Ahead Today

G3: JGB 40-year auction, US Mortgage Applications, Richmond Fed Manufacturing Index

Asia: Taiwan 1Q GDP, India industrial production

Market Highlights

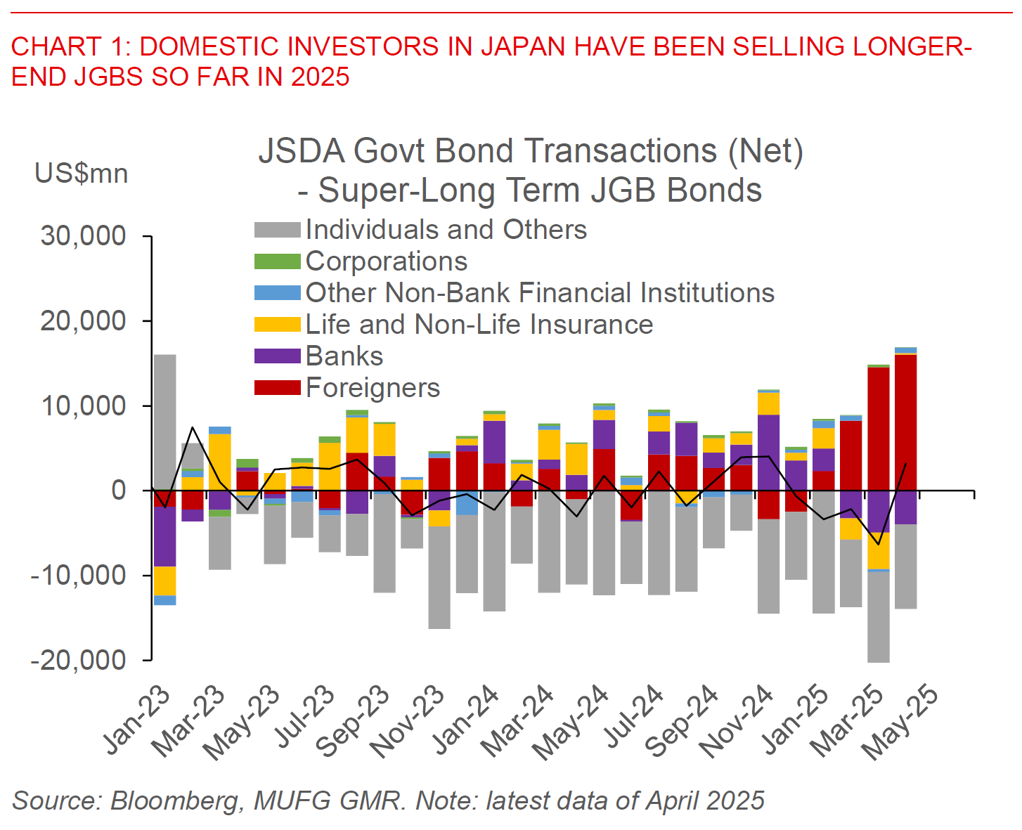

The US Dollar strengthened while most Asian currencies across the board weakened including the Japanese Yen, with USD/JPY rising above 144 yesterday. The key immediate driver both from a global FX and rates perspective was news the Japanese Ministry of Finance may adjust debt issuance following a sharp rise in longer-end JGB yields, with MOF reported to send a questionnaire to market participants asking for their views on issuance and the current market situation. This sparked a meaningful global bond rally, with JGB 30-year yield falling sharply to below 2.9% from 3.2%, and US 30-year yields fell to 4.96% from 5.15% at its most recent local peak.

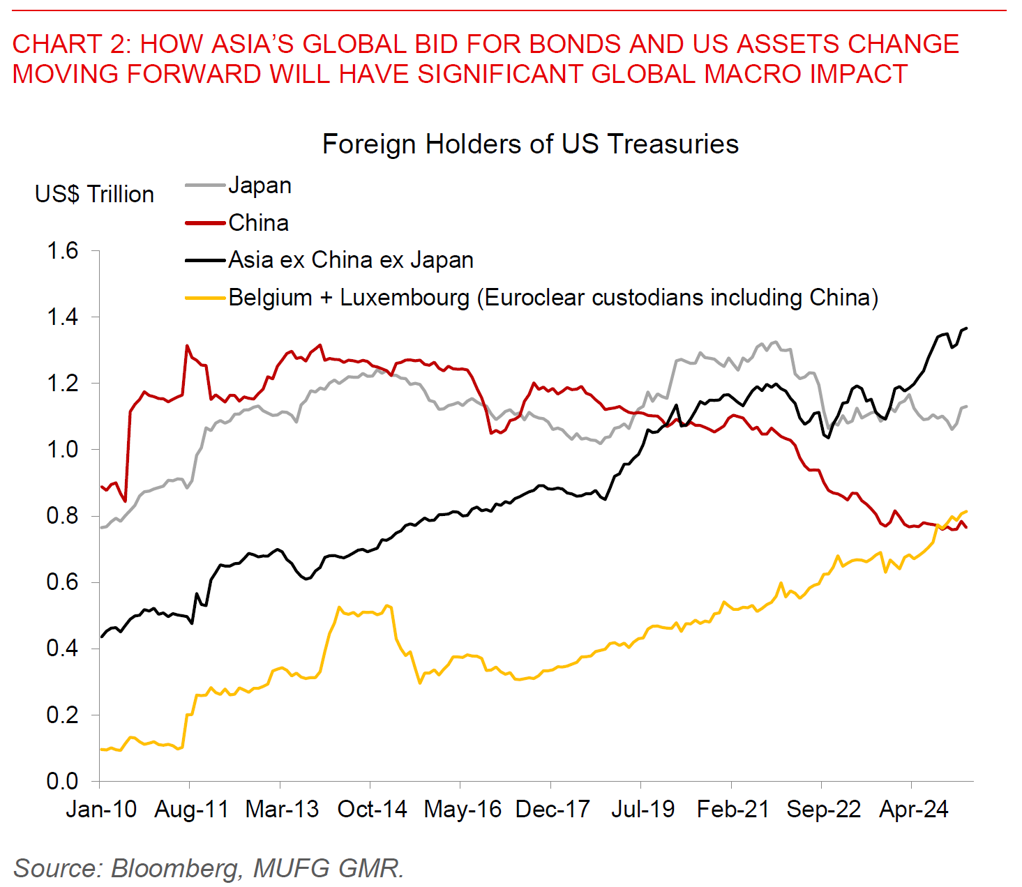

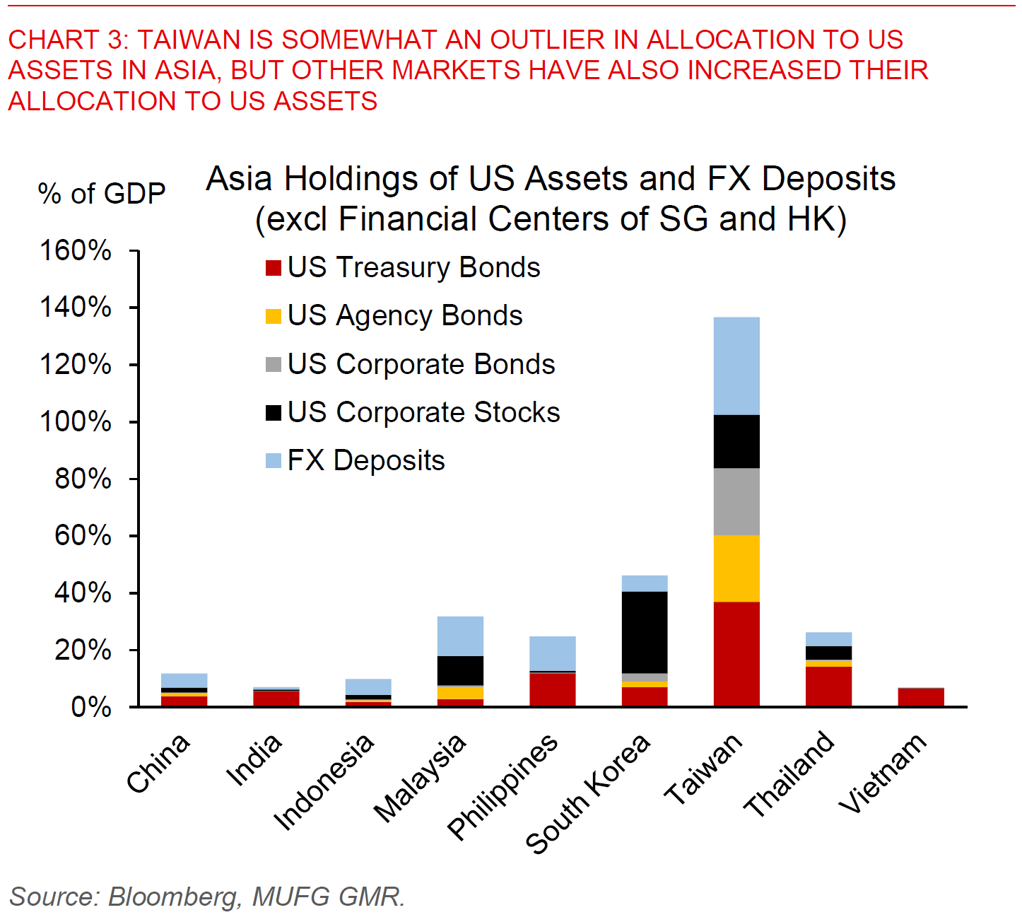

The market moves yesterday raise two meaningful global macro questions, with possible implications on the path ahead. First, it tells us that debt and deficit trajectories and with that issuance on the supply side matter, with a meaningful change in how longer-end developed market government bonds seem to be performing. Second, it raises questions around Asia’s global bid for bonds and assets more generally as a net creditor, and the spillover impact beyond idiosyncratic country factors. Of course, there are some Japan-specific factors such as unrealized losses on Japan insurers’ domestic JGB holdings potentially limiting near-term their ability to reallocate more towards the domestic portfolio away from their unhedged overseas portfolio. More broadly, as what both Taiwan and Japan (and perhaps increasingly other Asian net creditors) may tell us, their impact on global markets may continue to be outsized moving forward as meaningful macro shifts take place with the changing world order.

Regional FX

Of course, it would be remiss to say that the stronger Dollar and weaker Asian currencies was just due to the potential change in JGB auctions. The soft data out from the US yesterday including stronger than expected US consumer confidence and better Dallas Fed Manufacturing Index do point to some improvement in at least sentiment, and especially post the recent moves to both pause Liberation Day tariffs for 90-days and the recent US-China tariff pause. Our strong conviction is still that US growth should still slow down and inflation should still pick up, even if the left tail risks of sharp global recession have been reduced from tariff pause. This is not just due to tariffs themselves, but the way that they have been announced resulting in significant policy uncertainty, and thereby also constraining business investment decisions, coupled with likely supply chain disruptions moving forward. On our end, we are biased to take the opportunity to go long some Asian currencies with good domestic stories such as India and the Philippines, and to a smaller extent Indonesia (see India: Art of the Deal, Philippines: Steady as she goes and Indonesia: Rupiah to find support)