Ahead Today

G3: US Personal Spending, US Initial Jobless claims

Asia: Thailand Trade

Market Highlights

The Fed kept rates on hold as expected at 4.375%, but the key for markets was the firm hawkish tone Chair Powell took during his press conference. This outweighed the two dissents by Governor Waller and Governor Bowman during the meeting, the first time this happened in over 30 years in the Fed’s history. The best quote to encapsulate Powell’s hawkishness was his comment that “you could argue we are a bit looking through goods inflation by not raising rates”, in response to a question from Nick Timiraos from the Wall Street Journal around whether the reluctance for the Fed to look through tariff-driven inflation was driven by the COVID pandemic experience. Meanwhile, Chair Powell also did not commit to a September rate cut, and said that they will need to make a judgement as they see the data evolve.

Overall, Dollar strengthened by 0.5% with EUR/USD breaking the 1.15 level and falling to 1.143 while USD/JPY rose to 149.31. Meanwhile, 2-year US yields rose to 3.94% from 3.86% with the hawkish tone from the Fed press conference. The key element moving forward will also be whether the data starts to show some weakening in the US economy beyond the inflation and price impact of tariffs.

Regional Currencies

Asian currencies generally weakened on the back of the hawkish Fed and stronger Dollar, with the likes of USD/CNH rising to 7.206 and USD/SGD rising to 1.2956.

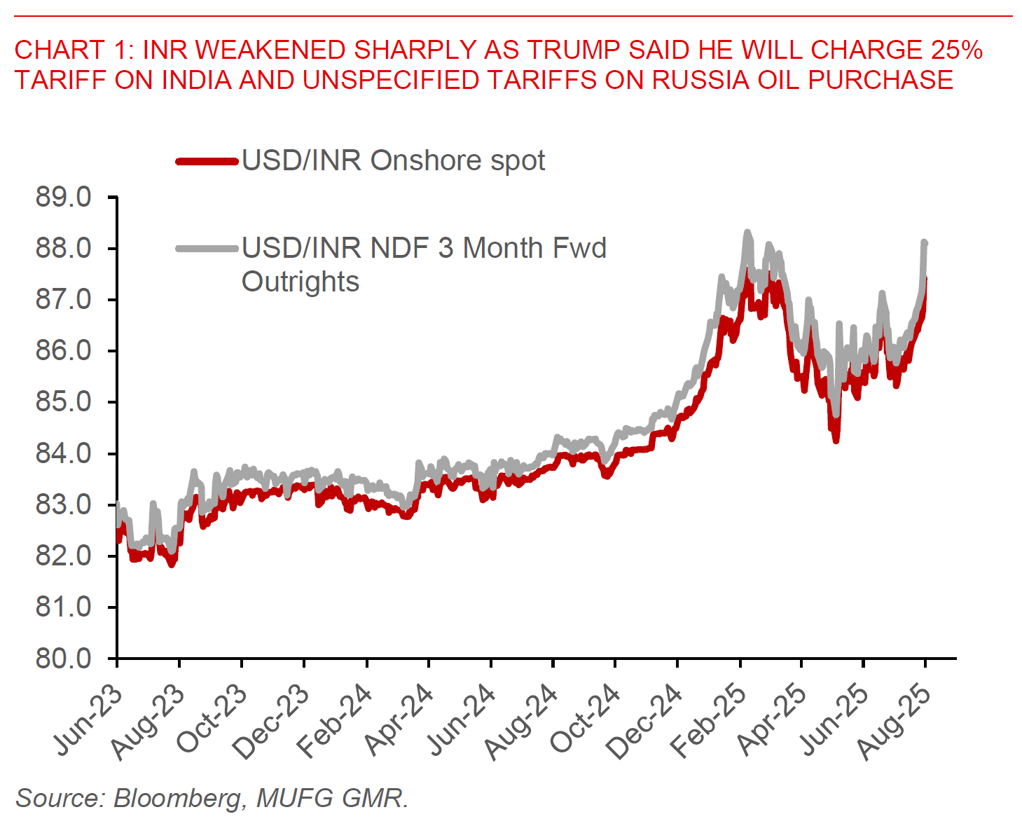

The biggest underperformer was the Indian Rupee both in the onshore and offshore markets, with 1-month USD/INR NDF rising closer to 88 levels before settling at 87.83. President Trump announced overnight that India will receive a 25% tariff together with a penalty for buying Russian energy and weapons, and this was somewhat in line with earlier reporting that India may receive a 20-25% tariff albeit in the interim as both parties continue to discuss a possible trade deal.

From a research perspective, we have been assuming that India strikes a trade deal with the US with tariffs likely below 20%. As such, the latest announcement that US-India tariffs will likely be 25% and also with additional unspecified penalties on Russian oil purchase is a downside surprise relative to our forecast assumptions for USD/INR. At the same time, other countries which compete directly with India (eg. Vietnam) also got lower rates and so competitive advantage for India’s export sector could be eroded to some extent if these proposed tariff rates stick.

The key for markets and our forecast profile for INR is whether a trade deal between India and US is delayed but not denied. Our best sense right now is that there will likely still be a deal for at least three reasons. First, there have already been lots of good faith trade negotiations discussions and back and forth, and so we are not starting out from a blank sheet of paper. The US trade team is scheduled to visit India for more talks in August, with the view from the India team to complete talks by September/October. Second, we think the India government also wants to make sure all the details are captured leaving lower chance for public interpretation. Third, India is also a fast-growing market that US companies continue to want to tap on and so that is one area of leverage India has currently. There are of course still difficult sticking points including opening up of India’s agriculture, and whether President Trump will view the deal as good enough from his perspective. We are currently forecasting USD/INR at 84.50 by December year-end and will relook our forecast and assumptions together with our global team in the upcoming FX Monthly.

On that front, in remarks to reporters at the White House as well, Trump said his team was still in discussions with India. “We’ll see what happens,” Trump said. “It doesn’t matter too much whether we have a deal or whether we charge them a certain tariff, but you’ll know at the end of this week.”