Ahead Today

G3: Eurozone Consumer Confidence, Fed’s Williams speaks

Asia: China 1-year loan prime rate, India Infrastructure Index

Market Highlights

The Trump administration’s policy change requiring a US$100,000 payment for H-1B non-immigrant visas caused significant confusion over the weekend, with many US technology companies advising staff on the H-1B to return to the US and limit travel until they can get better clarity. The proclamation was initially widely interpreted as enforcing a US$100,000 payment for H-1B visas when applying for a new visa, renewing an existing visa, or even for existing H-1B visa holders when entering the United States. This last point resulted in significant uncertainty for many H-1B visa holders who were outside the US for a variety of reasons, with the deadline to catch a flight and enter the US to avoid the US$100,000 payment set to be on Sunday midnight. US Commerce Secretary Howard Lutnick added further to the immigration mayhem, by proclaiming during the press conference that the payment will be US$100,000 per year rather than a one-off payment.

The White House subsequently came out with a clarification that this new rule: 1) only applies to new visa applications and not renewals and current visa holders, 2) existing H-1B visa holders can leave and re-enter the US and not be charged US$100,000 to do so, and 3) this fee is not an annual fee but a one-time fee.

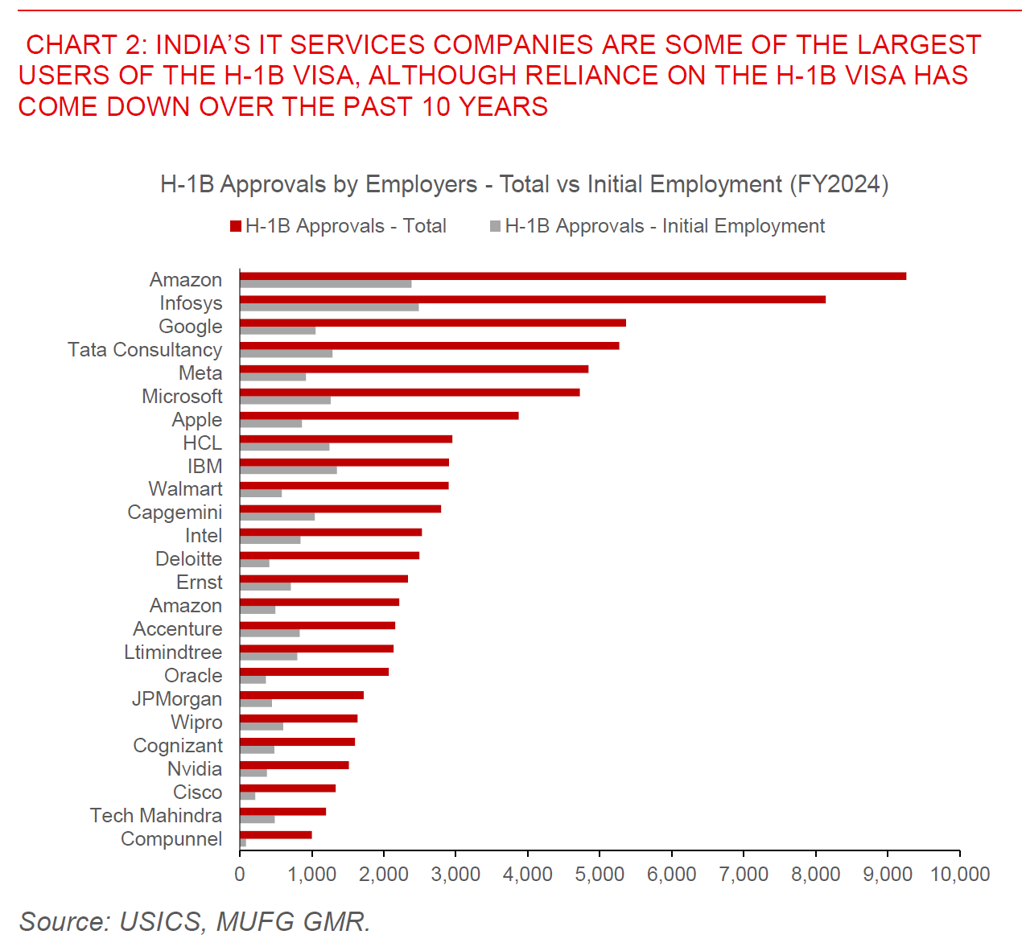

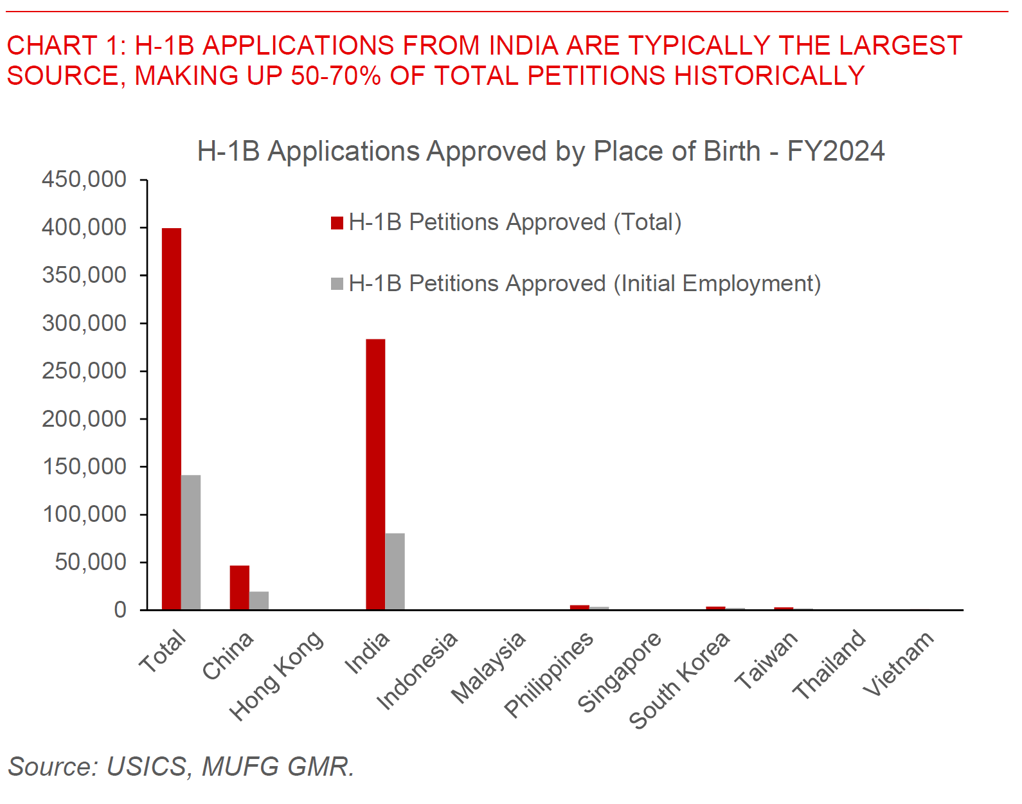

Across Asia, India stands out as the key country which could be negatively affected disproportionately by these visa changes. For one, Indians are historically the largest source of applicants and holders of the H-1B visas, making up anywhere from 50% to 70% of total petitions and new employment H-1B visa approvals. Second, India’s IT service firms are also some of the larger users of the H-1B visas historically, in order to help their US clients service their IT and engineering activity onshore in the US. That said, India’s IT services firms have also been reducing their reliance on the H-1B visa over the past 10 years, and so in some ways they have been preparing for possible tighter immigration policies, although the new US$100,000 payment is likely far higher than expected.

For India, these developments in H-1B visa changes could have some short-term impact on India IT services companies to fulfil their projects, and hence perhaps some knock-on impact to services exports revenues in the balance of payments. Over the medium-term, these changes could also result in slower remittances growth, but with the net-impact to services exports unclear given the possibility that more activity could be offshored outside the US.

From an FX perspective, we think this development gives us more confidence that the Indian Rupee will underperform Asian FX and core G10 crosses, but we think INR FX volatility should remain contained with the government also taking steps to structurally reform the economy including from recent GST changes. While current 50% tariff rates are unlikely to be sustained over the medium-term in our view, any meaningful trade deal with the US will likely also face some structural challenges including from recent H-1B visa changes coupled with difficulties in negotiating sensitive sectors such as in agriculture. We are forecasting USD/INR at 89.00 by 1Q2026 (calendar year) (see India: Most consequential GST reforms since 2017 and India: Restore, rebalance and reform?)