Ahead Today

G3: -

Asia: BSP and CBC policy meeting

Market Highlights

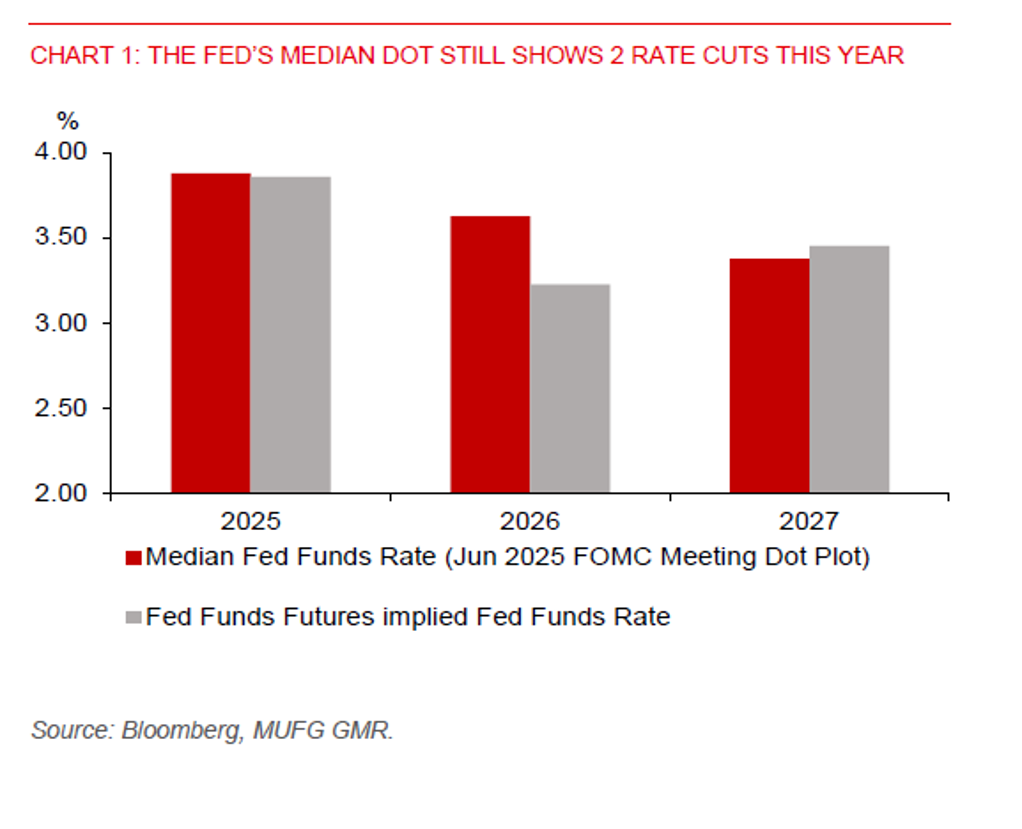

The Fed left the policy rate unchanged at 4.25%-4.50% in June as widely expected. The median Fed dot continues to signal 2 rate cuts for 2025. But the margin is narrow, with 8 policymakers expecting 2 rate cuts this year and 7 expecting none. Fed Chair Powell downplayed the split, citing elevated economic uncertainty, while reiterating that the Fed is well positioned to wait for more clarity about the impact of tariffs on growth and inflation dynamics before adjusting rates. The Fed’s median dot also shows only one rate cut each in 2026 and 2027. Policymakers have raised their median inflation outlook to 3% in 2025 from 2.7%, while lowering economic growth to 1.4% from 1.7%, and slightly revising up the unemployment rate forecast to 4.5%.

US Treasury gains stalled as the Fed signalled continued patience with rate cuts, while the US dollar ended flat. Markets are currently pricing in about 47bps of rate cuts this year, implying 2 cuts in H2, with the first fully priced in only for October.

Regional FX

Asian currencies have broadly extended their losses against the US dollar yesterday, with the PHP leading regional declines, falling 0.5% on the day and nearly 2% since Middle East tensions escalated last Friday. BSP governor has said that the central bank will tolerate currency weakness, noting that intervention will be futile amid global risk aversion. The key focus in Asia today is the BSP policy meeting, where markets widely expect a 25bps rate cut supported by moderating inflation.

Bank Indonesia held its benchmark policy rate unchanged at 5.50% at its 18 June meeting, following the 25bps rate cut in May. The decision aligns with both our and market expectations. Elevated Middle East tensions may have contributed to BI’s cautious stance towards policy easing, with rupiah stability remaining a key policy priority. BI reaffirmed its commitment to maintaining a stable exchange rate. Despite the rate hold, there may still be some modest rupiah weakness due to dividend outflows pressures and rising geopolitical tensions.