Ahead Today

G3: US JOLTS Job Openings, Germany CPI, US House Price Index

Asia: China Manufacturing and Non-Manufacturing PMI

Market Highlights

There were several key themes affecting markets overnight, with the key market moves including a sharp spike in gold prices above the US$3800 handle, rise in Bitcoin prices, coupled with continued good sentiment on risk assets including a 2% rise in MSCI China. One key driver is certainly the fast and exponential developments in the AI space, not just in the West but also in China. Huawei said that it is preparing to sharply ramp up production of its most advanced artificial intelligence chips over the next year, which would represent a technical breakthrough potentially in terms of chip self-sufficiency, with DeepSeek also providing an updated and optimized experimental AI model which it said it was working together with Chinese chipmakers. Meanwhile, Anthropic is releasing a new artificial intelligence model that is designed to code longer and more effectively than prior versions, with the new model better at following instructions and able to code on its own for up to 30 hours straight (compared with seven hours previously). While all these developments do not diminish the risk from high equity valuations in the US and exuberance in the AI space, they do point to extremely rapid developments in technology perhaps catalysed by geopolitical competition that is supportive of risk assets and hence also further Dollar weakness

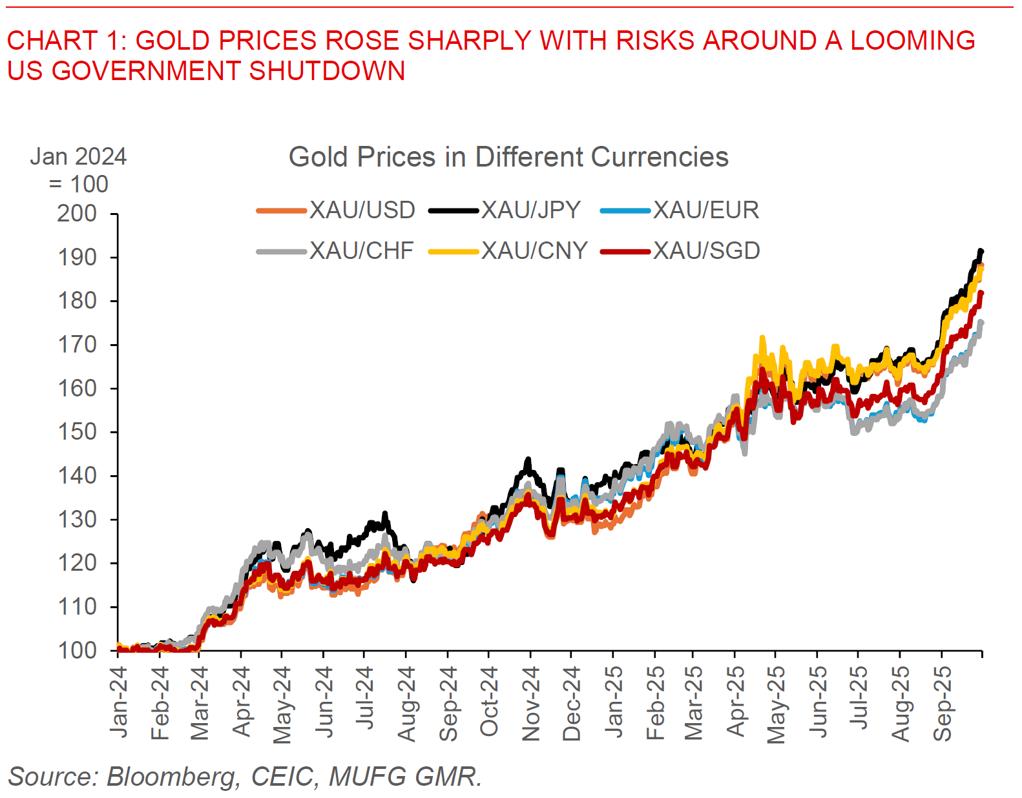

The second key theme is the perennial drama and deja-vu around a government shutdown in the US, with US Vice President JD Vance saying he believes the government is on track to shut down and seeking to pin the blame on Democrats. President Trump met with top congressional leaders overnight, but with the two sides no closer to resolving Democrats demands to extend health-care subsidies and reverse Medicaid funding cuts included in Trump’s signature tax legislation passed earlier this year. In this year’s version of the game of chicken, President Trump is threatening to permanently fire federal workers en-masse if the government shuts down. This would also delay the release of key economic indicators, including the important non-farm payrolls numbers to be released on Friday. While US equities have remained resilient, the Dollar has sold off to start the week with a sharp rise in alternative safe haven assets such as gold.

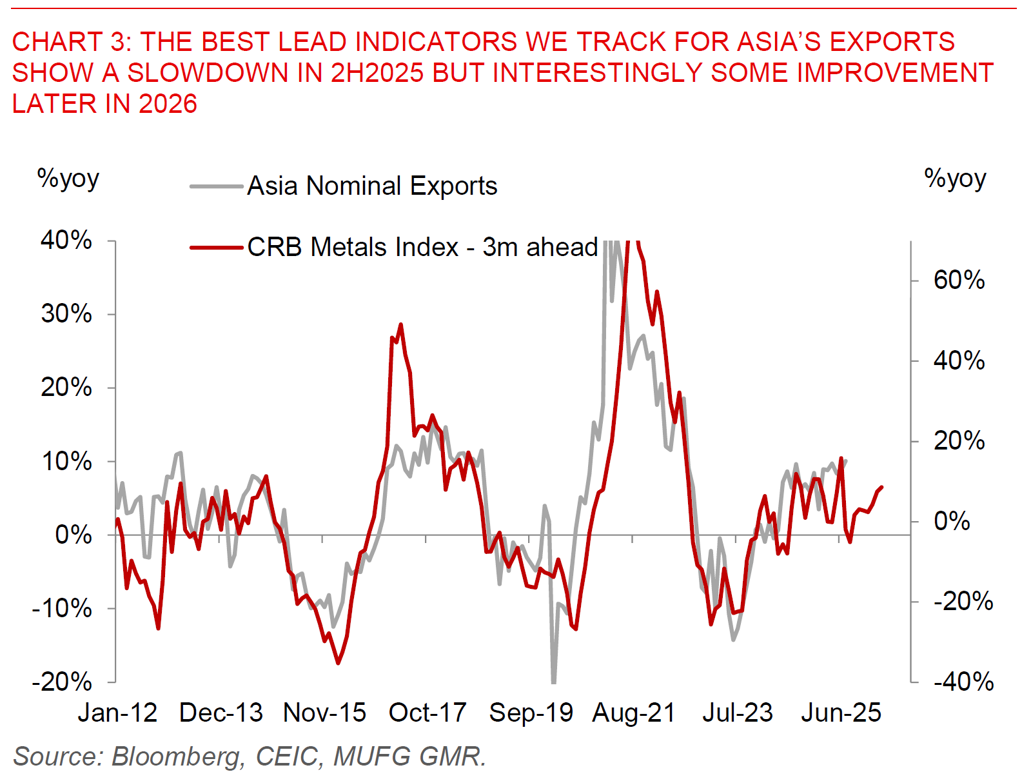

The last key important driver for markets are some of the details around how sectoral tariffs such as pharmaceuticals and semiconductors will be implemented, and with that whether Asian exports and industrial production have started to slowdown more meaningfully in September reflecting payback from tariff related front-loading. Singapore and to a smaller extent India are more exposed economies to pharmaceutical tariffs, and the implementation fine print around how companies are exempted and which products are defined as branded pharma will be extremely crucial for the outlook. Meanwhile, we will have September PMIs for China later today for both the manufacturing and non-manufacturing sector, together with China’s manufacturing PMIs, coupled with Asia’s PMI data for September out later tomorrow. South Korea and Vietnam will also release their September export numbers over the next couple of days and these will be key to gauge the initial impact from tariffs as well. The best lead indicators we track for Asia’s exports point to a slowdown in momentum in 2H2025, but interestingly some possible improvement as we head into 2026.