Ahead Today

G3: US: trade balance, initial jobless claims, factory orders, durable goods orders; Eurozone: manufacturing PMIs from Germany, France, Italy, and Spain

Asia: Indonesia inflation, India manufacturing PMI, Hong Kong GDP, Singapore PMI

Market Highlights

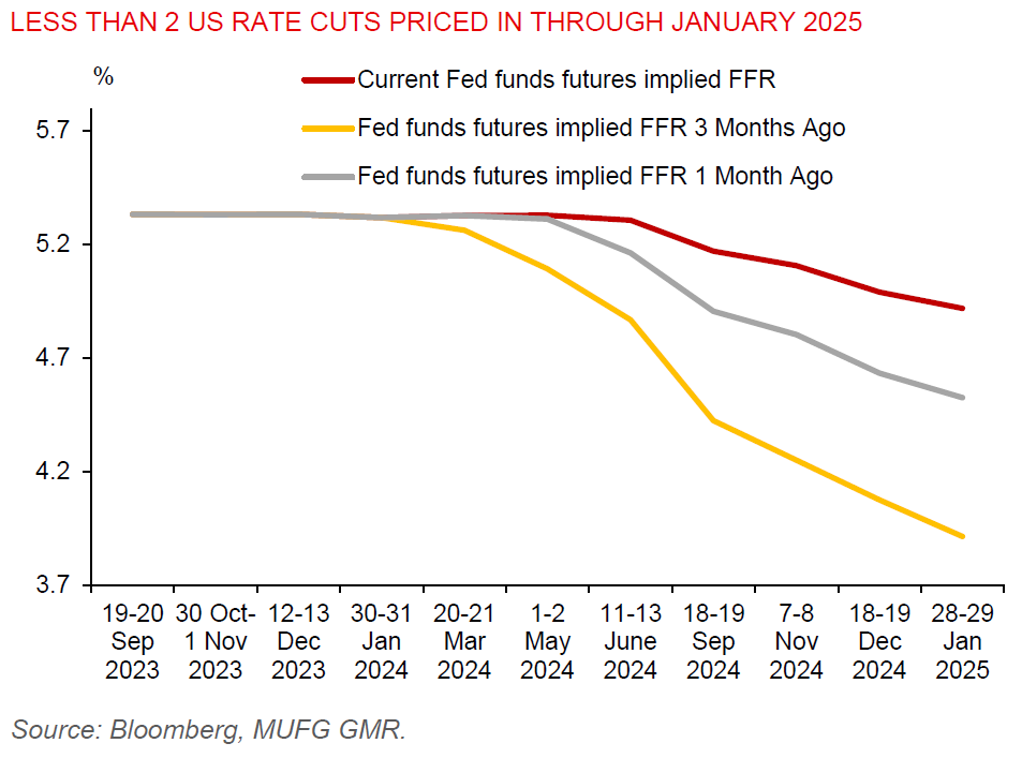

The US Fed has left its policy rate unchanged at 5.25%-5.50%. Policymakers noted there is a lack of progress towards inflation goals in recent months. Fed chair Powell said it takes longer than expected to gain confidence on inflation to cut rates, signaling high for longer US rates. But he has also added that it is unlikely for the next move to be a rate hike. The pace of balance-sheet run-off will be slowed beginning in June. The cap on treasury runoff will fall to $25b from $60b.

Meanwhile, the US treasury left its quarterly issuance of long-term debt steady at US$125bn, which is near record levels. The US treasury has also announced a new debt buyback program, starting on May 29, to buy up to US$2bn of nominal coupon securities each week and up to US$500mn for TIPS through July.

The latest US macro data show some signs of softening. The ISM factory index fell 1.1 points to 49.2 (<50 indicates contraction) in April, while JOLTs job openings were 8488k in March, down from a revised 8813k in February. Construction spending also fell 0.2%mom. However, ADP data showed private employers added 192k of jobs in April, higher than market expectation, while ISM prices paid increased by 5.1 points to 60.9, the highest level since June 2022.

Regional FX

FX movements were mostly muted in Asian FX, as many markets were closed yesterday for labour day holiday.

China’s politburo said measures will be stepped up to help digest housing inventories, overall borrowing costs to be lowered to support the economy, bond issuance to accelerate, while the third plenum will be held in July to chart long-term reform path.

South Korea’s exports rose 13.8%yoy in April, driven by strong US demand and semiconductor demand. Taiwan’s economy recorded an impressive consensus-beating growth of 6.5%yoy in Q1, up from 4.9% in Q4 2023, on the back of an AI-driven boost to chip demand and strong US demand.