Ahead Today

G3: US Initial Jobless Claims, US PCE Core Deflator, Eurozone CPI

Asia: China Manufacturing and Non-Manufacturing PMI, India GDP, Thailand Current Account

Market Highlights

Fed speakers were somewhat more divergent in tone, following Governor Christopher Waller’s market moving speech earlier in the week. Atlanta Fed President Raphael Bostic said that he’s growing increasingly confident inflation is firmly on a downward path. However, Richmond Fed chief Thomas Barkin isn’t yet convinced, arguing that the Fed should keep the option to hike on the table in case inflation proves stubborn. Both Bostic and Barkin are voting members in 2024. Meanwhile Cleveland Fed President Loretta Mester said policy is in a “good place” to assess whether inflation is on a path back to 2%.

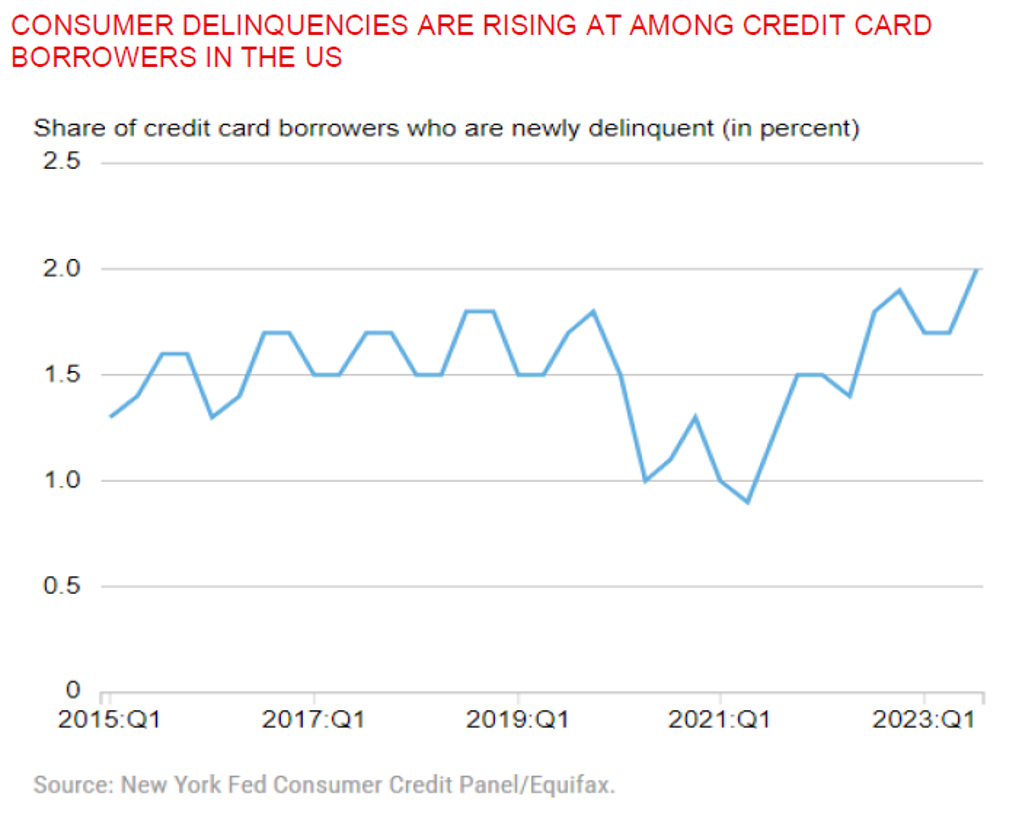

The Fed’s Beige book released yesterday showed economic activity slowing as consumers pulled back on discretionary spending such as furniture and appliances, labour demand continuing to ease gradually, together with a slight uptick in consumer delinquencies. Overall, markets are now priced for more than 100bps of Fed rate cuts in 2024 with a 48% chance of the 1st cut coming in March.

Regional FX

Asian FX pairs were generally stronger against the Dollar on back of lower US yields. China’s President Xi Jinping visited Shanghai for the 1st time in 3 years, together with Vice Premier He Lifeng. He visited the Shanghai Futures Exchange, and visited an exhibition at the city’s sci-tech innovation center, although with no specific company names mentioned. President Xi also stopped at a government-subsidised rental housing community to observe progress in social housing construction. On that front, recent news reports that the People’s Bank of China may provide at least 1 trillion yuan in low-cost targeted financing to affordable housing programmes could signal both more credit support to the property sector, together with longer-term policy shifts in China’s property market. Meanwhile, the Bank of Thailand kept its key rate on hold at 2.5% in a unanimous decision, with BOT Assistant Governor saying that the rate will probably remain at the current level for a while. Vietnam’s exports showed further signs of recovery, in line with green shoots in exports across Asia.