Ahead Today

G3: US CPI

Asia: Malaysia industrial production

Market Highlights

US and China have agreed to an in principle framework for de-escalating trade tensions by implementing the consensus they reached in Geneva in May, where significant tariffs were rolled back. US Commerce Secretary Lutnick said the issue with China’s rare earth export controls will also be resolved. There are no other bilateral meetings scheduled. The latest talks appear to be a constructive step forward, reducing the risk of a full-blown trade war.

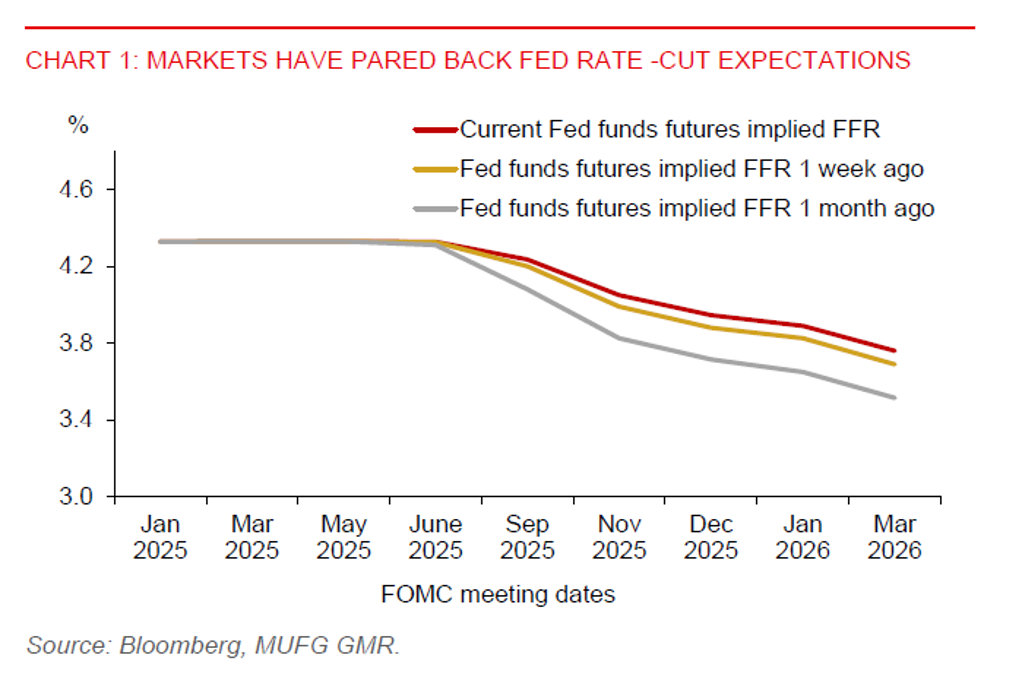

Market will turn their focus to the upcoming US CPI data due later today. Headline inflation could begin to edge higher, partly reflecting the impact of increased U.S. tariffs. Additionally, the soft monthly inflation prints from mid-2024 may mechanically push up year-on-year comparisons. Combined with only a gradual cooling in labour market conditions, this could constrain the pace of Fed rate cuts this year. Markets have already sharply repriced expectations, now anticipating fewer than two rate cuts (44bps), down from 54bps seen prior to last Friday’s nonfarm payrolls release.

Meanwhile, the NIFB small business optimism index rose to 98.8 in May, up from 95.8 in April, and beating market estimates of 96.0. This reflects improving optimism among small business owners, despite ongoing macroeconomic uncertainties. Key components of the index, such as sales expectations and economic expectations, showed notable gains.

In Japan, BoJ Governor Ueda appears to have become dovish. This has likely in part weakened the Japanese yen. Ueda has emphasized that Japan’s underlying inflation is still below its 2% inflation target.

Regional FX

Asian currencies largely consolidated against the US dollar yesterday, except for the Korean Won, which weakened by 0.9%. KRW has not been helped by news that the National Pension Service has stopped selling US dollars due to the won’s appreciation. Nonetheless, the won could be supported in the near term by strong inflows into its equity and bond markets.

Meanwhile, US-China trade talks have appeared to end on a positive note, which could help Asian currencies to consolidate their recent gains against the US dollar.

In Indonesia, we expect the rupiah will continue to find support from a weak US dollar, which will help offset the negative impact from current account deficits. Market sentiment towards Indonesia’s sovereign bond market has also stabilized. Foreign reserves were adequate at $152.5bn. Interbank liquidity conditions have also eased.