Ahead Today

G3: US Existing Home Sales, Canada October CPI

Asia: South Korea Household Credit, Indonesia 3Q Current Account

Market Highlights

The US Dollar weakened further by 0.4% while US Treasury 10-year yields fell to 4.42%, after 20-year Treasury Bond auction saw strong demand with a good bid-to-cover ratio of 2.58 and lower cut-off yields. Yesterday was light on data releases from the US.

China kept its 1-year and 5-year loan prime rates unchanged at 3.45% and 4.2% respectively, while continuing to focus on improving credit availability. Bloomberg News reported that Chinese regulators are drafting a list of 50 developers eligible for a range of financing, including both private and state-owned developers. Meanwhile, China’s biggest banks brokerages and distressed asset managers were told to meet all “reasonable” funding needs from property firms at a gathering with top financial regulators, while financial firms were asked to “treat private and state-owned developers” equally in lending.

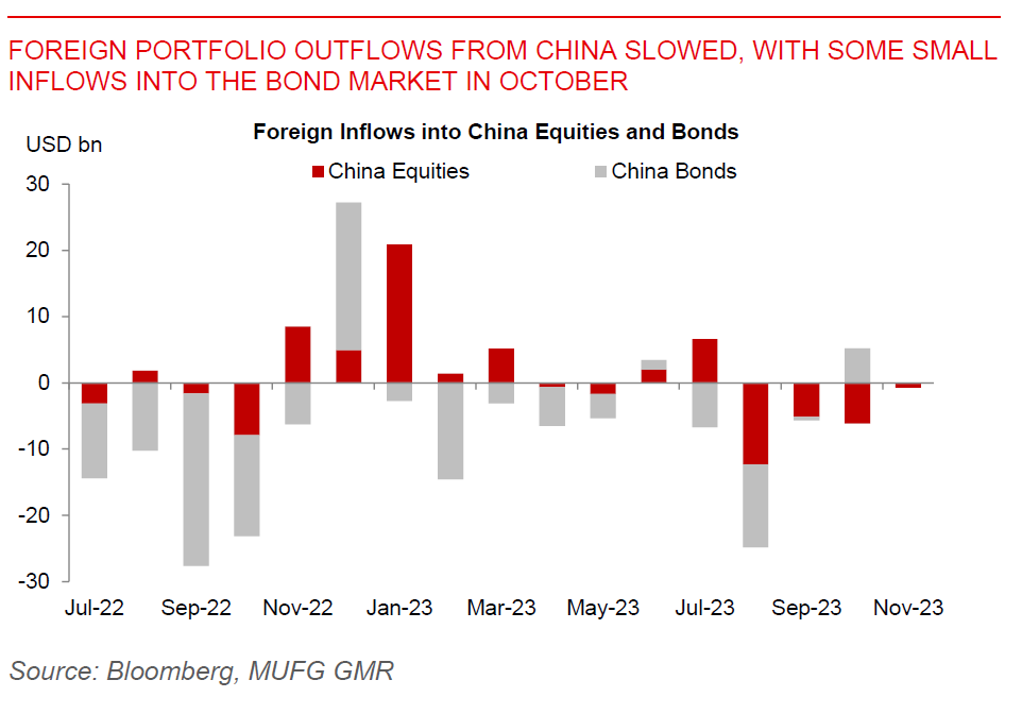

Overall, USDCNH had a sizeable move over the past week along with USDAsia more broadly, declining to 7.16. We have been reasonably positive on CNY as China pushes out more stimulus, and we are forecasting USDCNY at 7.15 in 3m and 6.85 in 12m.

Regional FX

Asian currencies continued to strengthen against the US Dollar on the back of weaker USD, with KRW, TWD, and THB all rising more than 2% over the past week, IDR rising 1.7%, while INR underperformed remaining flat against the Dollar. Stronger FX had a feed-through to Asia rates as well, with 10-year IndoGBs in particular declining to 6.82%. Thailand released its 3Q GDP data which came in weaker than expected at 1.5%yoy (from 1.8%yoy previously). The details looked better than headline numbers suggest, with private consumption growth accelerating to 8.1%yoy (from 7.8%yoy), while fixed investment picking up slightly to 1.5%yoy from 0.4%yoy. The Philippines’ Balance of Payments surplus for October was strong at US$1.5bn, likely helped by seasonal inflows from remittances and Business Process Outsourcing (BPO).