Ahead Today

G3: US CPI

Asia: India CPI

Market Highlights

President Trump extended a pause of tariffs on Chinese goods for another 90 days into early November. The details of the order was not immediately available, and it was not clear whether there were any specific terms underlying the pause and the agreement. Nonetheless, the developments over the past weeks including recent approvals for Nvidia’s H20 chips to be exported to China – albeit with an unorthodox 15% revenue share of the US government – coupled with recent exhortations by Trump for China to buy more soybeans may indicate the direction of travel for an eventual trade deal between US and China.

The other key global theme continues to be the possible successor to Fed Chair Powell, with news overnight suggesting that the search has expanded to the likes of the Fed’s two vice chairs - Michelle Bowman, Philip Jefferson and also Dallas Fed President Lorie Logan. While the latest reporting suggests that Governor Christopher Waller is the leading candidate for now, the ultimately decision still lies with President Trump and over here it is still unclear who he is leaning towards now.

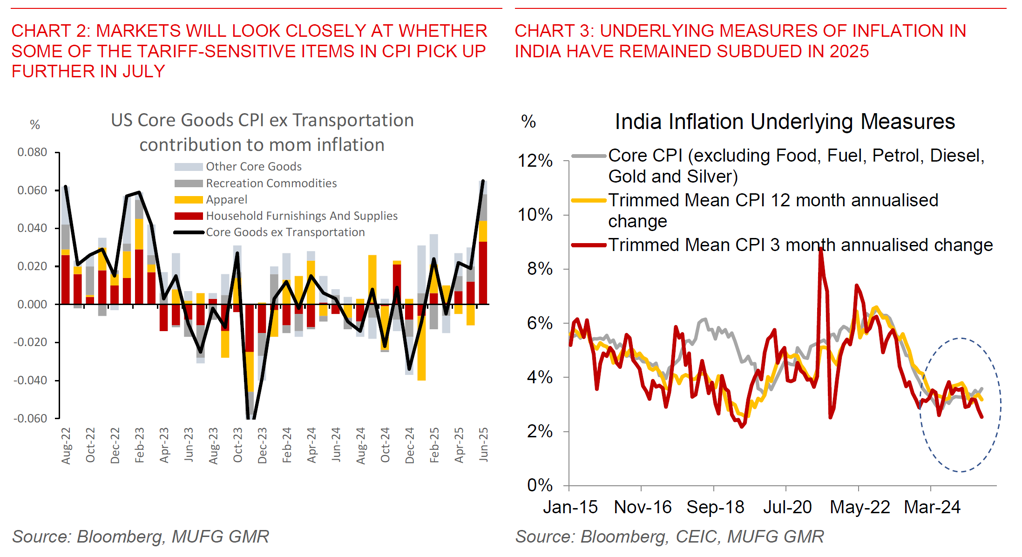

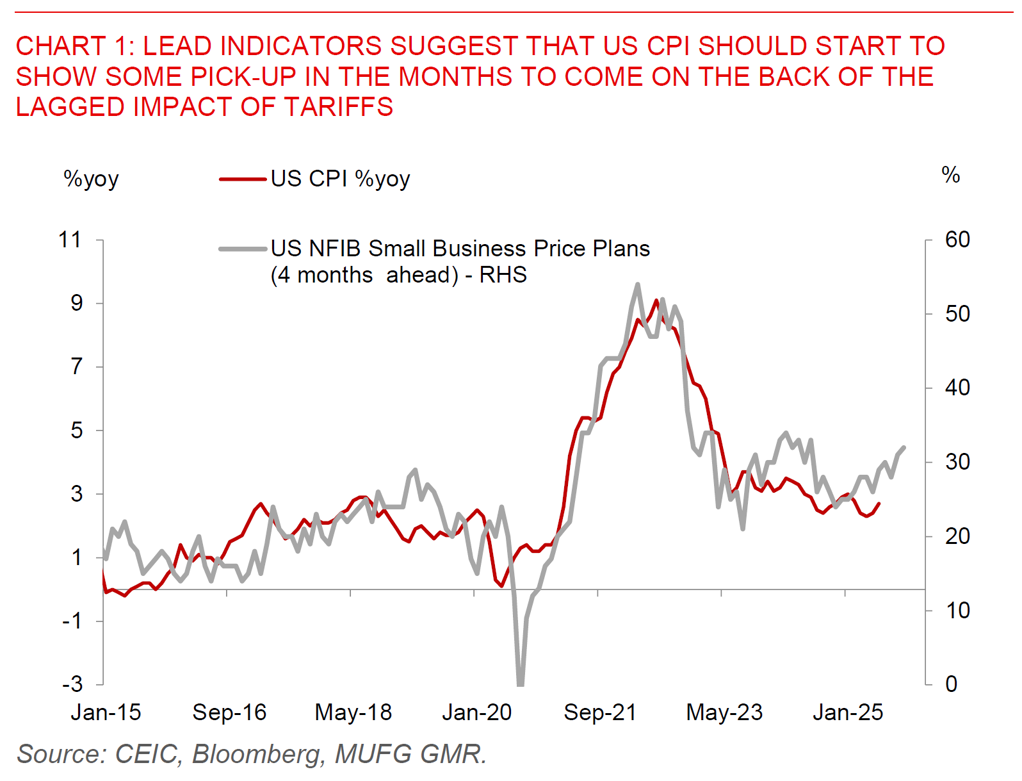

The focus of markets later today will be on US CPI numbers. The consensus is calling for a 0.2% mom rise in the headline rate and 0.3% mom rise in the core rate. More importantly, markets will focus on the details, and as we’ve seen last month, whether some of the more tariff-sensitive items such as apparel, household furnishings, toys, recreation goods, among others see further tariff passthrough in the numbers. On an aggregate perspective, the best lead indicators we have of US inflation points directionally to a rise in CPI, while we have also seen some corresponding pickup in US import prices in the likes of apparel and furniture goods not just from ASEAN countries but also out of China. Our best sense is that a rise in inflation should be viewed in this cycle as negative for the dollar (through lower real yields) and also bullish for bonds (through somewhat weaker growth and labour market expectations).

Meanwhile, India will report inflation numbers for July, with consensus expecting a further moderation to 1.4%yoy from 2.1%yoy on the back of generally soft food prices outside of tomatoes perhaps. We see the RBI cutting rates by 50bps in this cycle, bringing the repo rate to 5.00% by end-2025 from 5.50% currently, with inflation still expected to remain subdued and surprise the central bank’s forecast to the downside moving forward. We could see RBI cutting more if 50% tariffs stick for a sustained period, which we stress is not our current base case (see India: Restore, rebalance and reform).