Ahead Today

G3: US nonfarm payrolls, unemployment rate, hourly earnings, initial jobless claims, ISM services, factory orders, durable goods orders; eurozone PMI

Asia: Caixin China PMI, India PMI

Market Highlights

The US dollar saw a modest reprieve in yesterday’s session, but it likely remains entrenched in a broader downtrend. Market expectations for fed funds rate are likely to head lower in the coming months. Trump has renewed calls for ultra-low fed funds rate.

Meanwhile, fiscal stimulus from his signature tax bill would keep markets wary about rising federal debt. Markets are now pricing in some probability of a jumbo 50bps rate cut in the September FOMC meeting. This dovish sentiment was reinforced by the latest US ADP reports that showed private sector payrolls fell by 33,000 in June, missing Bloomberg consensus of a 98,000 gain and marking a first decline since Mach 2023. This follows a downward revision of May’s data to a 29,000 increase. The goods producing sector added 32,000 jobs, offset by a 66,000 drop in the service providing sector.

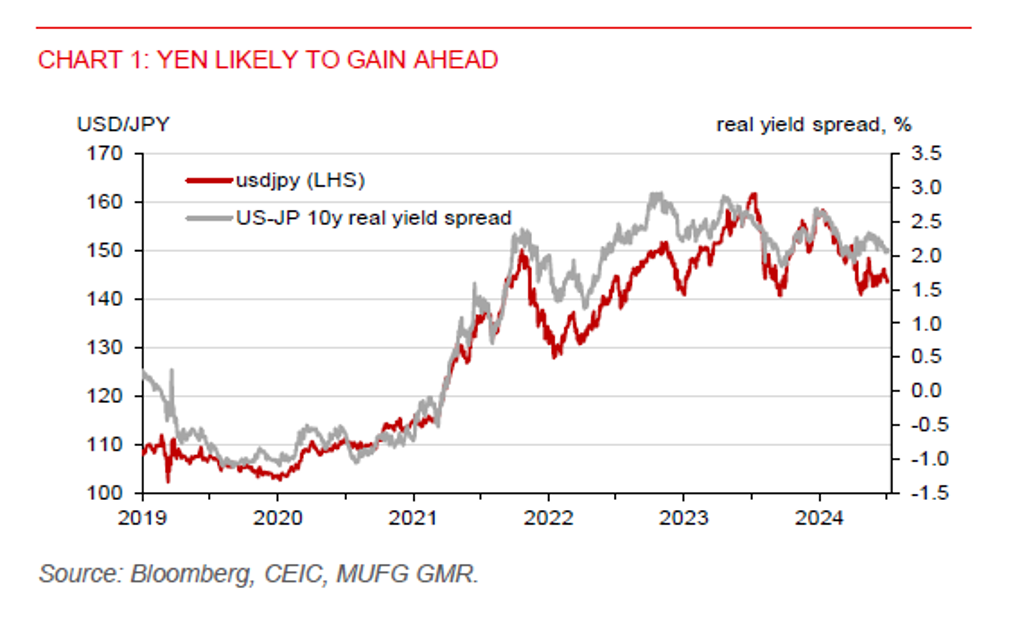

Meanwhile, USDJPY has edged higher, but continues to trade within a range of 140-150. This upside move in USDJPY may prove short-lived, as the yen could gain from safe-haven bids as markets brace for tariff announcement on 9 July. Any USDJPY upside could be limited. Global oil prices have eased, removing the risk of an oil price shock. A potential resumption of Fed rate cuts in H2 should also narrow the US-Japan yield differential, even as the BoJ stand pat over tariff impact on growth. A trade deal with the US still hangs in the balance, with Trump expressing frustration over a lack of progress.

Regional FX

Asian FX has briefly stalled its advance against the US dollar, except for the Taiwan Dollar, which gained 0.6% to the 29.00-level. The ringgit led losses in the region, down by 0.7%. Markets will watch for 3 key events ahead – the nonfarm payrolls, Trump’s tax bill, and the tariff announcement on 9 July. The 90-day pause on reciprocal tariff will lapse on 9 July, though it could be extended. Quite bearish positioning on the broad US dollar index also suggests that a near-term squeeze on dollar shorts may be on the cards, though the broader trend is still for Asian currencies to continue strengthening against the US dollar in H2 as the Fed lowers policy rate.

We remain constructive on the IDR outlook, despite finance minister Sri Mulyani noting that the budget deficit could rise to 2.8% of GDP this year, up from earlier projection of 2.5%. The wider deficit projection was mainly due to a downward revised outlook for state revenue to IDR2,864.5tn from IDR3,005.1tn. We expect the budget deficit will stay within the constitutional limit of 3% of GDP, so there may be limited pricing in of larger fiscal risks. A combination of a weaker USD, potential Indonesia-US trade deal, and bond inflows should help the rupiah to strengthen in H2.

Meanwhile, Trump has announced a trade deal with Vietnam, which includes a 20% tariff on Vietnamese exports to the US and a 40% on transshippment goods. Vietnam will drop all levies on US imports. The 20% tariff is notably below the 46% reciprocal tariff rate announced on US liberation day.