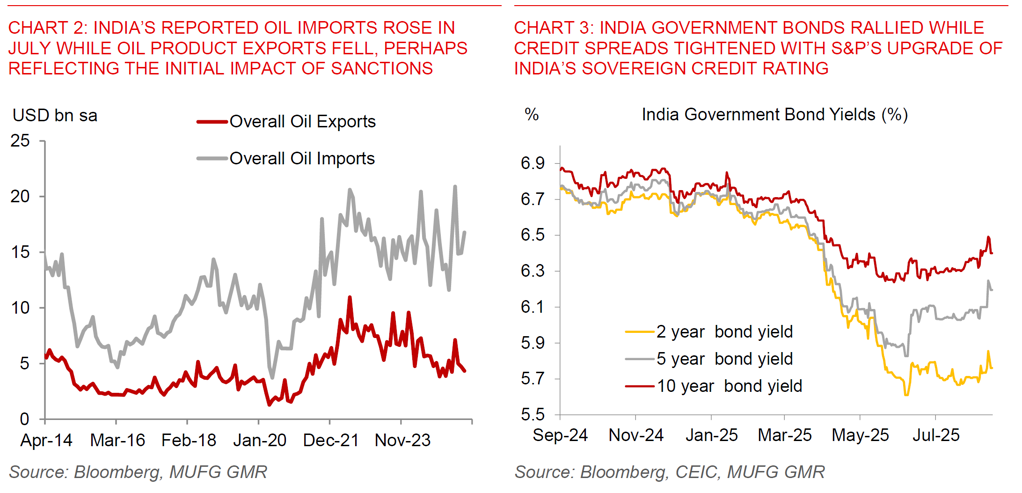

US producer prices jumped more than expected, rising 0.9% mom, compared with consensus expectations for a 0.2% mom rise, and up from 0% previously. While the latest consumer price data was still reasonably muted, the latest PPI numbers gave us some indication that Trump’s plethora of tariffs are likely still working their way through the system, perhaps causing businesses to raise the prices they charge each other and could also show up in higher consumer prices over time. The biggest contributor to the rise was in services, with core goods PPI also rising, although we note that the components that go mechanically into PCE inflation were reasonably muted outside of portfolio management imputed fees.

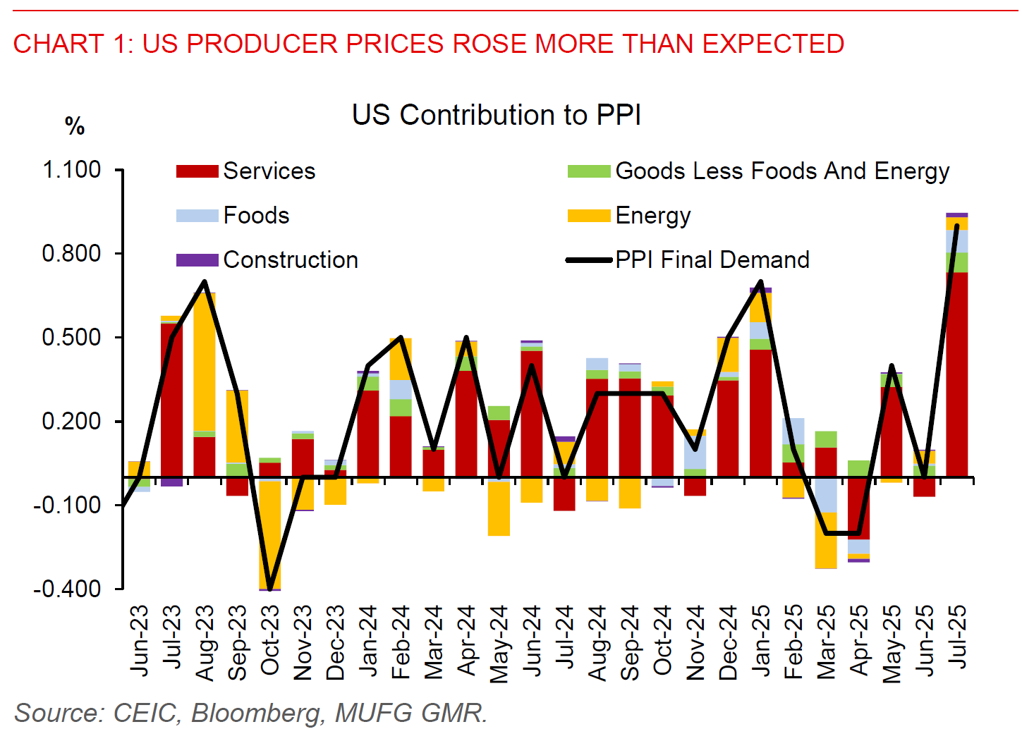

Meanwhile, S&P upgraded India’s credit rating to BBB from BBB- with a stable outlook, placing India in the same category as countries such as Indonesia, Mexico and Greece. In its statement, S&P said that the upgrade of India reflects its buoyant economic growth, sound monetary policy anchoring inflation expectations, the government’s commitment to fiscal consolidation and improvement in government spending quality. S&P also said it expects US tariffs to have a manageable impact on India as 60% of India’s growth is driven by domestic consumption, and that US tariffs “will not derail India’s long-term growth prospects.

The credit rating upgrade resulted in a rally in India government bonds, with the 10-year yield falling to 6.4% from 6.46%, while longer-dated credit spreads generally also tightened. On our end, while we generally agree with the logic of the credit rating upgrade, we are also left wondering “why now”? With the huge uncertainty of US tariffs hanging over India, we think that many commentators – S&P perhaps included – seem too sanguine on the longer-term impact on India’s growth prospects. This is not to say that we disagree with the logic that a more domestic oriented economy provides meaningful cushion for India – we do. But as we argued in our recent report, what is far more impactful for India over the medium-term are the potential lost opportunities in terms of future manufacturing FDI arising from the tariffs, beyond just the gross goods exports exposure to US and the near-term growth hit (see India – Restore, Rebalance, and Reform?). In addition, with the most affects sectors such as textiles and apparels being very employment intensive, there is a meaningful distributional and social impact for India as well.

The most consequential market event looking ahead would likely be Trump’s summit with Russian President Putin in Alaksa. Ahead of the event, Putin said that the White House was “making quite energetic and sincere efforts to end the conflict and the crisis through agreements that would represent the interest of all sides”. Meanwhile, Trump said that he still believed the Russian leader was willing to make a “deal”, and would subsequently decide if Ukraine President Zelenskyy should be brought into negotiations later. These outcomes will be crucial not just for Europe, but to some extent also countries such as India, where an additional 25% tariffs have been announced due to its purchases of Russian oil.