Ahead Today

G3: Japan tertiary industry index

Asia: Thailand Q2 GDP

Market Highlights

US import prices rose 0.4%mom in July, notably above Bloomberg consensus of +0.1%, suggesting some upward pressure on input costs. However, on a year-on-year basis, import prices fell 0.2%, indicating that firms may still be absorbing part of the tariff impact. That said, some tariff-related passthrough to consumer price inflation could emerge in the coming months, particularly if supply chains tighten. Meanwhile, the retail sales control group rose 0.5%mom, down from 0.8% in June, but still above market expectations of +0.4%, pointing to resilient consumer demand.

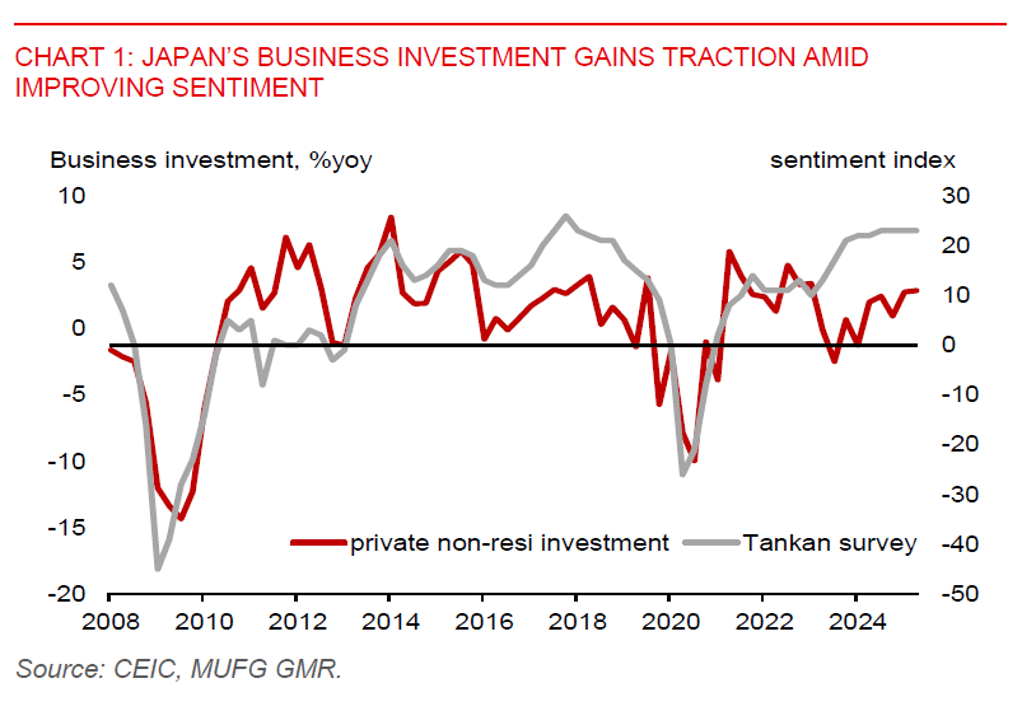

In Japan, seasonally adjusted GDP expanded at an annualized pace of 1.0% in Q2, up from 0.6% in Q1, despite ongoing tariff headwinds. Growth was primarily driven by business investment, which rose 1.3%qoq (vs. 1.0% in Q1), and exports, which rebounded 2.0%qoq from -0.3% in Q1. Notably, goods exports rose 2.0%, while services exports climbed 2.2%, supported by resilient inbound tourism. The Tankan survey indicates that business sentiment among large enterprises remains elevated, with improving confidence among medium and small firms. This suggests positive investment momentum could persist, helping to cushion against external pressures.

Japan’s resilient Q2 GDP print may reinforce expectations for BoJ rate hikes, with markets currently pricing in about 70% chance of a 25bps hike by year-end. This, along with market expectations for Fed rate cuts, point to a supportive backdrop for the yen. The yen appreciated by 0.4% against the US dollar last week.

Regional FX

Asian currencies largely strengthened against the US dollar last week. The Indonesian rupiah (IDR) and Malaysian ringgit (MYR) led regional gains, appreciating 0.8% and 0.7%, respectively. We remain constructive on the outlook for both currencies in H2 2025, underpinned by resilient domestic fundamentals.

In Indonesia, the government unveiled its 2026 budget, projecting revenues of IDR 3,147.7 trillion and expenditures of IDR 3,786.5 trillion, resulting in a budget deficit of IDR 638.8 trillion (2.48% of GDP). The fiscal plan targets 5.4% real GDP growth, with an emphasis on mineral downstreaming and the acceleration of US$38 billion in related projects. President Prabowo also highlighted the role of the new sovereign wealth fund, Danantara, in revitalizing state-owned enterprises and driving long-term growth. Notably, the budget allocates IDR 335 trillion to expand the free meal program to over 80 million beneficiaries, up sharply from IDR 71 trillion this year.

In Malaysia, final GDP data shows 4.4%yoy growth in Q2, slightly lower than the advance estimate of 4.5%yoy, but in line with the pace seen in Q1.

In contrast, China’s July data pointed to a broad-based slowdown. Key indicators decelerated: retail sales rose 3.7%yoy (vs. 4.8% in June), industrial production grew 5.7%yoy (vs. 6.8%), fixed asset investment slowed to 1.6%yoy YTD (vs. 2.8% in H1), and property investment contracted further at -12%yoy YTD. The trade-in stimulus policy appears to be losing traction, while the surveyed unemployment rate ticked up to 5.2% from 5%. These trends, alongside real estate weakness, portend continued headwinds for domestic demand.