Ahead Today

G3: Bank of Japan policy meeting

Asia: China FX settlement

Market Highlights

Geopolitical tensions and developments continued to whipsaw markets, with Brent Oil prices weakening during the US session to as low as US$71/bbl, before rallying morning Asia time close to US$ 75/bbl. The earlier declines in oil prices and improvement in risk sentiment were initially driven by a Wall Street Journal article saying Iran is signalling it wants to de-escalate hostilities with Israel and negotiate its nuclear program, although news articles also mentioned that Iran will not agree to talks until Israel stops its bombing. These market moves reversed as Trump called for Tehran’s evacuation, highlighted that there could be more developments in the Middle East, and amidst reports that Trump has left the G7 summit early.

Taking a step back, our 3 questions posed on the Israel-Iran conflict to gauge the path moving forward are still very much relevant (see 3 things on Israel-Iran tensions). First, whether there are actual physical disruptions to global oil supplies. Second, whether the Strait of Hormuz is impacted. Third, the role and involvement of the US in the conflict. On the 1st two counts, the latest information still suggests that there have been no physical disruptions to global oil supplies nor any impact to the Strait of Hormuz yet, with the impacted oil and gas infrastructure in Iran focused on domestic supplies. Nonetheless, how the US may get involved, and how Iran may respond moving forward will certainly be crucial for the path of markets moving forward.

Regional FX

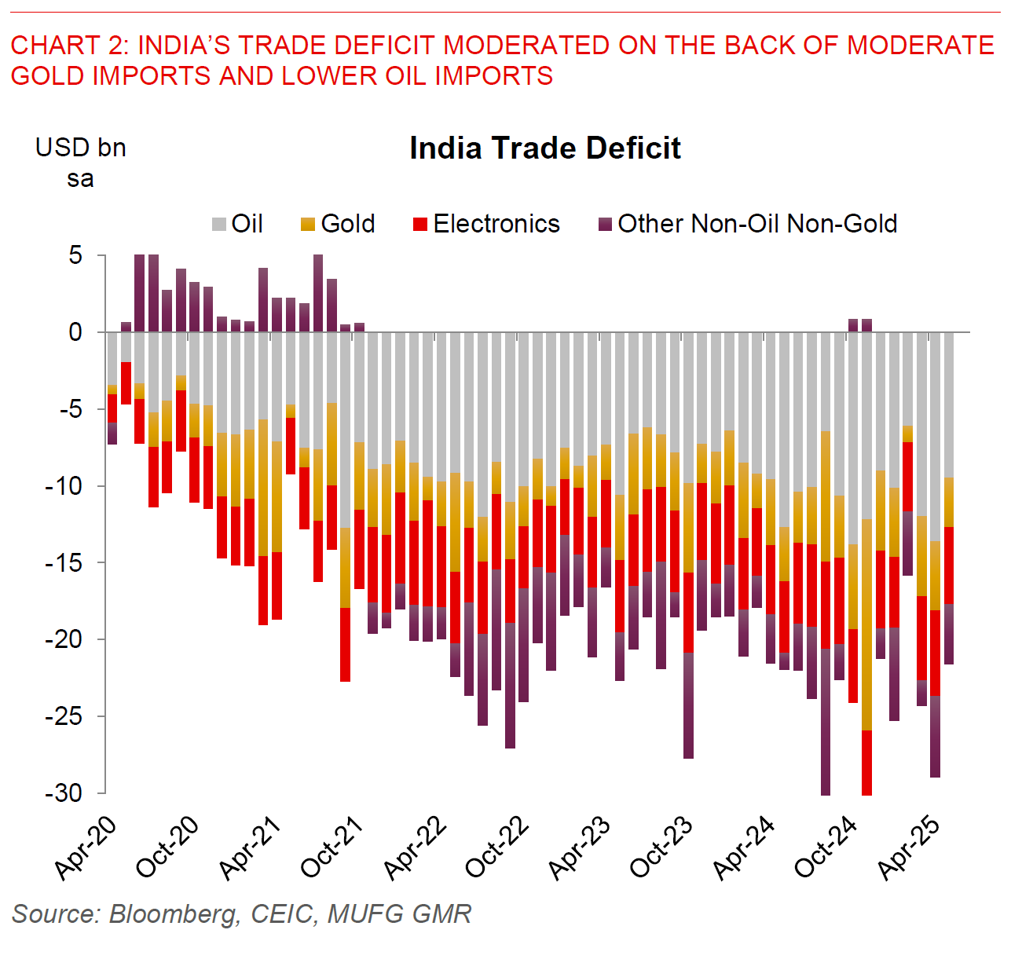

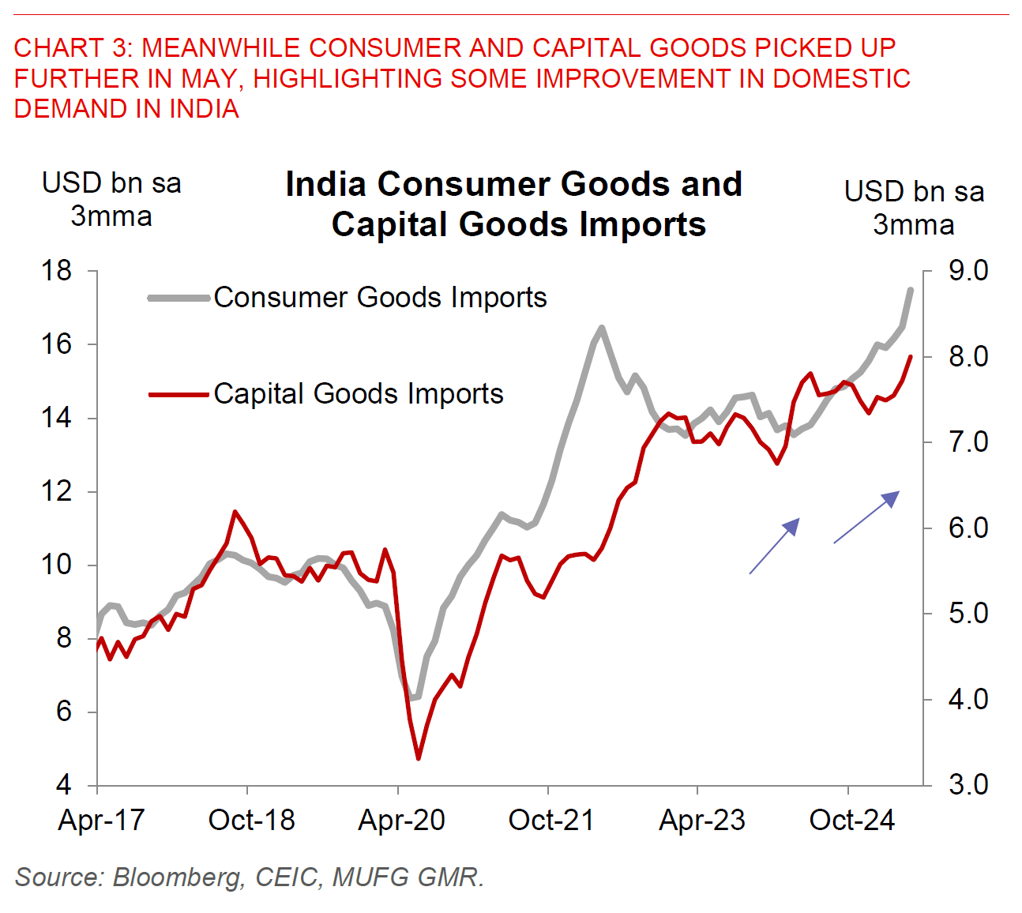

Asian currencies generally took their cue from global markets and the Dollar, with the US dollar weakening earlier overnight before strengthening on latest developments. The oil sensitive Asian currencies with current account deficits such as INR and PHP have continued to underperform, while we had outperformance in the undervalued currencies with current account surpluses such as TWD and KRW. China released its monthly data yesterday, and among the key datapoints retail sales came in much stronger than expected at 6.4%yoy. At least some of this could have been boosted by temporary factors such as the cash-for-clunkers program. Meanwhile, India released its trade deficit data for May which came in smaller than expected at US$22bn from US$26bn the previous month. The details were quite good, with lower oil imports, moderate gold imports, coupled with a pickup in consumer and capital goods imports signalling a potential improvement in domestic demand. At risk of stating the obvious, the path moving forward will be dependent on oil prices and risk sentiment for India. Nonetheless as we have also highlighted previously, the starting point for India is not a bad one, with low inflation, modest current account deficit of 1% of GDP, further space for policy rate cuts, coupled with a likely improvement in growth prospects moving forward. If geopolitical risks fade, we are biased to see USD/INR head lower over time (see India: Art of the deal).